Asian markets, euro jump on eurozone deal

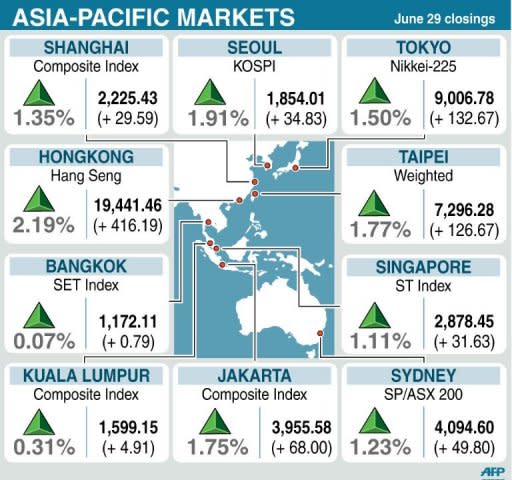

Asian markets and the euro surged Friday after eurozone leaders struck a surprise deal to allow the bloc's bailout fund to directly support struggling banks and pledged $150 billion to boost growth. The euro was up almost 1.2 percent after the agreement, which will allow emergency aid to crisis-hit Italy and Spain, was announced following marathon talks at an EU summit to save the ailing single currency. Regional bourses, which had expected little from the summit, surged on the news, with Tokyo ending 1.50 percent, or 132.67 points, higher at 9,006.78, and Hong Kong closing 2.19 percent, or 416.19 points, up at 19,441.46. Seoul finished up 1.91 percent, or 34.83 points, at 1,854.01, while Sydney ended up 1.23 percent, or 49.8 points, at 4,094.6. Shanghai closed 1.35 percent, or 29.59 points, higher at 2,225.43. The accord struck in Brussels paves the way for the eurozone's 500-billion-euro ($630 billion) bailout fund to recapitalise ailing banks directly, without passing through national budgets and adding to struggling countries' debt mountains. But this would occur only after a Europe-wide banking supervisory body is set up, with leaders aiming for that to happen at the end of the year. It was also agreed the bailout funds would be used "in a flexible and efficient manner in order to stabilise markets", a reference to buying countries' bonds to drive down high borrowing costs that have crippled Spain and Italy. EU president Herman Van Rompuy hailed the deal as a "real breakthrough" that would calm financial markets and reshape the eurozone to prevent a recurrence of the debt crisis. German Chancellor Angela Merkel appeared to have dropped her insistence on recapitalisation funds to banks being channelled through governments. EU leaders also agreed a package of measures worth some 120 billion euros they hope will bolster growth in the recession-hit bloc. In a shock move, Italy and Spain had earlier threatened to block the "growth pact" unless they won concessions on short-term moves to help their economies. But the head of the eurogroup finance ministers, Luxembourg Prime Minister Jean-Claude Juncker, said early Friday that the two countries had dropped their resistance in return for measures to stabilise their economies. Investors had low expectations from the summit, just one of many attempts to resolve the long-running euro debt crisis, and the deal took Asian markets by surprise. But analysts warned against overoptimism. "It is a bit of relief, but it is not a game changer," Wee-Khoon Chong, Asia rates strategist at Societe Generale in Hong Kong, told Dow Jones Newswires. "The market is quite thin and it might have overreacted." Markets had earlier edged higher after a decline on Wall Street. The Dow Jones Industrial Average closed down 0.20 percent, or 24.75 points, at 12,602.26 on Thursday, after having been off by more than 170 points during the session. The recovery from early losses in the last hour of New York trade came amid short covering and hopes that EU leaders would agree measures to stem the crisis. On currency markets in early European trade, the euro was at $1.2583 from $1.2449 in morning Tokyo trade, while it also rose against the Japanese currency to 99.92 yen from 98.60 earlier Friday. Oil surged on the eurozone deal. New York's main contract, light sweet crude for delivery in August rose $1.66 to $79.35 a barrel and Brent North Sea crude for August delivery gained $1.28 cents to $92.64. Gold was at $1,579.62 an ounce at 1110 GMT, compared with $1,569.79 an ounce late Thursday. In other markets: -- Taipei rose 1.77 percent, or 126.67 points, to 7,296.28. Smartphone maker HTC rose 3.87 percent to Tw$389.5 while Taiwan Semiconductor Manufacturing Co. was 1.75 percent higher at Tw$81.3. -- Wellington was down 0.04 percent, or 1.51 points, to finish at 3,399.84. Telecom Corp. dropped 0.42 percent to NZ$2.39, Fletcher Building was off 1.01 percent at NZ$5.87 and Chorus was up 0.64 percent to NZ$3.14. -- Manila closed 0.19 percent, or 9.74 points, at 5,246.41. Philippine Long Distance Telephone Co. slipped 1.41 percent to 2,650 pesos, while Metropolitan Bank lost 1.50 percent to 92.50 pesos. -- Singapore closed 1.11 percent, or 31.63 points, higher at 2,878.45 points. Diversified conglomerate Keppel Corp was 0.69 percent higher at Sg$10.28 and commodities trading firm Olam International eased 0.28 percent to Sg$1.81. -- Kuala Lumpur was 0.31 percent, or 4.91 points, higher at 1,599.15. Utility Tenaga Nasional gained 0.75 percent to 6.74 ringgit, while plantation giant Sime Darby inched up 0.10 percent to 9.89. Budget carrier AirAsia lost 0.28 percent to 3.57 ringgit. -- Jakarta rose 1.75 percent, or 68.00 points, to close at 3,955.57. Adaro rose 6.6 percent to 1,450 rupiah, Bayan Resources gained 6.4 percent to 700 rupiah, Bumi Resources added 2.8 percent to 1,110 rupiah and Bukit Asam rose one percent to 14,650 rupiah. -- Bangkok edged up 0.07 percent, or 0.79 points, to 1,172.11. Energy firm Banpu rose 2.28 percent to 448.00 baht and oil giant PTT was up 0.94 percent at 323.00 baht. -- Mumbai rose 2.59 percent, or 439.22 points, to 17,429.98.