Best Savings Accounts in Singapore with Highest Interest Rates (Nov 2023)

So far, 2023 has been pretty hard on our bank accounts. Between inflation and an impending recession, it looks like our wallets are taking quite a hit this year, even with the government payouts to aid us.

It’s times like these when saving your money is more important than ever. One easy way to do this is through a savings account. When you open a savings account with a bank, you deposit money into it and let that money earn interest. You’ll enjoy higher interest rates on a savings account than you would on your normal account (called a checking account).

However, not all savings accounts are made equal. Different banks offer different interest rates and different minimum sums. So to help you out, we’ve compiled the best savings accounts in Singapore with the highest interest rates in 2023 for different personal and financial needs.

Note: We update this article on a monthly basis with the latest rates; the rates below are as of 14 Nov 2023.

What are the best savings accounts in Singapore with the highest interest rates in 2023?

1. At a glance: Best savings accounts in Singapore with highest interest rates (Sep 2023)

Savings account | Interest rates | Best for |

Up to 7.88% (on first $100,000) | High spenders | |

Up to 7.80% (on next $25,000 after depositing $75,000) | Freelancers & self-employed | |

EIR of up to 7.65% (on first $100,000) | Growing your savings | |

Up to 7.51% (on first $50,000-$150,000) | Those with other Citibank products | |

Bank of China Smart Saver | Up to 6.70% (on first $100,000) | High earners & spenders |

Up to 4.30% (on first S$50,000) | Home, education, car loan users | |

Up to 4.10% (on first $50,000 – $100,000) | Salaried workers | |

CIMB FastSaver | Up to 3.50% (no cap!) | Young adults starting their careers |

1% interest + 1% cashback (capped at $300/month) | Those with other HSBC products |

Note: The maximum interest rates given above are for regular banking customers. Many banks offer higher rates for their priority banking customers and private clients. The maximum interest rates above only apply to a certain sum, such as the first $50,000.

