Asian markets mostly up on upbeat earnings

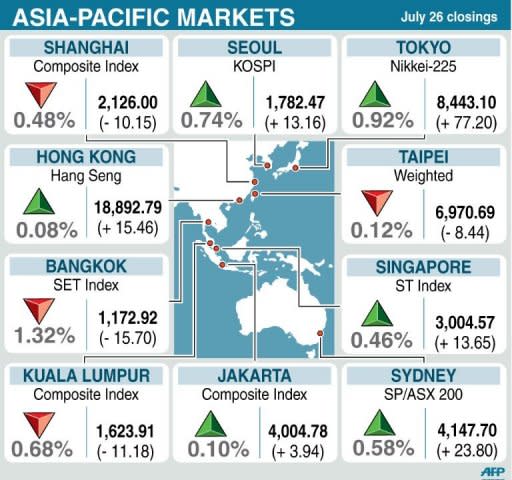

Asian markets mostly rose Thursday following upbeat earnings results in the region and the United States, while eurozone fears eased slightly on hopes over the funding of future bailouts. The first gain for the Dow in four sessions also provided some support but the euro gave up some of the rare recent gains it had made in New York currency trade. Tokyo's Nikkei index closed 0.92 percent, or 77.20 points, higher at 8,443.10, as investors sought out cheap buys after the benchmark hit a seven-week low on Wednesday, said Fumiyuki Nakanishi, SMBC Friend Securities' head of investment and research. Sharp closed up 0.76 percent at 262 yen after recouping losses on a report the consumer electronics firm may cut 15 percent of its workforce. Olympus jumped 9.63 percent to 1,400 yen after medical equipment maker Terumo said it offered to make a $640-million capital injection in the scandal-hit firm and merge under a holding company. Brokerage giant Nomura Holdings rose 5.71 percent to 259 yen after media reports that chief executive Kenichi Watanabe would step down over an insider trading scandal. Nomura said after the market close that its net profit dived 89.4 percent year-on-year to 1.89 billion yen in the three months to June as commission income fell in retail business while net gain on trading shrank. Canon plunged 7.76 percent to 2,470 yen after the export-dependent cameras and office equipment maker lowered its profit outlook for 2012. Meanwhile, the Seoul market was up 0.74 percent, or 13.16 points, at 1,782.47, and Sydney gained 0.58 percent, or 23.8 points, to 4,147.7. Hong Kong ended flat, edging up 0.08 percent, or 15.46 points, to 18,892.79, while Shanghai eased 0.48 percent, or 10.15 points, to 2,126.00. Regional investors followed the lead from the Dow and most European markets after Spanish borrowing costs fell slightly after hitting record highs on the back of fears Madrid will ask for a bailout. The yield on Madrid's 10-year bonds eased to a still-high 7.376 percent after soaring to as much as 7.621 percent at one point. Dealers were given some comfort after Austrian central bank chief Ewald Nowotny, a member of the European Central Bank governing council, said the soon-to-be launched European Stability Mechanism rescue fund might be granted a banking licence. That would allow the fund to exchange bonds for ECB cash, bolstering its capacity without governments having to contribute additional funds. Traders have been growing increasingly concerned that a possible rescue for Spain could cost hundreds of billions of dollars, which leaves very little in the pot to help other troubled economies. "Giving the ESM a banking licence would allow it to expand its firepower," CMC Markets chief market strategist Michael McCarthy in Australia told Dow Jones Newswires. "The sell-off this week was related to the failure of the eurozone to make any improvement in the structural process of directly aiding Spanish banks." But there was still plenty of gloom in Europe. In Germany a survey showed business confidence dropped for the third month in a row in July while Britain said its economy shrank a worse than expected 0.7 percent in April-June deepening the country's double-dip recession. On Japan's Nikkei, videogame maker Nintendo posted healthy gains of 3.19 percent after saying later Wednesday that its first-quarter losses were much lower than at the same time last year. And industrial robotics firm Fanuc surged 5.32 percent after saying earnings for the April-June period were better than expected. The earnings figures were followed by strong results on Wall Street from construction giant Caterpillar and airplane maker Boeing, which helped the Dow advance 0.47 percent on Wednesday. In Sydney flagship carrier Qantas jumped 9.6 percent after it said it was in talks with Emirates and other airlines about a possible tie up to save its struggling international arm. On currency markets the euro bought $1.2145 and 94.98 yen in afternoon Asian trade, compared with $1.2153 and 95.04 yen late Wednesday in New York, where it had made big gains from the previous session. The dollar was at 78.18 yen from 78.19 yen. Oil prices were down. New York's main contract, light sweet crude for delivery in September, dipped 34 cents to $88.63 a barrel in the afternoon while Brent North Sea crude for September delivery fell 38 cents to $104.00. Gold was at $1,604.23 at 0850 GMT from $1,592.40 late Wednesday. In other markets: -- Taipei was down 0.12 percent, or 8.44 points, at 6,970.69. Hon Hai Precision lost 1.71 percent to Tw$80.5 and Taiwan Semiconductor Manufacturing Co rose 2.28 percent to Tw$76.3. -- Manila closed 0.18 percent, or 9.24 points, lower at 5,152.56. Philippine Long Distance Telephone slipped 0.22 percent to 2,674 pesos but Ayala Corp. 0 rose 0.39 percent to 412.60 pesos. -- Wellington rose 0.77 percent, or 26.77 points, to 3,485.74. Fletcher Building was up 2.3 percent at NZ$5.90, Air New Zealand gained 0.6 percent to close at NZ$0.90 and Telecom Corp lifted 0.2 percent to NZ$2.57.