5 Top Growth Tech Stocks to Pick Amid Coronavirus Crisis

The coronavirus pandemic has rattled stock markets. The panic sell-off has terminated the 10 years of U.S. market expansion which began post the 2007-2009 financial crisis. The U.S. stock market is now officially in a bearish territory as all three major indices — the Dow Jones, the Nasdaq, and the S&P 500 — are down more than 20% from their recent highs.

Though the coronavirus outbreak has had a sector-wide impact globally, the U.S. tech sector has been more resilient compared with other sectors. The Technology Select Sector SPDR Fund XLK has depreciated 8.7% in the year-to-date (YTD) period, while Energy Select Sector SPDR Fund, Financial Select Sector SPDR Fund, and Industrial Select Sector SPDR Fund lost 47.7%, 31.6%, and 26.1%, respectively.

Why is the Tech Sector Least Affected?

The coronavirus outbreak has, surprisingly, opened up newer avenues of growth for tech companies. Shift in consumer preference for Internet-based services, owing to the increase in social-distancing practices, has propelled demand for PCs, notebooks and peripheral accessories. In addition, the growing demand for software and hardware that facilitates work-from-home setting is a key catalyst. (Read More: 6 Remote-Working Software Stocks to Ride on Virus-Led Lockdowns)

Furthermore, the sector’s resiliency can be attributed to the impressive long-term growth prospects of tech companies. Rapid adoption of cloud computing, along with ongoing integration of AI and machine learning, has been a major growth driver.

The accelerated deployment of 5G technology, blockchain, IoT, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

Additionally, tech companies are cash rich, which provides the cushion to remain afloat in an adverse business environment. Per their latest quarterly results, the FAAMG stocks (Facebook, Amazon, Apple, Microsoft, and Alphabet’s Google) have cumulative cash and short-term investments of more than $460 billion.

Investment in Growth Stocks Makes Sense

Considering the healthy long-term growth prospects of tech companies, we believe the recent sell-off provides solid buying opportunities for investors. In the present scenario, investors can look for beaten-down tech stocks that have robust fundamentals and can contribute to growth once normalcy resumes.

Amid this economic and financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, reaping profits in established markets. These stocks, with healthy fundamentals, help investors hedge their investments from any economic downturn.

Picking the Right Stocks

Growth stocks are fundamentally strong businesses that ensure stellar portfolio returns. We have used the Zacks Growth Score to pick such stocks. Our research shows that stocks with the combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer good investment opportunities.

You can see the complete list of today’s Zacks #1 Rank stocks here.

We have taken the help of the Zacks Stock Screener to zero in on five stocks with favorable Zacks Rank and Growth Score.

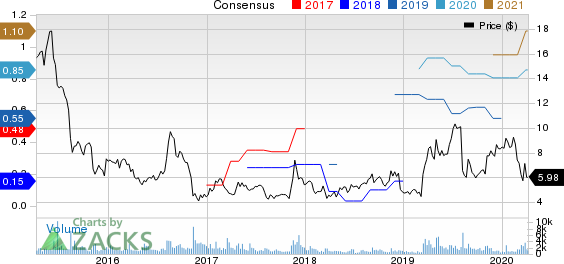

Avid Technology AVID is anticipated to benefit from increasing recurring revenues, driven by growth in subscriptions and the long-term agreements already signed. An expanding paid subscriber base and rising adoption of creative tools, owing to solid demand for the media, graphics and cloud solutions, are other tailwinds.

The company currently sports a Zacks Rank #1 and has a Growth Score of A. The Zacks Consensus Estimate for its current-fiscal EPS growth is pinned at 68.6%. In addition, the stock’s current market price of $5.98 is down 49% from its 52-week high of $10.79.