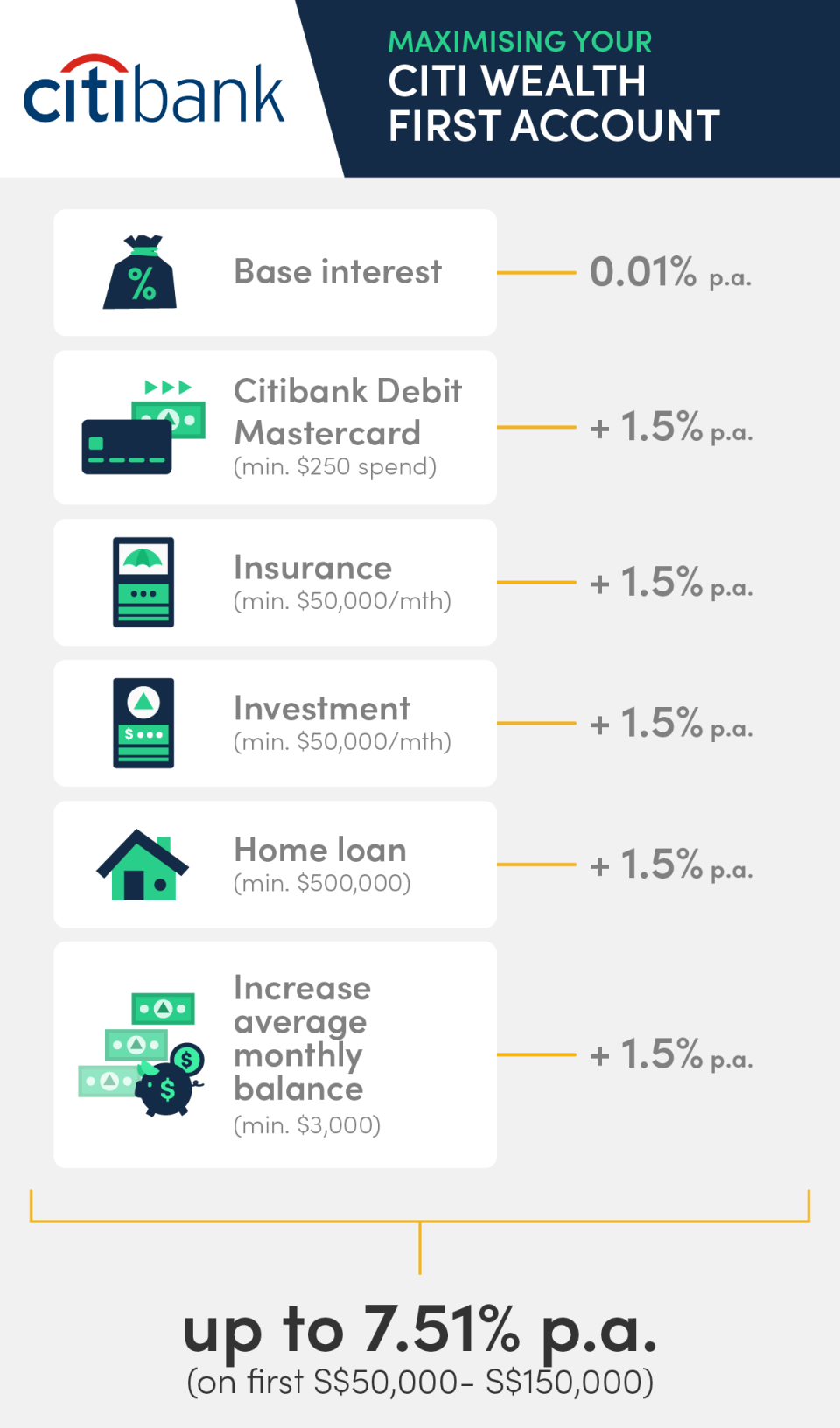

1. Citi Wealth First Account

Citibanking, Citi Priority | Citigold | Citigold Private Client | |

Deposit amount | First $50,000 | First $100,000 | First $150,000 |

Base interest rate | 0.01% p.a. | ||

Spend (min. $250/month on Citibank Debit Mastercard) | 1.5% p.a. | ||

Invest (min. $50,000/month) | 1.5% p.a. | ||

Insure (min. $50,000/month) | 1.5% p.a. | ||

Borrow (min. $500,000 home loan) | 1.5% p.a. | ||

Save (min. $3,000/month) | 1.5% p.a. | ||

TOTAL | 7.51% p.a. | ||

The Citi Wealth First Account has a simple mechanic for calculating its total interest rate: base interest + bonus interest.

Its base interest starts at 0.01% for everyone, whether you’re a Citibanking, Citi Priority, Citigold, or Citigold Private Client customer. That’s the lowest base interest rate out of all the savings accounts on this list.

Next, beef up that measly 0.01% up with bonus interest rates. You get different bonus rates depending on which of the following categories you fulfil:

Spend (+1.5%): Spend at least $250/month on your Citibank Debit Mastercard.

Invest (+1.5%): Purchase one or more new single lump sum investments totalling at least $50,000/month. Investments can include Unit Trust, Structured Notes and Bonds.

Insure (+1.5%): Purchase one or more new single premium policies totalling at least $50,000/month.

Borrow (+1.5%): Take up a new home loan of at least $500,000.

Save (+1.5%): Deposit more money into your account, increasing your account’s average daily balance by at least $3,000 from the previous month’s.

If you fulfil all of the transaction categories above, the maximum interest rate you can get with the Citi Wealth First Account is a generous 7.51%. That’s one of the highest rates among the savings accounts this month. Plus, it applies to the first $50,000 to $150,000 in your account, and not just the first $25,000 after the $100,000 mark or something like that.

The only advantage to starting a Citigold or Citigold Private Client banking relationship is that the bonus interest rates can apply to a larger sum of money. For Citibanking or Citi Priority customers, bonus interest rates are applied to only the first $50,000, according to the Citi Wealth First T&Cs. This increases to $100,000 for Citigold and $150,000 for Citigold Private Client.

However, you’ll need to maintain $250,000 in your account for Citigold, and $1,500,000 for Citigold Private Client. If you fall below these thresholds, the bonus 7.51% will only apply to the first $50,000 just like for everyone else.

Citi Wealth First Account

Minimum balance: $15,000

Fall below fee: $15

Bonus interest cap: $50,000-$150,000

2. Standard Chartered Bonus Saver account interest rates

Transactions | Interest rate |

None (base interest) | 0.05% |

Salary credit (min. $3,000) | + 2.50% |

Credit card spending (min. $500 or $2,000) | + 1.30% (min. $500) OR 2.05% (min. $2,000) |

3x GIRO bill payments (min. $50) | + 0.33% |

Invest in eligible unit trust (min. $30,000) | + 1.50% for 12 months |

Buy eligible insurance (min. $12,000) | + 1.50% for 12 months |

Standard Chartered Bonus$aver Account

More Details

Key Features

Standard Chartered Bonus$aver is a current savings account with a base interest rate of 0.01% per annum on your deposit amount (updated rates as of 1 October 2020)

Bonus interest rates range from 0.07% p.a. for bills, 0.40% p.a. for Standard Chartered debit or credit card spend, to 0.90% per annum for insurance purchase with Standard Chartered

Complete transactions in your Standard Chartered Bonus$aver account from any of these 5 categories to earn bonus interest: Card Spend, Salary Credit, Bill Payment, Insure or Invest.

Base interest will be calculated at the end of each day, and credited at the end of the month

Bonus interest will be calculated at the end of each calendar month, based on the average daily balance of your SGD balances in your Bonus$aver account, and credited in the following month.

Multi-currency feature: Access funds in up to 14 currencies with Bonus$aver account. The multi-currency feature on Bonus$aver account gives you the freedom to shop globally online or offline with S$0 overseas transactions fee*, invest in global markets with just one account and enjoy competitive foreign exchange rates when converting currencies.

The Standard Chartered Bonus Saver savings account currently offers the highest maximum interest rate on a savings account: 7.88 % p.a.. It isn’t easy to get there—you’d need to fulfil these 5 requirements: credit your salary, spend on your credit card, pay 3 bills, invest, and buy insurance.

However, the Standard Chartered Bonus Saver savings account does occupy a niche: It gives you pretty high bonus interest just for spending tons of money.

Pay 3 bills online or via GIRO and you’ll get an additional 0.33% interest. Spend at least $2,000 on your SCB Bonus$aver credit or debit card and you’ll already get 2.05% p.a. bonus interest on your savings. Not bad if your card’s main function is to pay for your kid’s tuition fees, dental checkups, condo MCST fees and what-not.

On top of that, crediting your salary will get you an additional 2.50% interest. However, you have to be earning at least $3,000 per month to qualify for the bonus interest.

