HDB resale flat prices continue to rise

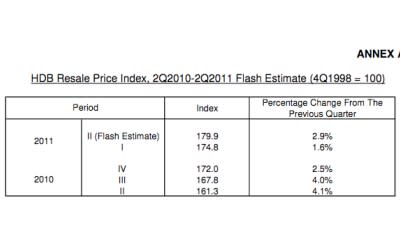

After moderating for three quarters, the prices of HDB resale flats increased by 2.9 per cent between April and June, almost double the rate of increase in the first quarter, according to HDB flash estimates released on Friday.

In comparison, the Urban Redevelopment Authority's (URA) figures show the prices of private homes increasing at a slower pace in the second quarter. The URA's price index for private homes grew by 1.9 per cent, compared to 2.2 per cent in the first quarter.

This is the seventh consecutive quarter in which the rate of increase for private home prices has fallen.

PropNex chief executive Mohamed Ismail told Today newspaper, the government's cooling measures have caused many owners to be reluctant to sell their flats. This supply crunch then drives up the median resale prices and Cash-Over-Valuation.

ERA Realty Network's data showed that median COV rose from S$30,000 to S$37,000 in June.

In April, HDB data showed median COV decreasing by S$2,000 to S$21,000 in the first quarter.

While HDB is on track to offer 25,000 Build-to-Order flats this year and plans to launch another 2,000 flats in August, ERA's key executive officer Eugene Lim said these new flats, targeted mainly at first-time buyers, will not have much impact on the resale market.

On the slower pace of increase for private homes, Lim said the prices are too high for HDB upgraders, who then postpone their upgrading plans.

Non-landed private residences in the city fringes increased by 1.2 per cent and those in suburban areas increased by 1.6 per cent in the second quarter.

In the first quarter, non-landed private residences in the city fringes increased 2 per cent while those in suburban areas increased by 3.1 per cent.

Chia Siew Chuin, director of Research and Advisory at Colliers International, told the paper, the statistics reflect the cautious stance and price sensitivity of buyers in those segments.

Analysts expect private home prices to grow between 6 and 8 per cent this year - lower than the 17.6 per cent last year.

However, Chesterton Suntec International head of research and consultancy Colin Tan cautioned, once the Euro debt crisis is resolved, market sentiment is expected to go back up because "the fundamentals haven't really changed much."