5 Perks of Dining Out with the Citibank DIVIDEND Card

If you’re a regular diner in Singapore, the right credit card can give you massive savings; the Citibank DIVIDEND Card could be the key to your stomach’s happiness and joy, on a daily basis.

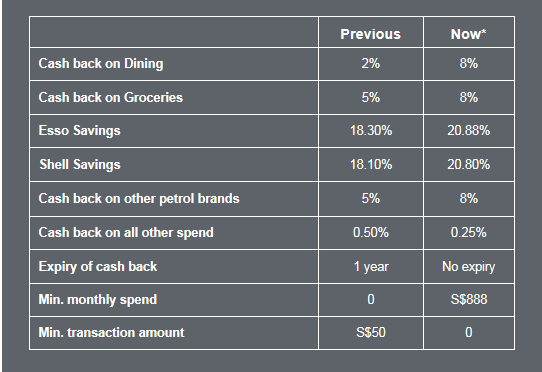

As of 28 Sep 2015, the newly re-launched Citibank DIVIDEND Card has the best cash back in town for the categories of dining, grocery and petrol pumping at a huge rate of 8% cash back.

This card is the ideal companion for people who eat out often, and even rewards you for your everyday purchases like groceries or petrol. The best part is, you can dine, buy groceries or pump petrol anywhere in the world – you’ll continue to earn 8% cash back worldwide. Given that we have to eat every day, and many of us eat out and travel these days, these savings can work out to massive amounts over time.

So what dining perks are there using the Citibank DIVIDEND Card? Read on.

1. Dine out and get 8% cash back

Eating is Singapore’s national past time, and with so many delicacies available all over the island, the foodie in you yearns to dine out regularly. Unfortunately for us, dining out in Singapore can be an expensive affair and this often limits our choice of restaurants and cafes.

With the Citibank DIVIDEND Card, dining out can be so much more cost-effective with 8% cash back at all restaurants and cafes in Singapore, and worldwide – the dining cashback has increased 4 times from the previous 2%! This extends to all food and beverage outlets in Singapore, on any day of the week. Say goodbye to waiting for special offers in order to dine out.

You won’t have to hunt for the best bargains like an auntie now. With a consistent 8% cash back with every meal charged to your Citibank DIVIDEND Card on any day of the week, you’ll save that much more effortlessly.

2. Drive out for dining and save on petrol

Drivers, rejoice. The expense of owning a car in Singapore can get ridiculously high, but still we want to own one due to accessibility and, of course, to travel in style when going on a dinner date – many restaurants are also hidden in notoriously ulu spots that require some mileage to get to.

Pumping petrol is an inevitable cost for driving and whilst there is no choice but to fill up our tanks regularly, we do have a choice when it comes to saving cash.

With the Citibank DIVIDEND Card, you can now enjoy savings of up to 20.88% at Esso Petrol Stations and up to 20.8% at Shell Petrol Stations island-wide. Not a customer of the mentioned petrol stations? Fret not, you can enjoy 8% cash back at all other petrol stations in Singapore, and worldwide as well. This is over and above the usual station discounts you would get.

3. Go for a outdoor picnic with cheap grocery shopping

If you are thinking of going for an outdoor picnic with a nice bottle of wine and some cheeses and hams, the supermarket is your best bet. We all like a nice change of pace once in a while rather than always dining in a fancy restaurant.

Though the ever increasing cost of daily essentials may fill you with dread, there is some good news for those of you with a Citibank DIVIDEND Card. You are entitled to 8% cash back at all supermarkets and grocery stores and not just in Singapore, but worldwide too!

4. Eat out and get cash back anywhere in the world too

Just wanted to emphasize that the 8% dining cash back is not just limited to Singapore! You can enjoy the flexibility of dining in any restaurant globally and still enjoy the same 8% cash back on dining.

Travel the world with your Citibank DIVIDEND Card and feast to your heart’s content without worrying about whether you’ve changed enough money for the meal. Enjoy the finer things in life with comfort of mind that you are being rewarded with every dollar spent on dining.

5. Complete your dining visit with other experiences as well

Fancy a movie after dinner? Some shopping to walk off the calories?

The Citibank DIVIDEND Card not only provides perks on purchases of petrol, groceries and dining out, it also offers 0.25% cash back reward on all other purchases as well. Whether you’re buying the latest best seller from the bookstore, or catching the latest blockbuster hit from the cinema, know that you’re getting more bang for every buck.

Once you accumulate S$50 or more cash back in a month, it will be automatically credited to your statement in multiples of S$10. What’s more, your cash back will never expire. A major benefit as sometimes we get so busy with life we overlook the little things.

———

With the latest enhancement of the Citibank DIVIDEND Card, your cash back rates are not only better, but they will never expire as well.

It’s pretty simple to meet the requirements of the Citibank DIVIDEND Card: All you have to do is spend a minimum of $888 per statement month and you can enjoy the high 8% cash back – up to $25 per category per month (that’s a total of $75 for the 3 categories of Dining, Groceries and Petrol). For the remaining amounts you’ve spent for these 3 categories, you will continue to earn 0.25% – there is no limit to that.

Check out how much cash back you can earn based on your own monthly spend or apply for the Citibank DIVIDEND Card via this link!

*This post was brought to you in partnership with Citibank Singapore

The post 5 Perks of Dining Out with the Citibank DIVIDEND Card appeared first on SETHLUI.com.