Standard Chartered Bonus Saver

Minimum balance: $3,000

Fall below fee: $5

Bonus interest cap: $100,000

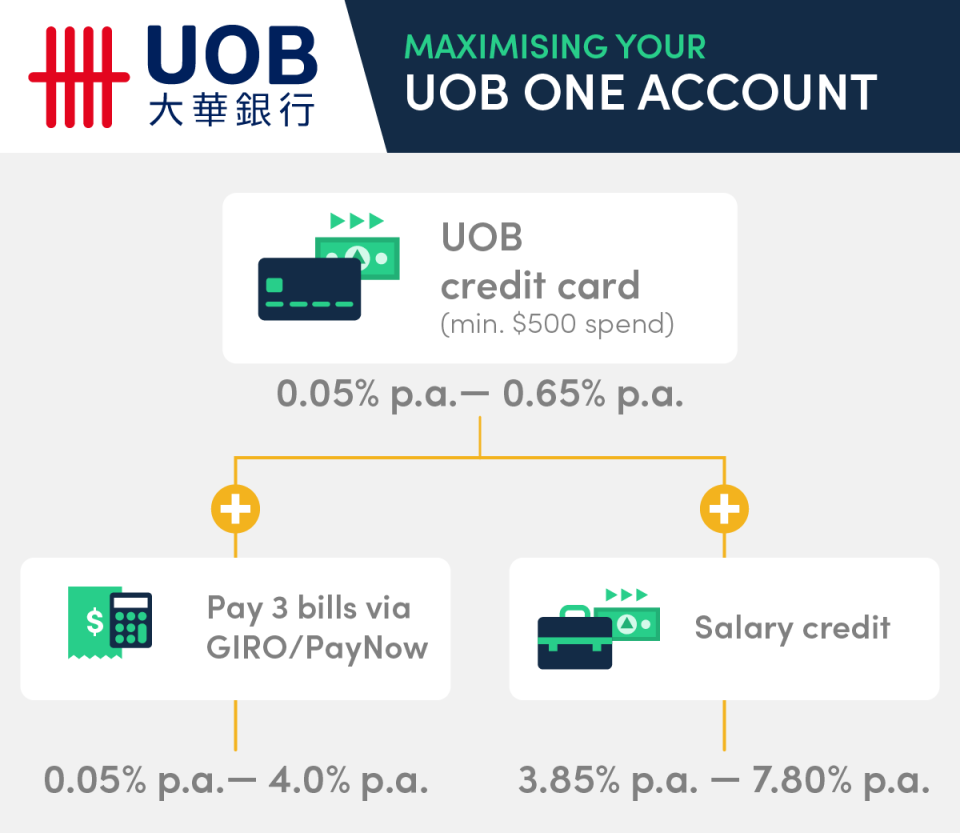

3. UOB One savings account interest rates

Account balance | S$500 spend per month on eligible UOB Card | S$500 spend per month on eligible UOB Card + 3 GIRO/PayNow debit transactions | S$500 spend per month on eligible UOB Card + credit salary via GIRO/PayNow |

First $30,000 | 0.65% | 2.50% | 3.85% |

Next $30,000 | 0.65% | 3.00% | 3.90% |

Next $15,000 | 0.65% | 4.00% | 4.85% |

Next $25,000 | 0.05% | 7.80% | |

Above $100,000 | 0.05% | ||

UOB One Account

More Details

Key Features

Up to 2.50% p.a. interest rates

Up to $200 cash credit when you sign up online and sign up for a UOB credit card. T&Cs apply

Low initial deposit of $500

Withdraw cash conveniently without an ATM card using Mobile Banking

UOB Young Professionals Solution is a combination of UOB One Account, UOB YOLO and the unique Sweep feature that allows you to automatically invest your earned account interests and card rebate into a Unit Trust

The easy-to-use UOB One account currently offers one of the highest maximum interest rates out there, at 7.8% p.a.. You’ll get to enjoy this rate on your next $25,000 after depositing $75,000 once you fulfil these requirements:

Credit your salary to the UOB One account via GIRO/PayNow

Spend at least S$500 spend per month on an eligible UOB Card

The eligible cards are:

UOB One Card

UOB Lady’s Card

UOB EVOL Card

UOB One Debit Visa Card

UOB One Debit Mastercard

UOB Lady’s Debit Card

UOB Mighty FX Debit Card

Don’t have a fixed monthly salary? You can still get up to 4% p.a. with the UOB one account if you pay 3 bills by GIRO. This is great for those without a regular paycheck such as freelancers, retirees or homemakers. If you go for this option, the interest rate rises with every additional $30,000 or $15,000 in your UOB One account, up to $75,000.

UOB One savings account

Minimum balance: $1,000

Fall below fee: $5 (Waived for first 6 months for accounts opened online)

