38 enterprise startups that will boom in 2017, according to VC investors

Jay Srinivasan

Jay Srinivasan, founder of the stealth startup Spoke.

2017 is almost here and it’s once again time to predict which startups will take the tech industry by storm.

Who better to ask than the startup experts, the VCs that watch the industry, guide the startups, hear their pitches, and invest in them?

So we reached out to a handful of top VCs and asked them which young or growth-stage startups will boom in 2017.

We asked them to particularly focus on enterprise startups — those that sell services to businesses, as opposed to selling to consumers. Enterprise IT is a $3 trillion industry and startups are the ones that are turning it on its head.

They gave us this list that includes everything from technology that brings artificial intelligence to salespeople, to tech that is changing agriculture, financial, cyber security, and international shipping industries.

Exabeam: rooting out internal hacker spies

Company name: Exabeam

VC: Sequoia’s Carl Eschenbach

Relationship: No relation. VC just thinks it’s cool.

Funding: $35 million

What it does: This is a security product that watches human behavior on the network to discover who is trying to hack or sabotage it. It can also be used in forensics after an attack.

Why it’s hot: “The simplicity and user interface of Exabeam’s User Entity Behavior Analytics is a serious differentiator compared to the rest of the market. It’s amazing how easy it is to use. They have the ability to cut incident investigations down from what would be days or weeks to literally minutes because of their data science approach to finding the threats. 2017 will be a year where I expect Exabeam to really accelerate growth,” Eschenbach says.

Viptela: a better way to manage networks

Company name: Viptela

VC: Sequoia’s Carl Eschenbach

Relationship: VC is an investor.

Funding: $108.5 million

What it does: This is cloud software that helps companies manage their wide-area computer networks, the part that connects remote offices together via telecom providers.

Why it’s hot: “Corporations spend upwards of 10% of their IT budgets on telecom costs. With Viptela’s software-defined WAN you can see upwards of 50% savings by replacing operationally complex MPLS networks. It’s not a matter of if people will deploy SD-WAN’s, it’s when and how fast. 2017 will be the year we see this acceleration,” Eschenbach says.

Domino Data Lab: The Github for data science

Company name: Domino Data Lab

VC: Sequoia’s Pat Grady

Relationship: VC is an investor.

Funding: $10.5 million

What it does: This is cloud software that helps data science teams collaborate, even across industries, share the analysis tools they create.

Why it’s hot: “Domino is to data science as GitHub is to coding; it’s a collaborative system of record. Over the last ten years, with the rise of software, GitHub became a household name. Over the next ten years, as data science makes software intelligent, Domino will become a household name,” Grady says.

Classy: next-gen fundraising for non-profits

Company name: Classy

VC: Sequoia’s Pat Grady

Relationship: No relation. VC just thinks it’s cool.

Funding: $48 million

What it does: Classy is a fundraising platform for social good organizations.

Why it’s hot: “Classy is a business operating system for non-profits. It’s about time for the great causes we all care about to have access to great software. Classy is rapidly replacing Blackbaud, the $3 billion, last generation ‘Oracle for non-profits’,” Grady says.

Clari: artificial intelligence that helps salespeople sell

Company name: Clari

VC: Sequoia’s Aaref Hilaly

Relationship: VC is an investor.

Funding: $26 million

What it does: Clari offers sales analytics and forecasting cloud software.

Why it’s hot: “Clari is at the leading edge of an important trend towards ‘systems of engagement’, meaning apps that use great design, integrations and machine learning to help people be more productive. As these apps gather more data, and the ability to analyze that data via AI improves, there’s the opportunity to create the next wave of huge app companies,” says Hilaly.

World View: sending balloons into the stratosphere

Company name: World View Enterprises

VC: Sequoia’s Aaref Hilaly

Relationship: No relation. VC just thinks it’s cool.

Funding: $15.25 million

What it does: Sends balloons into the stratosphere to take images and collect data, the kind of work normally done by more expensive satellites. (It also plans to do stratosphere tourism, taking people for rides above the earth.)