Avid Technology, Inc. Price and Consensus

Avid Technology, Inc. price-consensus-chart | Avid Technology, Inc. Quote

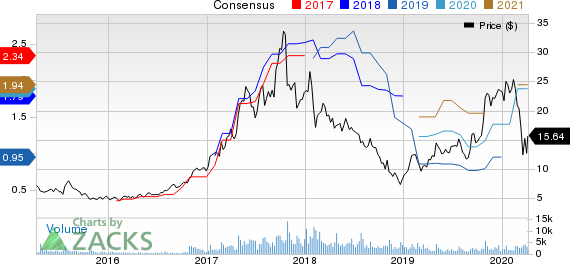

Ultra Clean Holdings UCTT has been riding on improvement in fab utilization, which is expected to bolster growth in the services division. Moreover, the company is well poised to combat the coronavirus crisis-led supply bottlenecks on uptick in memory segment.

Currently, the company flaunts a Zacks Rank of 1 and has a Growth Score of A. The Zacks Consensus Estimate for its 2020 EPS growth is pegged at 107.7%. Also, the stock’s current market price of $15.64 is down 48% from its 52-week high of $30.

Ultra Clean Holdings, Inc. Price and Consensus

Ultra Clean Holdings, Inc. price-consensus-chart | Ultra Clean Holdings, Inc. Quote

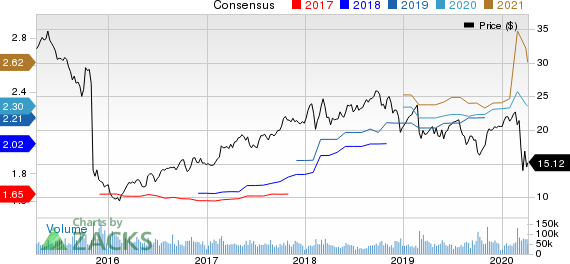

Synaptics SYNA is well poised to capitalize on its market-leading position for both touchpads and secure fingerprint sensors amid upbeat trends in PC shipments. New design wins across all OEM leaders, including Dell, HP and Lenovo, deserve a special mention.

Further, incremental adoption of this Zacks #1 Ranked company’s edge SoCs, integrated with AI and embedded neural networks capabilities for smart video and audio devices, is anticipated to be conducive to its financial performance in the days ahead.

The stock has a Growth Score of A and its fiscal 2020 earnings are likely to soar approximately 41% year over year. Shares of the company are currently trading nearly 31% lower than the 52-week high.

Synaptics Incorporated Price and Consensus

Synaptics Incorporated price-consensus-chart | Synaptics Incorporated Quote

FormFactor FORM is likely to continue benefiting from solid demand for both Foundry & Logic probe cards. Growing probe-card demand, customer node transitions and new design releases are major positives for this Zacks Rank #2 company. Furthermore, its increasing focus on Mobile SoC and Mobile DRAM probe-card segments is another key growth driver.

Additionally, FormFactor’s 2020 earnings are projected to rise 9.6% year on year. The stock, which has a Growth Score of A, currently trades roughly 28% lower than it 52-week high.

FormFactor, Inc. Price and Consensus

FormFactor, Inc. price-consensus-chart | FormFactor, Inc. Quote

HP HPQ is expected to gain from the growing demand for PCs and notebooks amid coronavirus-induced stay-home wave. Stellar revenue growth in retail solutions business, and gaming and services orders is a positive. Moreover, stringent cost-control measures undertaken by this Zacks Rank #2 company will likely boost margins.

The company's improving market share across the PC and Printer businesses makes us optimistic regarding its long-term prospects.

The Zacks Consensus Estimate for HP’s fiscal 2020 earnings of $2.30 calls for a year-over-year increase of 2.7%. The stock, which has a Growth Score of B, currently trades 37% lower than it 52-week high.

HP Inc. Price and Consensus

HP Inc. price-consensus-chart | HP Inc. Quote

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Ultra Clean Holdings, Inc. (UCTT) : Free Stock Analysis Report

FormFactor, Inc. (FORM) : Free Stock Analysis Report

Avid Technology, Inc. (AVID) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research