Bonus interest cap: $100,000

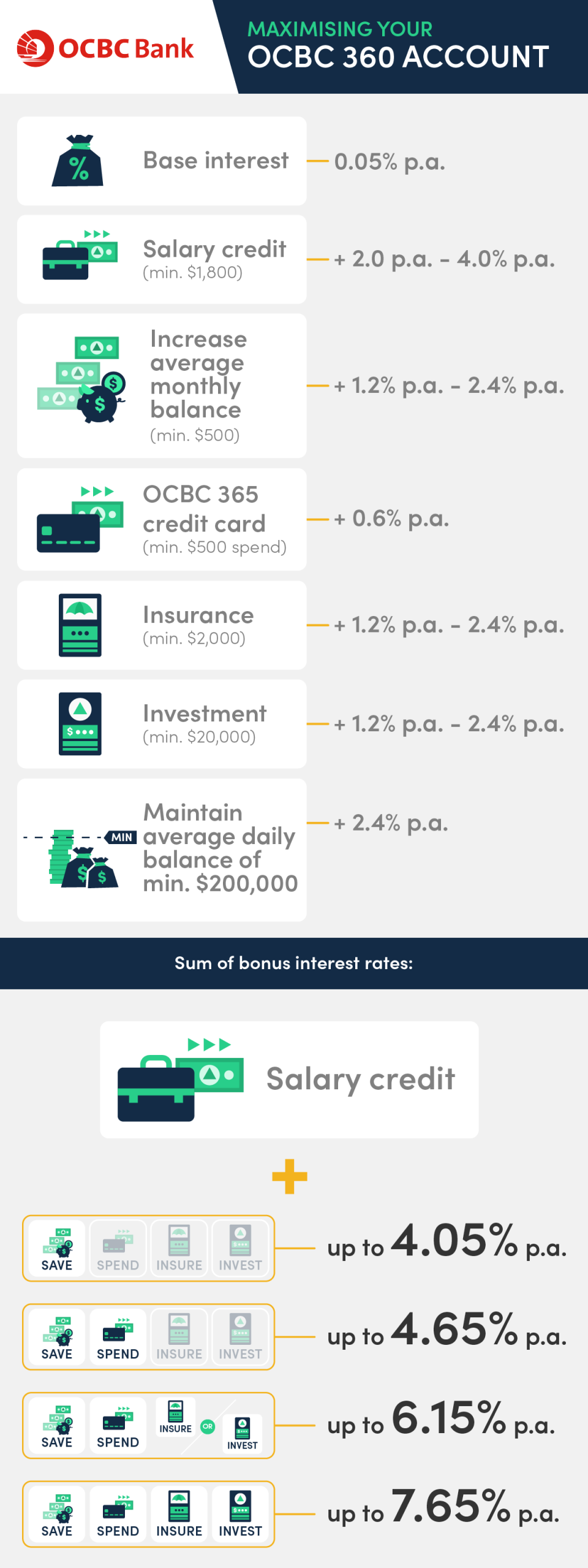

4. OCBC 360 savings account interest rates

Transactions | Interest rate (first $75,000) | Interest rate (next $25,000) | |

None (base interest) | 0.05% | 0.05% | |

Salary credit (min. $1,800) | + 2.00% | + 4.00% | |

Increase avg. monthly balance (min. $500) | + 1.20% | + 2.40% | |

Spend (min. $500 on OCBC 365 card) | + 0.60% | ||

Insure in selected products (min $2,000) | +1.20% | + 2.40% | |

Invest in selected products (min. $20,000) | + 1.20 % | + 2.40% | |

Maintain average daily balance of min. $200,000 | 2.40% | ||

OCBC 360 Account

More Details

Key Features

Minimum salary credit of S$1,800 via GIRO

OCBC 360 is a savings account with a base interest rate of 0.05% per annum on the account’s balance

You enjoy bonus interest rates when you credit your monthly salary, meet certain deposit amounts such as S$500 monthly increases or S$200,000 total balance, purchase insurance, or invest with OCBC

Increase your OCBC 360 account savings balance by S$500 monthly to enjoy 0.10% bonus interest on the first S$25,000, followed by 0.20% bonus interest for the next S$25,000, and 0.40% bonus interest for the third S$25,000

If your account balance is above S$200,000, you enjoy an additional 0.40% on your first S$75,000 deposited

The OCBC 360 savings account starts at a base interest of 0.05% p.a., and gives you varying bonus rates for crediting your salary, spending, growing your balance, insuring and investing. If you fulfil several of these requirements, this is what your maximum Effective Interest Rate (EIR) will be on your first $100,000:

Salary + Save: 4.05% p.a.

Salary + Save + Spend: 4.65% p.a.

Salary + Save + Spend + Insure / Invest: 6.15% p.a.

Salary + Save + Spend + Insure + Invest: 7.65% p.a.

The OCBC 360 is more complicated than the UOB One, but also more flexible in that there is no one mandatory requirement. This account makes sense if you’re earning just enough to meet the $1,800 minimum, and don’t want to jump through any further hoops. You’ll earn a bonus 2% for not doing much else than crediting your salary to the OCBC 360 account.

You get a bonus 1.2% every month that your account balance increases by $500 or more, so that might encourage you to save more.

