3 Investment Strategies To Adopt In April

Following consolidation in STI’s trading range, DBS believes that a breakout is expected to happen in the next 1-2 months. DBS notes that STI will break out from its 3400-3500 range. However, the directional breakout will depend on the outcome of the US-China trade skirmish and the upcoming earnings season. How should investors navigate the month of April? According to DBS, there are three investment strategies that investors can consider for the month of April.

Investors Takeaway: 3 Investment Strategies To Adopt In April

Hedging Against Inflation

Low inflation has long been a concern in the market. However, DBS believes that inflation could rise steadily, leading to a market re-focus on inflation. This is primarily driven by the Fed raising 2019 interest forecast by 20 basis points (bps) to 2.9 percent and by 30bps to 3.4 percent for 2020 on the back of stronger economic growth. Additionally, the current US-China trade tensions could further increase the market’s concern of higher-than-expected inflation with tariffs causing an inflationary impact.

Gold has historically been a hedge against inflation. Thus, DBS highlights Gold US$ ETF as an option for hedging against inflation. Commodities like oil have also been good hedges against inflation. DBS recommends being vested in oil-related stocks like rigbuilders (Keppel Corp, SembCorp Industries, SembCorp Marine). The reason is that inflation will lead to higher oil prices and a more positive outlook for oil rigbuilders in the medium to long term. Property plays will also be significant in hedging against inflation as property prices generally rise in tandem with inflation. Some property plays to consider include City Developments, UOL, Roxy Pacific, CapitaLand and Hong Fok and Sunningdale Tech.

US-China Trade Tension Plays

While China has extended its hand to play down the US-China trade tension in the Boao forum, it is still unclear whether Trump will continue his antics and further agitate trade relations between the two giants. According to DBS, an escalation of US-China trade war is negative for the global economy including Singapore’s open economy. DBS notes that the current US trade tariff on China is negative for Singapore manufacturing companies with China operations and end product destination in US as order visibility becomes unclear.

Among the manufacturing plays in Singapore, DBS recommends Hi-P, Sunningdale, Venture Corp and UMS. These technology manufacturing stocks are likely to benefit from potential cool off if both sides reach a compromise. Furthermore, Venture Corp and UMS have no manufacturing facilities in China, which limits the impact of US tariff on China.

Positioning Ahead Of Upcoming Ex-Dividend Dates

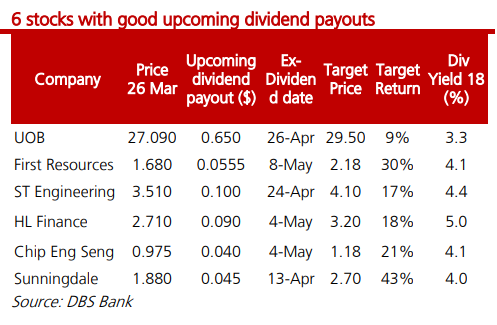

DBS notes that a number of companies are going ex-dividend over the next 1-2 months. Stocks with good dividend payouts during this period are likely to be supported as investors position ahead of ex-dividend dates. UOB, ST Engineering, Chip Eng Seng, First Resources, Hong Leong Finance and aare six stocks with good dividend payouts that DBS recommends.