Arcosa (ACA) to Report Q4 Earnings: What's in the Offing?

Arcosa, Inc. ACA is slated to report fourth-quarter 2019 results on Feb 26, after market close.

The company reported better-than-expected earnings in third-quarter 2019. Also, earnings and sales grew approximately 33% and 18%, respectively, on a year-over-year basis. The upside was backed by the successful implementation of lean manufacturing initiatives, solid margins growth in the Energy Equipment segment and acquisition strategy.

Trend in Estimate Revision

The Zacks Consensus Estimate for earnings for the quarter to be reported has been unchanged at 34 cents per share over the past 60 days. The said figure indicates a 15% decrease from the year-ago earnings of 40 cents per share. The consensus mark for revenues is $485 million, suggesting a 29.5% year-over-year improvement.

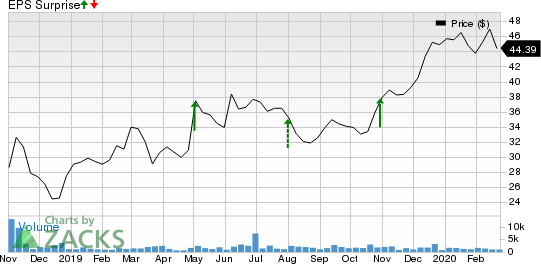

Arcosa, Inc. Price and EPS Surprise

Arcosa, Inc. price-eps-surprise | Arcosa, Inc. Quote

Factors to Note

Arcosa’s business has been gaining from strategic buyouts, solid execution of Stage 1 priorities and strong prospects in the Energy Equipment business. The company — which engages in infrastructure-related products and solutions with leading positions in construction, energy, and transportation markets — has been benefiting from solid infrastructure and housing markets fundamentals.

Acquisitions have been an integral part of its growth strategy. On Jan 6, 2020, it announced the completion of Cherry Industries, Inc. and affiliated entities’ acquisition. Also, in 2019, it acquired two construction aggregates businesses in the Construction Products unit and an inland barge components business in the Transportation Products segment. Owing to this buyout, the company is expected to have registered solid improvement in net sales.

Its Stage 1 priorities primarily focuses on growing Construction Products organically and through acquisitions; improving Energy Equipment’s operational performance while pursuing disciplined growth; expanding Transportation Products organically as barge and rail markets recover; along with operating a flat and responsive corporate structure. So far, these initiatives have provided much support to Arcosa’s business post spin-off and are expected to drive results in fourth-quarter 2019. However, slowdown in rail components and pricing pressure in the Transportation Products segment remain a cause of concern.

The Construction Products unit has been doing well on the back of acquisitions and strategic initiatives. The company expects strong fourth-quarter 2019 results in the segment. The consensus mark for the Construction products segment’s revenues is $120 million, suggesting growth of 83% year over year.

Markedly, the company has been successfully executing lean improvement initiatives. Particularly, the Energy equipment business has gained significantly. Top-line numbers of the segment are expected to have registered no change sequentially in the to-be-reported quarter.

However, it projects margins to decrease sequentially as it produces more lower-priced wind towers and has started the production of a new tower type that requires additional changeovers.

The consensus estimate for the segment’s revenues is pegged at $201 million, indicating a 2.9% decrease from the year-ago period.

In the Transportation Products segment, the company anticipates strong barge revenues in fourth-quarter 2019 owing to higher production levels. However, components revenues are expected to have offset the positives due to lower pricing on a long-term contract and soft volume in new railcar orders. The consensus estimate for Transportation Products is pegged at $166 million, implying 62.6% increase from a year ago.

What Our Model Suggests

Our proven model doesn’t conclusively predict an earnings beat for Arcosa this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arcosa — which shares space with Foundation Building Materials, Inc. FBM, Installed Building Products, Inc. IBP and Simpson Manufacturing Co., Inc. SSD in the Zacks Building Products - Miscellaneous industry — has an Earnings ESP of 0.00% and currently carries a Zacks Rank #3. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Simpson Manufacturing Company, Inc. (SSD) : Free Stock Analysis Report

Foundation Building Materials, Inc. (FBM) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research