Why it’s hot: “An exceptional team, trying something genuinely different. By lowering the cost of getting to and from the stratosphere, it expands existing markets (e.g., satellite photography) and opens the way to new ones (e.g., space tourism),” Hilaly says.

Spoke: bringing AI to helpdesk tickets

Company name: Spoke

VC: Accel’s Vas Natarajan

Relationship: VC is an investor.

Funding: Undisclosed.

What it does: A still-in-stealth startup building an intelligent service to automate help requests, such as sending a support ticket to the IT department or asking HR a question.

Why it’s hot: Spoke is founded by Jay Srinivasan, who previously co-founded Appurify, which was acquired by Google.

“Think of large enterprises where thousands of requests get sent each month by employees to the internal help desk; tickets are issued to big staffs who manually respond and resolve a ticket, or route you to the right piece of internal knowledge. Today it’s a massive space dominated by legacy software players like ServiceNow, BMC Remedy, IBM and others,” Natarajan says.

Periscope Data: Turns a database into a business analysis tool

Company name: Periscope Data

VC: Accel’s Vas Natarajan

Relationship: No relation. VC just thinks it’s cool.

Funding: $34.5 million

Why it’s hot: Periscope Data takes data from apps like databases and billing systems to let businesses understand what’s impacting their business, such as which sales channels produce the most loyal customers.

Reason: “The company is building modern data exploration tools for enterprises. It’s fast becoming a standard for how progressive teams ask questions of their business. They’re the new nerve center for biz-ops,” Natarajan says.

InfluxData: Managing the next wave of data known as “time-series”

Company name: InfluxData

VC: Battery Ventures’ Dharmesh Thakker

Relationship: VC is an investor.

Funding: $24.89 million

What it does: InfluxData developed something called the “TICK stack” an open source platform for managing IoT “time-series” data, or data that is measured over time. It’s already in use at companies like Cisco, eBay, AXA, Solar City, Telefonica.

Why it’s hot: “There’s a big need for time-series data, especially thanks to the billions of sensors being deployed as part of the Internet of Things (IoT). 2017 will be the year to watch, as time-series data goes mainstream, driving high-value business decisions, whether for IT professionals managing a cloud infrastructure or facilities managers analyzing the efficiency of smart buildings to auto engineers leveraging time-series data to program autonomous driving cars,” says Thakker.

Qubole: instant cloud access to big data

Company name: Qubole

VC: Battery Ventures’ Dharmesh Thakker

Relationship: No relation. VC just thinks it’s cool.

Funding: $50 million

What it does: Qubole was founded by the former Facebook big data team. With Qubole, a data scientist can almost instantly take data stored in the popular storage systems Hadoop of Spark, set it up in a cloud like Amazon or Google, and start analyzing it.

Why it’s hot: “2017 will mark the rapid proliferation of enterprises transitioning to the hybrid-cloud and data moving to Hadoop and Spark. Qubole will help accelerate the transition,” Thakker says.

Sisense: Big data analytics for business people

Company name: Sisense

VC: Battery Ventures’ Itzik Parnafes

Relationship: VC is an investor.

Funding: $94 million

What it does: Sisense lets non-technical business managers analyze big data that comes from a lot of different sources.

Why it’s hot: “Sisense gives users the freedom to ask any question and get meaningful answers from their data quickly and easily. With customers in 50 countries, including global brands like Target and Samsung, Sisense is revolutionizing the business analytics market,” Parnafes says.

Prospera: bringing AI to agriculture

Company name: Prospera

VC: Battery Ventures’ Itzik Parnafes

Relationship: No relation. VC just thinks it’s cool.

Funding: $7 million

What it does: Bringing big data and artificial intelligence to improve agriculture.

Why it’s hot: “Deep-learning technologies are transforming many industries. In agriculture — one of the largest industries globally — deep-learning has the potential to benefit farmers and consumers by assisting in the growth of cleaner, healthier, more economical foods. The team at Prospera is comprised of computer scientists, physicists and experienced agri-business leaders on a mission to reinvent the way data is used in agriculture,” Parnafes says.

Rubrik: a better way to protect corporate data

Company name: Rubrik

VC: Greylock’s Jerry Chen

Relationship: VC is an investor.

