Asian markets slip on EU summit concerns

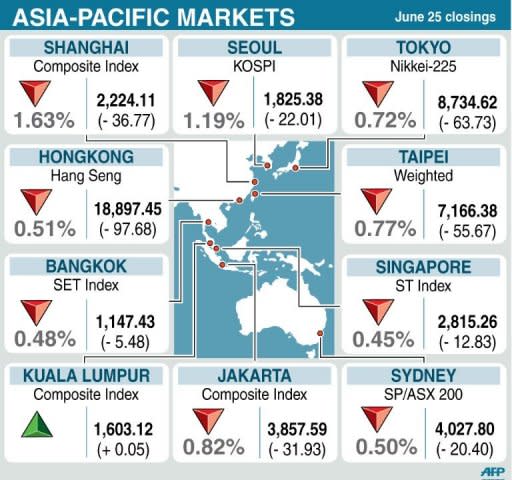

Asian markets fell Monday on pessimism over whether a European summit this week will come up with a plan to address the region's crippling debt crisis. Last week's announcement by the eurozone's four biggest economies to set aside more than $160 billion to boost growth had little impact on sentiment, with most of the cash coming from existing projects. Tokyo fell 0.72 percent, or 63.73 points, to 8,734.62, Seoul dived 1.19 percent, or 22.01 points, to 1,825.38 and Sydney closed 0.50 percent, or 20.4 points, lower at 4,027.8. Shanghai tumbled 1.63 percent, or 36.77 points, to 2,224.11 and Hong Kong closed 0.51 percent, or 97.68 points, lower at 18,897.45. Attention has turned to the meeting in Brussels on Thursday and Friday, where leaders will try to come up with a plan to support weaker economies and avoid a potentially catastrophic economic collapse. The talks come as debt woes have spread from Greece to Spain, which is enveloped by a banking and economic crisis, while Italy is also in danger of succumbing. But despite so much at stake there are concerns the differences between leaders on the best way forward -- with powerhouse Germany almost alone in arguing for austerity -- will mean no concrete or effective plan is agreed. "We suspect investors will walk away disappointed once again," said Standard Chartered in a note. "We expect the pressure on both Europe and its financial system to resume, encouraging further depreciation of the euro," it said, according to Dow Jones Newswires. On Friday, Germany, France, Italy and Spain -- the four biggest economies in the eurozone -- agreed measures worth up to 130 billion euros ($163 billion) to tackle the debt crisis. French President Francois Hollande said the leaders had agreed to mobilise "one percent of European GDP, that is 120 to 130 billion euros, to support growth" -- a move Germany's Angela Merkel hailed as "an important signal". Italian Prime Minister Mario Monti said the four leaders had agreed that boosting growth in the eurozone was key to restoring confidence. The measures include a capital injection for the European Investment Bank, the redirection of some unspent EU regional funds and "project bonds" to finance infrastructure works. However, much of the money comes from already existing programmes. In early European forex trade the euro bought $1.2485 and 99.70 yen, down from $1.2569 and 101.10 yen in New York late Friday. The dollar weakened to 79.85 yen from 80.43 yen. On Wall Street Friday the Dow gained 0.53 percent, the S&P 500 climbed 0.72 percent and the tech-rich Nasdaq 1.17 percent. On oil markets Monday New York's main contract, light sweet crude for delivery in August, fell 44 cents to $79.32 a barrel in the late afternoon and Brent North Sea crude for August lost 54 cents to $90.34. Gold was at $1,569.01 an ounce at 1050 GMT, compared with $1,568.20 late Friday. In other markets: -- Singapore closed down 0.45 percent, or 12.83 points, at 2,815.26. Singapore Telecom gained 1.27 percent to Sg$3.20 while Keppel Corp fell 1.09 percent to Sg$9.99. -- Taipei fell 0.77 percent, or 55.67 points, to 7,166.38. Taiwan Semiconductor Manufacturing Company ended 0.62 percent lower at Tw$79.6 while leading smartphone maker HTC lost 1.94 percent to finish at Tw$378.5. -- Manila closed 0.92 percent, or 47.13 points, up at 5,167.20. Philippine Long Distance Telephone was up 4.88 percent at 2,624 pesos while Alliance Global Group gained 0.67 percent to 12 pesos. -- Wellington closed flat, edging up 1.93 points to 3,401.13. Telecom was up 0.41 percent to NZ$2.47 and Fletcher Building off 0.17 percent at NZ$5.98. -- Jakarta fell 0.82 percent, or 31.93 points, to 3,857.59. -- Bangkok closed 0.48 percent, or 5.48 points, lower at 1,147.43. Banpu fell 2.23 percent to 438.00 baht, while PTT dropped 1.27 percent to 310.00 baht. -- Kuala Lumpur was almost unchanged, nudging up 0.05 points to 1,603.12. Coal miner Bumi Resources fell 9.1 percent to 1,100 rupiah, nickel miner Vale Indonesia slid 3.0 percent to 2,425 rupiah and cement maker Indocement declined 0.89 percent to 16,700 rupiah. -- Mumbai was down 0.53 percent or 90.35 points to 16,882.16. India's largest private aluminium producer Hindalco fell 2.35 percent to 114.5 rupees while the largest commercial bank State Bank of India fell 1.94 percent to 2,114.9.