AMETEK (AME) Q3 Earnings Beat Estimates, Revenues Down Y/Y

AMETEK, Inc. AME reported third-quarter 2020 adjusted earnings of $1.01 per share, which beat the Zacks Consensus Estimate by 6.3%.

Further, the bottom line improved 20.2% sequentially but declined 4.7% from the year-ago quarter.

Net sales of $1.13 billion surpassed the Zacks Consensus Estimate of $1.09 billion. Notably, the top line was up 11.4% from the previous quarter but down 11.7% year over year.

Disruptions caused by the COVID-19 pandemic led to a decline in the company’s top line. Moreover, sluggishness in the Electronic Instruments Group (EIG) and Electromechanical Group(EMG) segments isconcerning.

Nevertheless, the company delivered strong operational performance during the second quarter.

We believe AMETEK’s proper execution of the four core growth strategies — operational excellence, global market expansion, investments in product development and acquisitions —are expected to continue aiding its financial growth in the near term and the long haul. Moreover, the AMETEK Growth Model is likely to continue driving the company’s business performance.

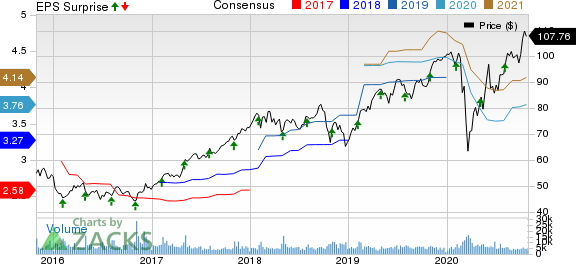

AMETEK, Inc. Price, Consensus and EPS Surprise

AMETEK, Inc. price-consensus-eps-surprise-chart | AMETEK, Inc. Quote

Segments in Detail

EIG (66.4% of total sales): AMETEK generated sales of $748.4 million from this segment, reflecting a decline of 8% from the year-ago quarter. This can primarily be attributed to the coronavirus pandemic. Nevertheless, the segment witnessed strong sequential improvement on the back of the ongoing economic recovery. Further, it delivered solid operating performance during the reported quarter.

EMG (33.6% of sales): This segment generated $378.6 million of sales in the third quarter, which declined 18% on a year-over-year basis. The coronavirus-induced headwinds were major negatives. Further, the Reading Alloys divestiture impacted the top line negatively. Nevertheless, the segment delivered strong operational results on the back of the proper execution of operational excellence initiatives.

Operating Details

For the third quarter, operating expenses were $856.2 billion, down 12.2% year over year. Further, the figure contracted 50 basis points (bps) from the year-ago quarter as a percentage of net sales to 75.9%.

Consequently, operating margin was 24%, which expanded 40 bps from the year-ago reported figure.

Although operating margin for EIG expanded 30 bps year over year to 27.2%, the same for EMG contracted 10 bps from the year-ago quarter to 22.3%.

Balance Sheet & Cash Flow

As of Sep 30, 2020, cash and cash equivalents were $1.3 billion, up from $1.1 billion as of Jun 30, 2020.

Further, inventories amounted to $584.7 million at the end of the third quarter compared with $621.5 million at the end of the prior quarter.

Long-term debt was $2.3 billion in the reported quarter, down from $2.7 billion in the prior quarter.

The company generated $309.7 million of cash from operation during the third quarter compared with $314.6 million in the previous quarter.

Further, AMETEK generated free cash flow of $299.6 million in the reported quarter.

Guidance

For fourth-quarter 2020, the company expects sales to decline in high-single digits on a year-over-year basis. Nevertheless, sales are expected to exhibit strong sequential improvement.

The Zacks Consensus Estimate for fourth-quarter sales is pegged at $1.16 billion.

Adjusted earnings are anticipated to be $1.00-$1.04 per diluted share. The Zacks Consensus Estimate for earnings is projected at 95 cents.

Zacks Rank &Stocks to Consider

AMETEK currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are CDW Corp. CDW, Qorvo QRVO and Fortinet FTNT. While CDW and Qorvo sport a Zacks Rank #1 (Strong Buy), Fortinet carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate of CDW, Qorvo and Fortinet is pegged at 13.1%, 12.35%, and 14%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research