Funding: Funding: $112 million

What it does: Rubrik is built by the same people who built Google File System/Search/Maps. It helps companies easily back up, archive, and protect their data whether that data is in their own data center or in the cloud.

Why it’s hot: “Rubrik can manage content in the cloud and on-premises, and can retrieve files instantly from the cloud, something that is lacking in legacy solutions from companies and even from companies like Amazon Web Services. The leadership team is stellar. Co-founder and CEO Bipul Singha was a partner at Lighspeed where he invested in Nutanix (founding investor), Vernix Data and Numerify,” Chen says.

Minio: open source cloud storage designed for developers

Company name: Minio

VC: Greylock’s Jerry Chen

Relationship: No relation. VC just thinks it’s cool.

Funding: $3.3 million

What it does: Cloud storage designed for developers and cloud apps.

Why it’s hot: “Minio’s goal is to provide a scalable, yet simple storage solution built for developers. The idea is to offer an open source alternative to Amazon S3 (that is still compatible with the Amazon offering) and simplify the storage component for the developer community,” Chen says.

Gladly: next-generation customer service software

Company name: Gladly Software

VC: Greylock’s Jerry Chen

Relationship: VC is an investor.

Funding: $27 million

What it does: Gladly is next-generation customer service software, built for today’s mobile, social, texting world.

Why it’s hot: “Consumers expect brands they love to recognize them and communicate over their preferred channel. Agents are doing the best they can but legacy tools were designed decades ago and can’t keep up with the pace of modern communications. The platform is built on a modern, secure, globally scalable platform with the same technology stacks used by Google, Facebook, LinkedIn and Twitter,” Chen says.

Cask: an easier way to do big data

Company name: Cask

VC: Greylock’s Jerry Chen

Relationship: No relation. VC just thinks it’s cool.

Funding: $32.5 million

What it does: Cask helps two popular big data technologies, Hadoop and Apache Spark, work better together and makes them easier to use.

Why it’s hot: “Cask enables enterprise to build application on top of Hadoop and all the big data infrastructure they have invested in over the past year. It’s a sign of a new generation of big data/ machine learning applications being built for tomorrow,” Chen says.

Cato Networks: a network in the cloud

Company name: Cato Networks

VC: Greylock’s Jerry Chen

Relationship: VC is an investor.

Funding: $50 million

What it does: Connects remote offices and remote workers together in the cloud. It’s a cloud replacement for a corporate wide area network.

Why it’s hot: “With Cato, a company can connect each branch office, data center, and HQ, along with its mobile users, directly to the Cato Cloud. This impressive vision for the future of security is a result of the impressive Cato Networks team. Co-founder Shlomo Kramer founded Check Point Software and Imperva, and was on the board of Palo Alto Networks and Sumo Logic,” Chen says.

Spilt: A better way to send new software features to customers

Company name: Split Software

VC: Greylock’s Jerry Chen

Relationship: No relation. VC just thinks it’s cool.

Funding: Undisclosed seed funding.

What it does: Gives companies granular control over how they test and deploy new software or new software features to customers.

Why it’s hot: “Split enables developers to test new features for their customers enabling companies to roll out and test new features as quickly as possible,” Chen says.

Security Scorecard: Ensuring partners won’t cause security problems

Company name: Security Scorecard

VC: GV’s Karim Faris

Relationship: VC is an investor.

Funding: $34.7 million

What it does: Security Scorecard continuously monitors and identifies risks to a company’s IT systems even if the risks comes from its partners, not its own systems.

Why it’s hot: “Organizations spend a lot of effort securing their own assets but don’t have as good visibility into their partners/vendors. A significant number of breaches have happened through third parties whose security stance is largely self-reported,” Faris says.

Align Commerce: Global payments made easy for businesses

Company name: Align Commerce

VC: GV’s Karim Faris

Relationship: No relation. VC just thinks it’s cool.

Funding: $20.25 million

What it does: Align Commerce lets small businesses send and receive payments internationally in the local currency.