OCBC 360

Minimum balance: $1,000

Fall below fee: $2. Waived for first year

Bonus interest cap: $100,000

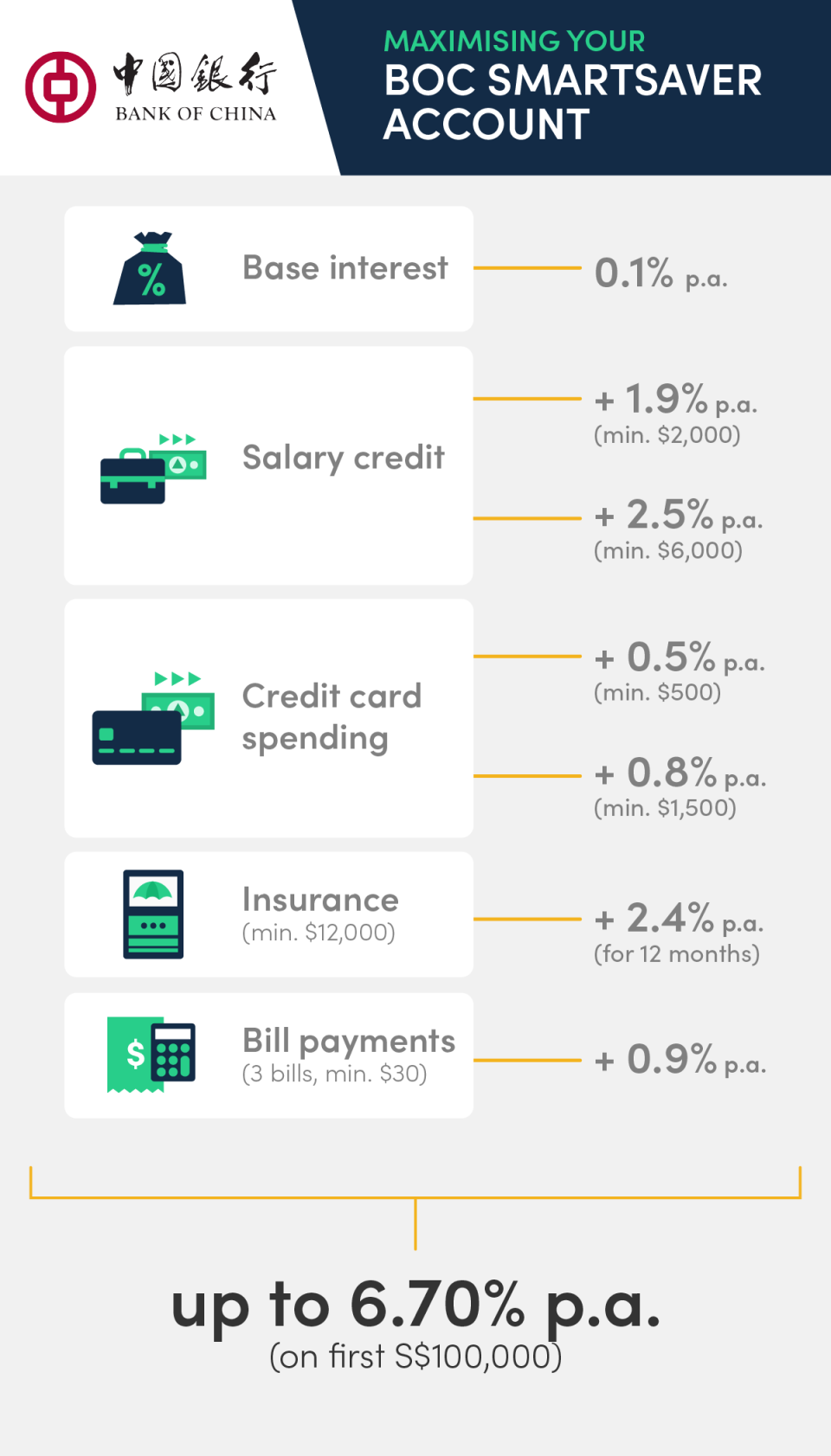

5. Bank of China Smart Saver account interest rates

Transactions | Interest rate |

None (base interest) | 0.1% |

Insurance plan spending | +2.40% p.a. for 12 consecutive months |

Salary credit | + 1.90% (min. $2,000) OR 2.50% (min. $6,000) |

Credit card spending | + 0.50% (min. $500) OR 0.80% (min. $1,500) |

3x bill payments of at least S$30 each (GIRO or internet/mobile banking) | +0.9% p.a. |

The Bank of China SmartSaver account is a decently good choice for high earners. They offer probably the highest interest rates in Singapore for those who take home a monthly salary of at least $6,000. You get a cool 2.6% p.a. just for opening the account and crediting your salary to it. If raking up a credit card bill of at least $1,500 is no problem for you, you’ll get an additional 0.8% bonus interest.

The Bank of China SmartSaver account also awards a wealth bonus of 2.4% per annum for 12 consecutive months. However, to qualify, you’ll have to put down a pretty hefty sum on their insurance products. We’re talking a minimum of $12,000 in annual premiums with a 10-year premium term.

If you max out the bonus interest in all categories, you can enjoy a rate of up to 6.7% p.a. on your first $100,000 saved with the Bank of China.

Bank of China Smart Saver

Minimum balance: $200 (Maintain at least $1,500 to enjoy bonus interests)

