Asian markets higher after Wall St rally

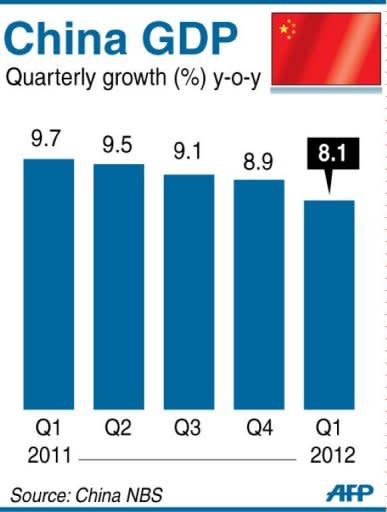

Asian markets mostly rose on Friday after a strong rally on Wall Street while dealers absorbed data showing China's economy grew at its slowest pace in almost three years in the first quarter. The mood was also lifted by news that a North Korean rocket launch, which had raised regional security tensions, had failed. Tokyo rose 1.19 percent, or 113.20 points, to 9,637.99 and Seoul climbed 1.12 percent, or 22.28 points, to 2,008.91 while Sydney gained 0.99 percent, or 42.3 points, to 4,322.9. Hong Kong added 1.84 percent, or 373.72 points, to 20,701.04 and Shanghai was up 0.35 percent, or 8.30 points, to 2,359.16. Investors took their cue from a Wall Street surge that was driven by hopes the Federal Reserve will introduce fresh stimulus measures after a second straight week of rising jobs claims. Adding to the buying sentiment was data showing the country's trade deficit had narrowed in February. The Dow closed up 1.41 percent, the S&P 500 gained 1.38 percent and the tech-heavy Nasdaq climbed 1.30 percent. However, China's keenly-awaited gross domestic product results showed the economy grew just 8.1 percent in the first three months of the year, the weakest since the second quarter of 2009. The export-driven economy was hurt by the ongoing troubles in its key European and US markets, while demand at home was also weak. Friday's figures follow a string of bad results from Beijing that many analysts fear point to a sharp slowdown, which could have huge knock-on effects for other economies that rely on Chinese growth. Shuang Ding, senior China economist at Citigroup, told Dow Jones Newswires: "We think the policy easing will continue, or in case it's necessary, could be beefed up." However, the 8.1 percent growth was above Beijing's target 7.5 percent for the year and in line with World Bank's forecast of 8.2 percent. Dealers were cheered by official data showing Chinese banks ramped up lending in March by issuing 1.01 trillion yuan ($160.3 billion) in new loans, much higher than February's 710.7 billion yuan and the expected 800 billion yuan. Analysts said the surge indicated the government was carrying out its aims to "fine-tune" monetary policy to keep the economy moving, which also include cutting the amount of cash banks must keep in reserve. There was also relief around the region after Pyongyang's attempt to fire a rocket into space ended in failure when it exploded over the sea after just two minutes in the air. North Korea had said the rocket would place a satellite in orbit for peaceful research purposes, but Western critics saw the launch as a thinly veiled ballistic missile test, banned by United Nations resolutions. The planned launch had investors jittery, with worries escalating over security on the Korean peninsula and beyond. Kenichi Hirano, operating officer at Tachibana Securities in Tokyo, said traders were "somewhat relieved" by the news. On currency markets, the euro bought $1.3157 and 106.42 yen in late Asian trade, from $1.3199 and 106.65 yen in New York late Thursday. The dollar was at 80.88 yen, from 80.74 yen. New York's main oil contract, West Texas Intermediate crude for delivery in May was down 47 cents to $103.17 per barrel in late afternoon trade while Brent North Sea crude for May fell 46 cents to $121.25. Gold was at $1,672.90 an ounce at 0810 GMT, compared with $1,654.45 late Thursday. In other markets: -- Taipei climbed 1.64 percent, or 125.35 points, to 7,788.27. TSMC added 2.78 percent to Tw$84.9 while China Airlines was 1.74 percent higher at Tw$11.7. -- Manila closed 1.00 percent higher, adding 50.52 points to 5,097.30. Alliance Global Group gained 0.66 percent to 12.12 pesos while JG Summit Holdings rose 7.20 percent to 33.50 pesos. Metropolitan Bank and Trust Co. rose 1.85 percent to 88 pesos. -- Wellington closed flat, adding 0.10 points to 3,487.17. Contact Energy slipped 0.62 percent to NZ$4.80, Fletcher Building added 0.81 percent to NZ$6.20 and Telecom was down 1.00 percent at NZ$2.49. -- Bangkok was closed for a public holiday.