Why it’s hot: “Align has developed a comprehensive routing stack able to move money globally and at the lowest cost with an ability to track money as it moves through the system. It’s a much better product enabling commerce across currencies compared to bank wires,” Faris says.

Mist: Smart Wifi for the smart device era

Company name: Mist Systems

VC: GV’s Karim Faris and Lightspeed’s Arif Mohammed

Relationship: VCs are investors

Funding: $42.4 million

What it does: Mist provides wireless access for hotels, retail, and other venues that can also provide location-aware apps to the venue’s customers.

Why it’s hot: “Smooth connectivity and accurate location in one. When was the last time you had consistent, reliable WiFi in a venue or a hotel? That same [Mist] device also enables accurate location, unlocking a number of awesome location-based experiences,” says Karis

“This is the first company since the advent of the iPhone and the adoption of the cloud to build an enterprise wireless company from the ground up. The founders previously ran Cisco’s multi billion dollar wireless group and since founding Mist two years ago have shipped their first product, signed up dozens of customers and partners,” Mohammed says.

Headspin: Global testing platform for mobile apps

Company name: Headspin

VC: GV’s Karim Faris

Relationship: VC is an investor.

Funding: Undisclosed series A

What it does: Tests mobile apps on global cell networks covering 63 countries, 127 cities and 1800 cell networks worldwide

Why it’s hot: “Headspin allows developers to test their apps on local devices and carriers all over the world to understand app behavior across various network conditions (two bars, wifi, offline, etc.). The platform then algorithmically analyzes user experience to find and help fix issues,” Faris says.

Opsclarity: watches the infrastructure you don’t even know you’re using

Company name: Opsclarity

VC: GV’s Karim Faris

Relationship: No relation. VC just thinks it’s cool.

Funding: $21.23 million

What it does: Opsclarity does detailed monitoring of infrastructure including apps that use containers and the cloud.

Why it’s hot: “The product provides a map of app dependencies and health status by leveraging models to automatically discover your dynamic applications and infrastructure. It collects metrics, analyzes failures, and helps identify bottlenecks,” Faris says.

Prevedere: get data from outside your company to make predictions

Company name: Prevedere

VC: GV’s Karim Faris

Relationship: No relation. VC just thinks it’s cool.

Funding: $9.55 million

What it does: Prevedere provides instant access to all kinds of external data on the global economy, manufacturing activity, consumer behavior, and the weather.

Why it’s hot: “Prevedere enables better business performance forecasting by helping enterprises build models to understand both internal as well as external factors that drive their forecasts,” Faris says.

Cockroach Labs: the un-killable database

Company name: Cockroach Labs

VC: GV’s Dave Munichiello

Relationship: VC is an investor

Funding: $26.5 million

What it does: The company behind CockroachDB, an open source, scalable SQL database.

Why it’s hot: Cockroach is “building the enterprise database of the future much like the un-killable databases that web-scale companies (like Amazon and Google) use internally. Big data requires a database that scales across datacenters and geographies without interruption. Regulations increasingly require applications to limit where certain data can be stored (German data in Germany, for instance),” Munichiello says.

Lattice Data: Shining the light on “dark” data

Company name: Lattice Data

VC: GV’s Dave Munichiello

Relationship: No relation. VC just thinks it’s cool.

Funding: Undisclosed series A

What it does: Lattice turns massive amounts of “dark” data such as text and images, into “structured” data, the kind used by a traditional database.

Why it’s hot: “A company that recently emerged from stealth mode founded by Chris Re (Stanford computer science professor and MacArthur Genius Award winner) and Mike Cafarella (Michigan computer science professor and Hadoop Cofounder). The company has built out a suite of proprietary software on top of Stanford’s OpenSource DeepDive technology, which was incubated for over six years with $20 million of DARPA funding, to rapidly make sense out of unstructured data,” Munichiello says.

OverOps: helps programmers figure out what broke their code

Company name: OverOps

VC: Lightspeed’s Nakul Mandan

Relationship: VC is an investor.

Funding: $19.5 million

What it does: OverOps uses big data technologies to help developers debug their apps that run on the cloud.

