4 Singapore hotels fined more than $1.5m for violating competition laws

Owners and operators of four hotels in the eastern part of Singapore were issued an Infringement Decision and fined more than $1.5 million for violating competition laws, said the Republic’s competition watchdog on Wednesday (30 January).

Staff at Capri, Crowne Plaza Changi Airport Hotel, Village Hotel Katong and Village Hotel Changi exchanged confidential pricing information of corporate customers – including Standard Chartered Bank and Swire Pacific – in 2014 and 2015, the Competition and Consumer Commission of Singapore (CCCS) had ruled in an earlier proposed infringement decision in August last year.

Ascendas Frasers was the owner of Capri until 30 March 2015. Together with Capri’s current operator Frasers Hospitality, the duo were fined close to $794,000 by the Competition and Consumer Commission of Singapore (CCCS). Separately, Capri’s current owner Frasers Hospitality Trustee, which took over the hotel from 31 March 2015, and operator were fined more than $216,000.

Far East Organisation Centre, Orchard Mall and Far East Hospitality Management, are the owners and operator of Village Hotel Katong and Village Hotel Changi, respectively. They were also fined more than $286,000.

Meanwhile, the owner and operator of Crowne Plaza Changi Airport Hotel, OUE Airport Hotel and Inter-Continental Hotels (Singapore) respectively, were fined over $225,000.

On 30 June 2015, CCCS conducted a round of unannounced inspections at various hotel premises in Singapore and conducted interviews with key personnel at the premises.