Fall below fee: $3

Bonus interest cap: $100,000

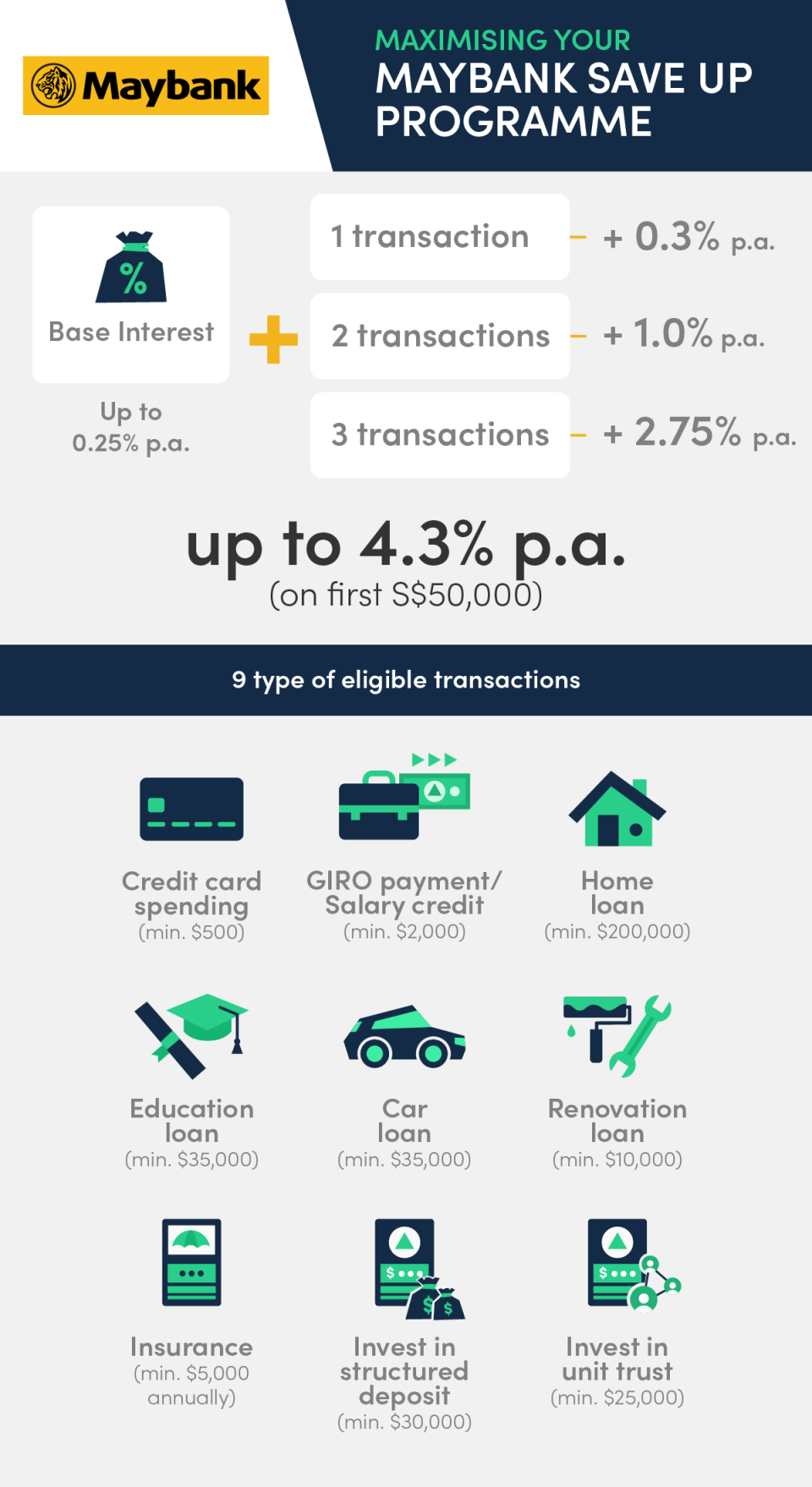

6. Maybank Save Up Programme interest rates

Interest rates (applicable from 1 Jun 2023) | |||

Transactions | First S$50,000 | Next S$25,000 | Maximum Effective Interest Rate |

None (base interest) | Up to 0.25% p.a. | Up to 0.25% p.a. | |

1 x transaction | + 0.30% p.a. | + 1.00% p.a. | 0.53% p.a. |

2 x transactions | + 1.00% p.a. | + 1.50% p.a. | 1.17% p.a. |

3 x transactions | + 2.75% p.a. | + 3.75% p.a. | 3.08% p.a. |

Maybank SaveUp Programme

More Details

Key Features

Earn up to 3% p.a. on the first S$50,000 of your account with Save Up Programme, when you save, spend, invest, insure or borrow with Maybank.

Earn bonus interest based on the number of qualifying products held:

1 qualifying product: 0.3% p.a. bonus interest

2 qualifying products: 0.8% p.a. bonus interest

3 qualifying products or more: 2.75% p.a. bonus interest

Choice of 9 qualifying products include salary or GIRO, home loans, car loans, investments and insurance.

The Maybank Save Up Programme lets you choose from 9 different Maybank products/services to get bonus interest:

GIRO payment (min. $300) OR salary credit (min. $2,000)

Credit card spending (min. $500) on Maybank Platinum Visa Card and/or Horizon Visa Signature Card

Invest in structured deposit (min. $30,000)

Invest in unit trust (min. $25,000)

Buy insurance (min. $5,000 annually)

Home loan (min. $200,000)

Renovation loan (min. $10,000)

Car loan (min. $35,000)

Education loan (min. $10,000)

The Maybank Save Up Programme starts with a higher base interest rate than most other savings accounts. However, the bonus interest rates aren’t competitive unless you fulfil 3 transactions. Assuming you hit 3 transactions and start with a bonus interest rate of 0.25%, you’ll get 4.3% on your first $50,000 and 5.5% p.a. on the next $25,000. For comparison, the OCBC 360 account will give you 4.65% p.a. for hitting the three categories of crediting your salary, saving, and spending on your credit card.

Maybank Save Up Programme

Minimum balance: $1,000

Fall below fee: $2. Waived for individuals below age 25.