Why it’s hot: “Incredibly talented team solving one of the most challenging but most useful software infrastructure problems: helping companies understand when and why their production code breaks without having to search through logs, which leads to faster time to error resolution and more production uptime,” Mandan says.

Pendo: a ‘cockpit’ for product management

Company name: Pendo

VC: Lightspeed’s Nakul Mandan

Relationship: No relation. VC just thinks it’s cool.

Funding: $13.25 million

What it does: Pendo helps a company capture product usage data and influence behavior with in-app messaging.

Why it’s hot: “There is no one main system of record and engagement for the product management function today. Pendo is building a solution that is becoming the cockpit from where its customers build product and engage with their users,” Mandan says.

Qadium: gathering data about devices

Company name: Qadium

VC: Lightspeed’s Arif Mohammed

Relationship: No relation. VC just thinks it’s cool.

Funding: $25.97 million

What it does: Qadium is creating a massive index of knowledge about the world’s devices.

Why it’s hot: “Disruptive technology that continuously scans the public internet to discover, track and analyze all devices connected to the internet. One of the sharpest technical teams tackling a massively complex problem,” Mohammed says.

ThoughtSpot: the Google of big data analytics

Company name: ThoughtSpot

VC: Lightspeed’s Ravi Mhatre

Relationship: VC is an investor.

Funding: $90.7 million

What it does: Building a new kind of search engine just for big data apps.

Why it’s hot: “Defining a new category of enterprise business analytics called ‘Search-based BI (business intelligence)’. The company has a large contingent of ex-Google and ex-Oracle engineers and has built the first product that brings the ease, power and scale of Google-like search navigation to a company’s business information,” says Mhatre.

AVI Networks: ‘Predictive autoscaling’ for a company’s data center

Company name: AVI Networks

VC: Lightspeed’s Barry Eggers

Relationship: VC is an investor.

Funding: $33 million

What it does: Avi Networks offers enterprises advanced ways to use their infrastructure more efficiently like something called “predictive autoscaling.” It’s the next generation of a technology called load balancing.

Why it’s hot: “Just like Nicira disrupted Cisco with a micro-services approach, Avi is having success disrupting Layer 4-7 vendor F5 with a similar approach,” says Eggers.

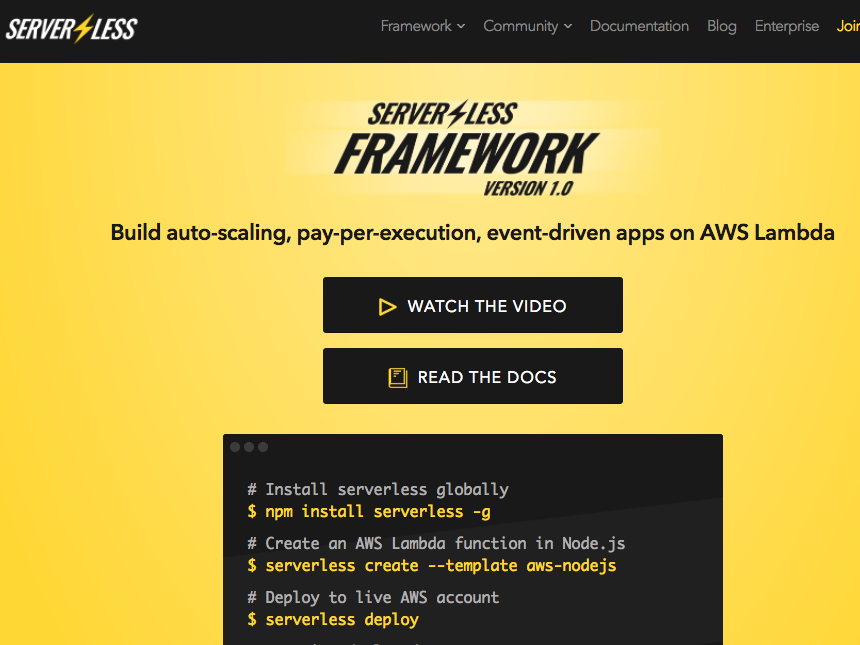

Serverless: the latest trend in cloud computing

Company name: Serverless

VC: Lightspeed’s Barry Eggers

Relationship: No relation. VC just thinks it’s cool.

