Actinium (ATNM) to Report Q2 Earnings: What's in the Cards?

We expect investors to focus on pipeline updates when Actinium Pharmaceuticals, Inc. ATNM reports second-quarter 2020 results.

Actinium's stock has surged 164.7% so far this year against the industry's decline of 6.4%.

Factors to Note

Actinium Pharmaceuticals is a clinical-stage biopharmaceutical company developing ARCs or antibody radiation-conjugates, which combine the targeting ability of antibodies with the cell, killing the ability of radiation. Since the company does not have any approved product in its candidate, the focus of the second quarter conference call will be on pipeline updates.

The company's lead product candidate, Iomab-B (apamistamab-I-131). is being studied in an ongoing pivotal phase III Study, SIERRA, in elderly relapsed or refractory acute myeloid leukemia patients for Bone Marrow Transplant (BMT) conditioning. Enrollment is ongoing in the study with more than 50% enrolled. The company is expected to have conducted an ad-hoc analysis of the primary endpoint in the second quarter, triggered following an enrollment range of 70 to 110 patients. The primary endpoint of SIERRA is durable Complete Remission (dCR) of 180 days.

Previously, the company had announced positive data from the mid-point analysis of SIERRA study. The data showed substantially lower rates of febrile neutropenia and sepsis in patients receiving Iomab-B compared to patients receiving salvage chemotherapy in the control arm.

We expect the company to provide an update related to the ad-hoc analysis on its second quarter earnings call. If data from this analysis is positive, it could generate final top-line data in late 2020 and early termination of the study.

Apart from Iomab-B, Actinium has a multi-disease, multi-target pipeline of clinical-stage ARCs, targeting the antigens CD45 and CD33, for targeted conditioning and as a therapeutic either in combination with other therapeutic modalities or as a single agent for patients with a broad range of hematologic malignancies, including acute myeloid leukemia (AML) myelodysplastic syndrome (MDS) multiple myeloma (MM). Ongoing combination trials include its CD33 alpha ARC, actimab-A, in combination with the salvage chemotherapy CLAG-M and the Bcl-2 targeted therapy venetoclax.

These ongoing clinical studies are expected to have driven operating expenses higher in the soon-to-be reposted quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Actinium this time around. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for Actinium is 0.00%, as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 2 cents per share.

Zacks Rank: The company currently carries a Zacks Rank of 2.

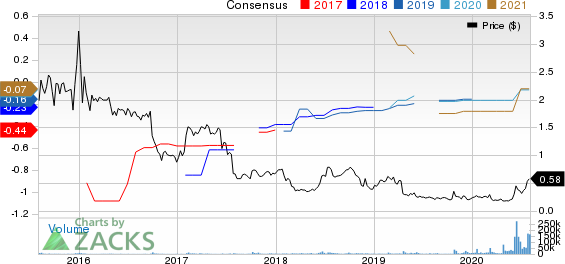

Actinium Pharmaceuticals, Inc. Price and Consensus

Actinium Pharmaceuticals, Inc. price-consensus-chart | Actinium Pharmaceuticals, Inc. Quote

Stocks to Consider

Here are some stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

AcelRx Pharmaceuticals, Inc. ACRX has an Earnings ESP of +40.74% and carries a Zacks Rank #2, at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Translate Bio, Inc. TBIO has an Earnings ESP of +5.26% and holds a Zacks Rank of 2.

Pacira BioSciences, Inc. PCRX has an Earnings ESP of +28.42% and carries a Zacks Rank of 2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They're also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Translate Bio, Inc. (TBIO) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

AcelRx Pharmaceuticals, Inc. (ACRX) : Free Stock Analysis Report

Actinium Pharmaceuticals, Inc. (ATNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research