Bonus interest cap: $50,000

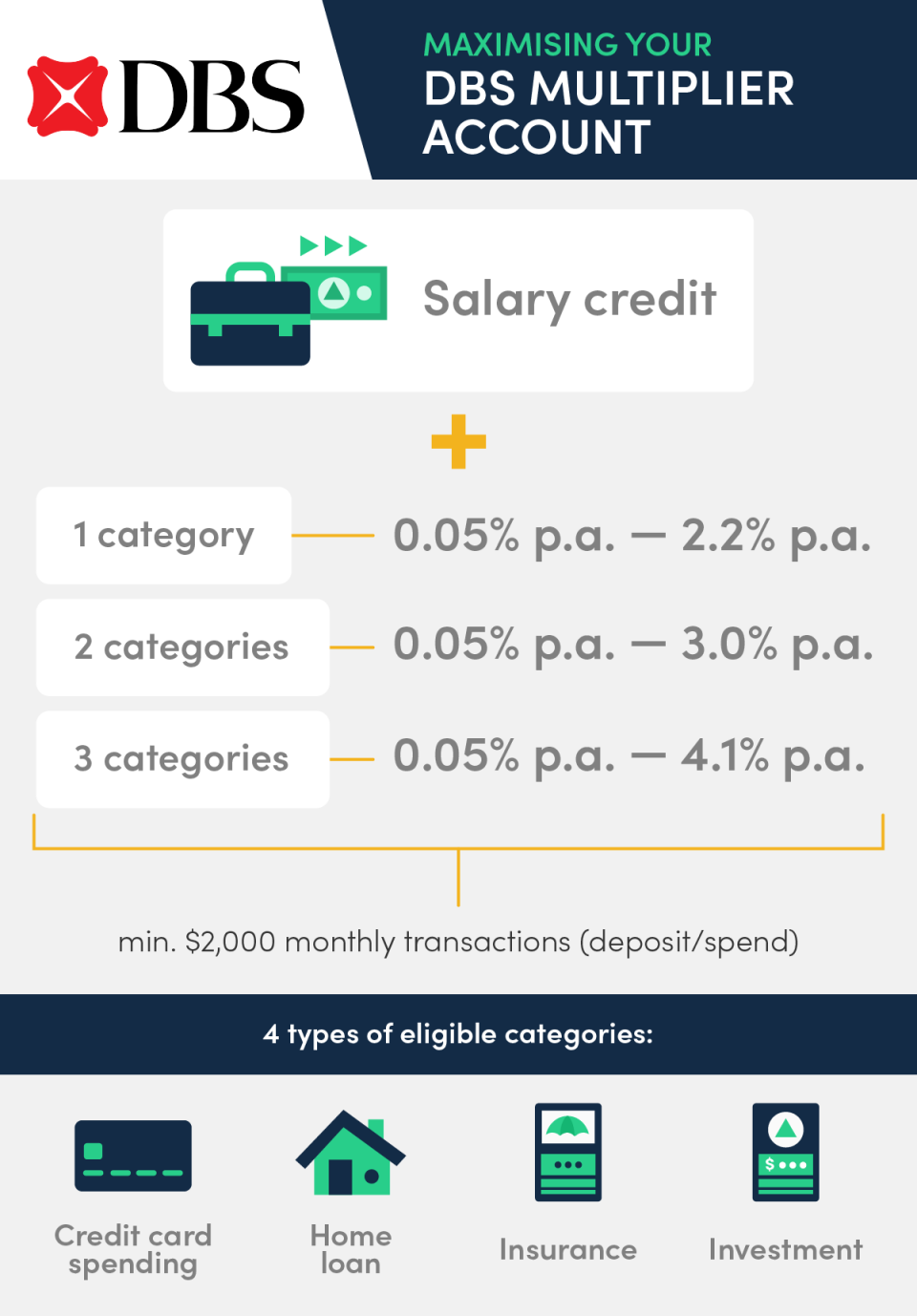

7. DBS Multiplier savings account interest rates

Total monthly transactions | Income + 1 category | Income + 2 categories | Income + 3 categories |

First $50,000 | First $100,000 | First $100,000 | |

$500 to $14,999 | 1.80% | 2.10% | 2.40% |

$15,000 to $29,999 | 1.90% | 2.20% | 2.50% |

$30,000 and up | 2.20% | 3.00% | 4.10% |

High Interest Rates

DBS Multiplier Account

More Details

Key Features

No minimum salary credit

DBS Multiplier Account is a deposit account with a base interest rate of 0.05% per annum

Bonus interest rates: 1.40% to 3.80% per annum. DBS Multiplier Account 2020 interest rates have been updated as of 1 August 2020

To enjoy bonus interest rates, you need to credit your salary or dividends via GIRO to any DBS/ POSB deposit account that you hold, and transact a minimum of S$2,000 on any DBS/ POSB credit card you hold, DBS/ POSB home loan monthly instalments, DBS/ POSB insurance regular monthly premium, or DBS investments. Your bonus interest rate increases if you transact in more of the above categories

Bonus interest rates for 29-year-olds and below: Credit your income and spend above S$500 via PayLah! to qualify for 0.30% bonus interest rates on your PayLah! retail spend

DBS Multiplier 2020 interest rate updates: As of 1 August 2020, interest rates have been revised for DBS Multiplier account holders with transactions in 1 and 2 categories. Refer to Bonus Interest Rate tab below to see the change in interest rates

Students, NSF, self-employed, salaried or retired individuals are eligible to apply

The rates in the table above apply to you if you credit your salary/dividends/SGFinDex to any DBS or POSB account (yes, it doesn’t need to be your DBS Multiplier account!). You need to have $2,000 worth of transactions moving in and out of your DBS Multiplier account from your salary credit and one or more of the following categories:

Credit card spending (no minimum)

Home loan (cash + CPF components counted)

Selected insurance policies (life insurance, critical illness, endowment plans and selected single premium policies)

Selected investments (regular savings plan, unit trust, online equities trade, digiPortfolio or bonds, and structured products)

The more categories you hit, the higher bonus interest rates you get.

