Aon's (AON) Q3 Earnings Surpass Estimates, Increase Y/Y

Aon plc’s AON third-quarter 2020 operating earnings of $1.53 per share surpassed the Zacks Consensus Estimate by 1.3%. Further, the bottom line improved 5.5% year over year on the back of reduced operating expenses.

However, total revenues were flat year over year at $2.4 billion, which included unchanged organic revenues. Meanwhile, the top line beat the consensus mark by 2.1%. This upside was on the back of better performance by Reinsurance Solutions.

Operating margin grew 340 basis points (bps) to 18.5% while operating margin, adjusted for certain items, expanded 40 bps to 22.4%.

Total operating expenses in the second quarter declined 4% year over year to $1.9 billion, primarily owing to reduced information technology costs and general expenses plus depreciation of fixed costs.

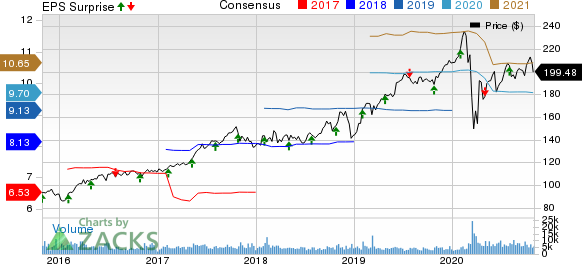

Aon plc Price, Consensus and EPS Surprise

Aon plc price-consensus-eps-surprise-chart | Aon plc Quote

Organic Revenue Catalysts

Commercial Risk Solutions: Organic revenues inched up 2% year over year on the back of strong growth across every major geography, highlighted by double-digit growth in Asia, primarily driven by solid retention and management of the renewal book portfolio. Results also reflect robust growth in core P&C in the United States.

The segment, however, reported a year-over-year 1% dip in total revenues to $1 billion.

Reinsurance Solutions: Organic revenues improved 13% owing to double-digit growth across treaty, facultative and capital markets transactions, reflecting constant new business generation. Moreover, total revenues for the segment improved 10% year over year to $321 million.

Retirement Solutions: Organic revenues slid 5% year over year. The results were impacted by a continued pressure on the company’s more discretionary parts of the business due to the pandemic, mainly in Human Capital for rewards and assessment services. Further, total revenues decreased 3% year over year to $468 million.

Health Solutions: Organic revenues inched up 1% year over year, primarily on the back of robust international growth, particularly in Asia and the Pacific region as well as a modest positive impact from the timing of certain revenues. The metric from this segment increased 1% year over year to $282 million.

Data & Analytic Services: Organic revenues fell 7% year over year due to reduction in travel and events practice, globally. Revenues increased 3% year over year to $274 million.

Financial Position

In the first nine months of 2020, the company’s cash flow from operations soared 74% from the level in the same period of 2019 to $2 billion.

Moreover, the company’s free cash flow of $1.9 billion skyrocketed 91% from the figure in the first nine months of 2019. This upside can be attributed to an increase in cash flow from operations and a decrease in capital expenditures.

The company exited the third quarter with cash and cash equivalents of $821 million, up 3.9% from the level at 2019 end. As of Sep 30, 2020, Aon had total assets worth $31.3 billion, up 6.6% from the level on Dec 31, 2019.

As of Sep 30, 2020, long-term debt stands at $7.2 billion, increasing 9.4% from the level at 2019 end.

Zacks Rank & Performance of Other Insurers

Aon carries a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other insurance industry players, which reported third-quarter earnings so far, the bottom-line results of Marsh McLennan Companies, Inc. MMC, Arthur J. Gallagher Co. AJG and Brown Brown, Inc. BRO beat the respective Zacks Consensus Estimate.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Arthur J. Gallagher Co. (AJG) : Free Stock Analysis Report

Brown Brown, Inc. (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research