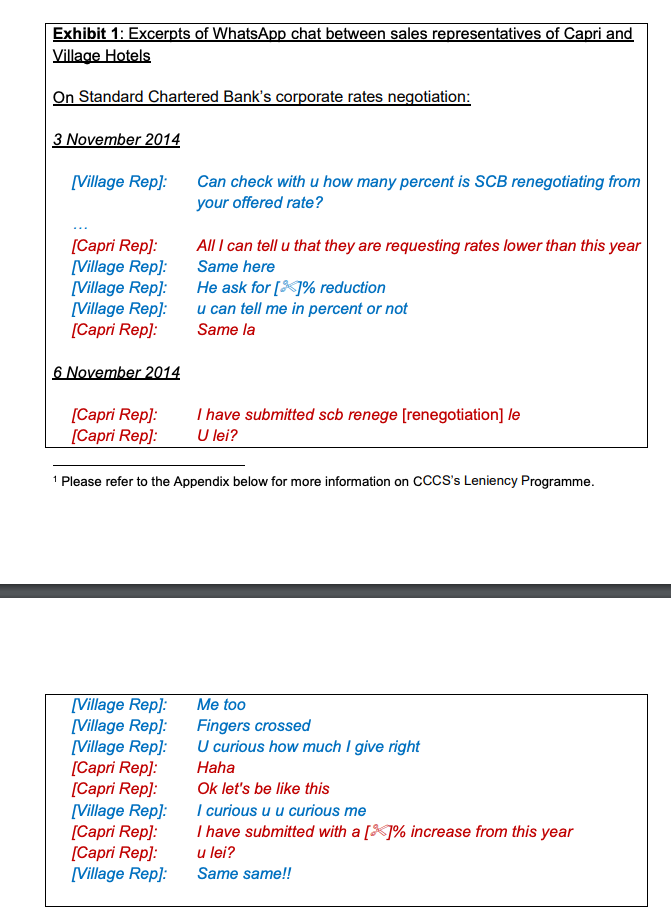

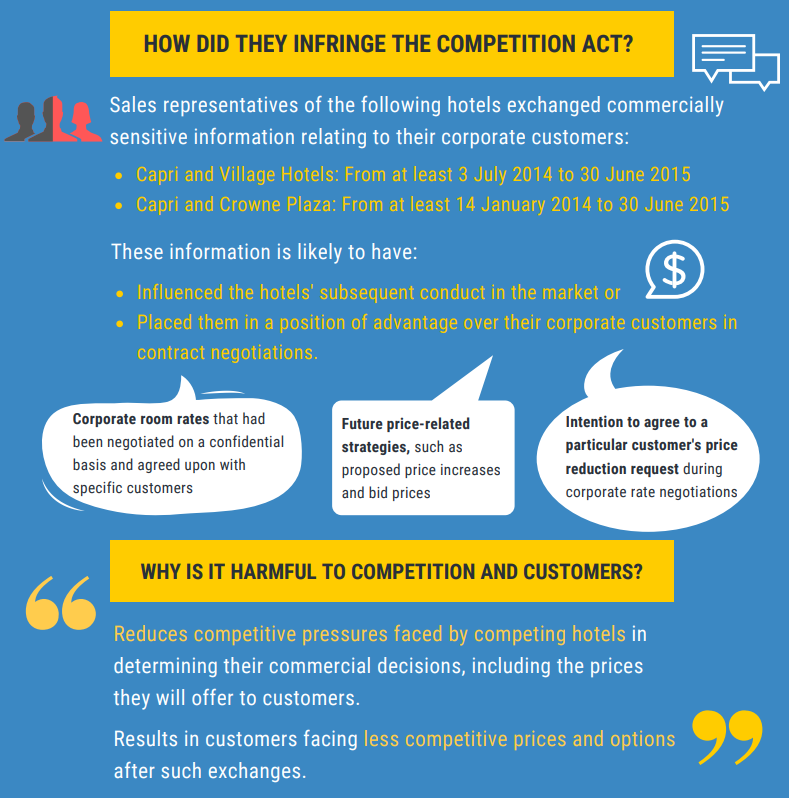

Investigations by the competition watchdog revealed that sales representatives of Capri and VIllage Hotels had exchanged commercially sensitive information relating to their corporate customers from at least 3 July, 2014 to 30 June, 2015.

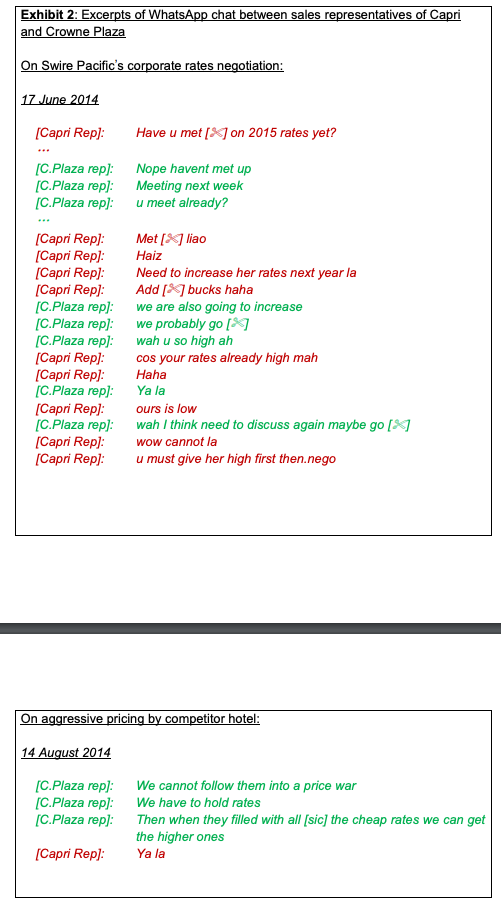

Separately, sales representatives of Capri and Crowne Plaza were found to have exchanged commercially sensitive information relating to their corporate customers from at least 14 January 2014 to 30 June, 2015.

The information exchanged is “likely to have influenced the hotels’ subsequent conduct in the market or placed them in a position of advantage over their corporate customers in contract negotiations”, the CCCS added.

These included critical factors that were taken into consideration in the determination of subsequent prices that were offered by the hotels to their corporate customers.

For instance, the sales representatives disclosed to each other corporate room rates that were negotiated on a confidential basis and agreed upon with specific customers.

Also discussed were future price-related strategies, including proposed price increases for the following contractual year, proposed bid prices in response to customer requests, and whether or not they intended to agree to a particular customer’s price reduction request in the course of corporate rate negotiations.

WhatsApp excerpts, shared by the CCCS, showed representatives from Village Hotels and Capri discussing discount negotiations with Standard Chartered Bank.

Another WhatsApp conversation showed the same representative from Capri agreeing with a Crowne Plaza representative about maintaining room rates so as to avoid being involved in a “price war”.

“Without the exchange of commercially sensitive information, each sales representative would have had to independently determine their conduct on the market; and there would have been more competitive pressure on rates (and/or terms) offered to corporate customers,” said the CCCS.

It added that these actions were “anti-competitive and caused serious harm to competition”.

“This can result in customers having less competitive prices and options after such exchanges. If a business receives such information from its competitor, it should immediately and clearly distance itself from such conduct and report it to CCCS,” said CCCS chief executive Toh Han Li.

On 2 August last year, the CCCS had sent all parties involved a notice of its Proposed Infringement Decision (PID). Representations on the PID were received between 17 September and 9 October and the CCC had “carefully considered” all representations in reaching its findings.

In levying financial penalties, the competition watchdog took into account the relevant turnovers of involved parties, the nature, duration, and seriousness of the infringement, aggravating and mitigating factors, as well as their representations, it added.

If found guilty under the Competition Act, offenders can face a maximum fine of up to 10 per cent of the turnover of their businesses in Singapore for each year of infringement, capped at three years.

More Singapore stories:

Insurance agent who signed off as ‘Lord Voldermort’ in threatening emails to clients jailed

NEA lifts food poisoning suspension on Mandarin Orchard Hotel’s banquet kitchen

Singapore-Malaysia working group had ‘constructive discussions’ on maritime issues