What if you don’t have any DBS credit card, insurance, or investments? Unfortunately, the bonus interest rates aren’t as high, at 1.5% p.a. for the first $50,000. And while you have the option to not credit your salary to a DBS/POSB account, DBS will still require you to at least use PayLah!. The good news is that there isn’t a minimum amount for PayLah! spend. Just use it to pay for anything, even if it’s a $1+ cup of kopi at your local coffeeshop. Easy!

The DBS Multiplier account makes it easy to earn bonus interest with its zero minimum spend transaction categories and the flexibility to credit your salary into any DBS account, not necessarily the DBS Multiplier.

However, DBS Multiplier account interest rates start pretty low. If you don’t credit your salary to a DBS/POSB account, your interest rates max out at 0.40% p.a..

In fact, DBS Multiplier interest rates are nowhere near even the 1% p.a. mark unless Option 1 applies to you, i.e. you have other DBS/POSB transactions. Comparatively, CIMB FastSaver’s interest rates start at 1.50% p.a. for just opening the account and depositing a minimum of $1,000.

DBS Multiplier

Minimum balance: $3,000

Fall below fee: $5. Waived for first-time customers & those up to age 29.

Bonus interest cap: $100,000

8. CIMB FastSaver savings account interest rates

The CIMB FastSaver account is the easiest savings account to earn money with this month. They’re running a promotion that lets new-to-bank customers earn 3.50% p.a. from the first dollar, with a minimum deposit of S$1,000. Simply maintain or increase your month-end balance, and start accruing interest!

Those with an existing CIMB FastSaver account enjoy the same rate on incremental funds after they top up their account. Again, there are no requirements to hit a certain credit card spend or buy insurance to enjoy this rate.

Admittedly, 3.50% p.a. interest is not a lot. But we have to give the CIMB FastSaver account credit where it’s due—it’s the least headache-inducing of all the savings accounts to have. Their mechanic is as simple as it gets: deposit money, earn interest. The only requirement is to maintain at least $1,000 in your account for you to earn the advertised interest rates. You can do the least with CIMB FastSaver’s account and still reap the benefits of its rather generous interest rates.

This account is also perfect for most young adults starting out their career, because of the very low “minimum” balance of $1,000 and no fall below fee.

CIMB FastSaver

Minimum balance: $1,000

Fall below fee: None!

Bonus interest cap: $75,000

9. POSB SAYE savings account interest rates

What if you want to open a savings account, but don’t want to do anything but credit money into it? The best zero-effort contender is the POSB SAYE (Save As You Earn) account.

You need to set up a standing order to credit a fixed amount every month (anything from $50 to $3,000) into your SAYE account, then resist the urge to touch it for 2 years. As a reward for your restraint, you earn 3.5% p.a..

Note that it’s a whole lot less liquid than any other savings account, so for the love of God, please don’t put your emergency stash in here.

10. HSBC Everyday Global Account

Online Promo

Earn 1% cashback

HSBC Everyday Global Account (Personal Banking)

More Details

Key Features

A multi-currency account that meets your transactional needs in up to 11 different currencies

Get real-time exchange rates with Online GetRate

Instant worldwide transfers to your other HSBC accounts with Global Transfers

Perform FX transactions through HSBC Singapore app

Receive up to S$600 in cashback and bonus interest every month through the HSBC Everyday+ rewards programme

Bonus cashback and interest granted by spending on HSBC debit/credit cards, making GIRO bill payments, and increasing account balance

The HSBC Everyday Global Account is a multi-currency account that also doubles up as a savings account…masquerading as an interest/cashback-earning hybrid. Let me explain.

Unlike the other savings accounts on this list, the HSBC Everyday Global Account doesn’t stack bonus interest the more you spend/save/borrow/invest/insure. Instead, the account works hand in hand with the HSBC Everyday+ Rewards Programme to earn you a maximum of 4.50% interest per year.

3.45% p.a. Everyday Global Account Bonus Interest

0.05% p.a. Everyday Global Account’s prevailing interest rate

1.00% p.a. when you qualify for the HSBC Everyday+ Rewards Programme

To qualify for the HSBC Everyday+ Rewards Programme, you need to:

Deposit at least $2,000 (for Personal Banking customers) or $5,000 (for Premier customers) into the account

Make 5 eligible transactions, with no minimum amount. These can be any combination of the following types:

Transactions made with a HSBC personal credit card

Transactions made with a HSBC Everyday Global Debit Card

GIRO bill payments

Fund transfers

Qualifying for the Everyday+ Rewards Programme also gets you 1% cashback (capped at $300/month).

On top of the interest and cashback, HSBC will give you one-time cash bonuses of up to $150 (for Personal banking customers) or $300 (for Premier banking customers) when you deposits at least $100,000 (Personal banking) / $200,000 (Premier Banking) and meets the eligibility criteria above for the first 6 months.

Know someone who needs to switch their savings account? Share this article with them!

The post Best Savings Accounts in Singapore with Highest Interest Rates (Nov 2023) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Best Savings Accounts in Singapore with Highest Interest Rates (Nov 2023) appeared first on MoneySmart Blog.

Original article: Best Savings Accounts in Singapore with Highest Interest Rates (Nov 2023).

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.