Funding: $3 million

What it does: Serverless helps developers take advantage of the new trend toward “serverless” cloud computing, which means the cloud automatically figures out what server setup an app needs. It uses Amazon Web Services’ Lambda.

Why it’s hot: “The trend towards serverless computing, or Functions as a Service, has tremendous momentum and Serverless is the leading framework for developers,” Eggers says.

Cloudistics: an operating system for virtual data centers

Company name: Cloudistics

VC: Bain Capital Ventures’ Ben Nye

Relationship: VC is an investor.

Funding: $15.72 million

What it does: Cloudistics offers an operating system that manages data center infrastructure, servers, storage, and networking as one big block, making them all work together more efficiently.

Why it’s hot: “CIOs should be able to run their datacenters more cost-effectively than public cloud providers, but they are hobbled by separate server, network, and storage silos. The Cloudistics team, with its extensive large-scale computing expertise, has enabled just this. The solution scales to thousands of nodes to give enterprises the same benefits of scale, speed of provisioning, and pay-as-you-go economics that AWS and Azure provide,” Nye says.

Assent Compliance: shedding light on your suppliers and their suppliers

Company name: Assent Compliance

VC: Bain Capital Ventures’ Ben Nye

Relationship: No relation. VC just thinks it’s cool.

Funding: $20 million

What it does: Software to ensure supply chain compliance in manufacturing

Why it’s hot: “Supply chains are getting longer as manufacturers integrate more components into our cars, homes, and portable gadgets. Concurrently, the regulatory environment has also grown more complex, with our new awareness of carcinogenic or ozone-depleting materials, conflict minerals, and deplorable working conditions. Assent helps manufacturers audit and manage their supply chains to ensure they know what’s inside their products,” Nye says.

Freightos

Company name: Freightos

VC: OurCrowd’s Jon Medved

Relationship: VC is an investor.

Funding: $23.3 million

What it does: An online freight marketplace that includes international freight routing/pricing technology.

Why it’s hot: “World’s first B2B marketplace for freight forwarding — result of four years of development to automate one of the largest yet still not ‘disrupted’ industries, the trillion-dollar freight industry. It’s led by serial entrepreneur Zvi Schreiber who has sold previous companies to GE and IBM,” Medved says.

Sixgill

Company name: SixGill

VC: OurCrowd’s Jon Medved

Relationship: No relation. VC just thinks it’s cool.

Funding: $6 million

What it does: SixGill is a cyber intelligence platform that continuously monitors the places where criminal hackers hang out, known as the “dark web,” to detect and defuse cyber threats before they become attacks.

Why it’s hot: “Sixgill cyber intelligence platform provides organizations with continuous monitoring, prioritized real time alerts and actionable dark web intelligence,” Medved says.

Proov: an easier to way for enterprises to find and try startups

Company name: Proov

VC: OurCrowd’s Jon Medved

Relationship: VC is an investor.

Funding: $7 million

What it does: Proov offers a platform that lets enterprises discover and try out many startups’ technology.

Why it’s hot: “Proov provides a Pilot-as-a-Service platform where large enterprises can discover, and startups can showcase innovative technology solutions and easily run multiple ‘Proof of Concepts’ at once, on a secure cloud-based testing environment. Hundreds of startups and large enterprises are already on the Proov platform, and more than a hundred Pilots are running concurrently,” Medved says.

Zerto: Disaster recovery for a new world

Company name: Zerto

VC: OurCrowd’s Jon Medved

Relationship: No relation. VC just thinks it’s cool.

Funding: $130 million

What it does: Zerto provides backup and disaster recovery that’s specially tailored to the new world of virtual computers, storage and networks and cloud computing.

Why it’s hot: “Zerto provides enterprise-class disaster recovery and business continuity software specifically for virtualized data centers and cloud environments,” Medved says.

The post 38 enterprise startups that will boom in 2017, according to VC investors appeared first on Business Insider.