Dollar swoons after Trump critique; Pound rises on Brexit plan

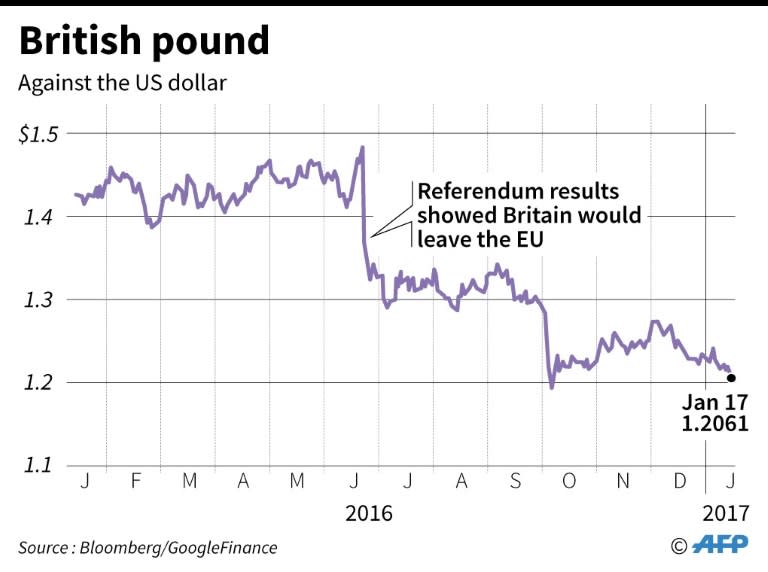

The dollar tumbled Tuesday after President-elect Donald Trump said the American currency was too strong, while the pound rallied after British Prime Minister Theresa May released her Brexit blueprint. The fluctuations in foreign exchange came as most larger equity markets fell as markets look ahead to Friday's inauguration of US President-elect Donald Trump. The greenback fell sharply against the euro, pound and other major currencies following a Trump interview, published in Monday's Wall Street Journal, in which he called the dollar "too strong" and said China's comparatively cheap currency was "killing us." The dollar was further buffeted by Trump's criticism in the same article of a Republican plan in Congress to enact a border tax adjustment that has been seen as supporting a strong dollar. "On balance, with just four business days until Mr. Trump's inauguration, global financial markets are beginning to pare back some of the initial optimism surrounding the election of Donald Trump," said Omer Esiner, analyst at Commonwealth Foreign Exchange. The broad-based S&P 500 lost 0.3 percent, with banking and pharmaceutical shares especially weak. - May outlines Brexit plan - In a highly-anticipated speech, May set the stage for a "hard" Brexit, meaning a firm split from the EU. "Brexit must mean control of the number of people who come to Britain from Europe. And that is what we will deliver," May told foreign ambassadors in London. "What I am proposing cannot mean membership of the single market." In a concession to parliamentary critics, the Conservative leader also said lawmakers would get a vote on any final Brexit agreement negotiated with Brussels. Although such a break is seen as a tough challenge for the British economy, the pound rallied in part because "market participants were happy to see a clear path forward," said BK Asset Management analyst Kathy Lien. "They also cheered the news that the government will put the final deal to vote in Parliament and that they will strive for a phased transition that would limit the inevitable damage on the economy and the market." The British pound shot up nearly three percent to more than $1.24 following May's remarks, although the currency's gain weighed on British stocks. The FTSE 100 lost 1.5 percent. "The bulk of what May said today had already been leaked... The one point of interest was the revelation that parliament will vote on the deal which sent the pound higher," noted Oanda analyst Craig Erlam. Britain has two years to negotiate a break-up deal once May triggers Article 50 of the Lisbon Treaty, officially declaring the country's intention to quit, or face leaving with no agreement. Article 50 will be triggered by late March at the latest. - Key figures around 2200 GMT - New York - Dow: DOWN 0.3 percent at 19,826.77 (close) New York - S&P 500: DOWN 0.3 percent at 2,267.89 (close) New York - Nasdaq: DOWN 0.6 percent at 5,538.73 (close) London - FTSE 100: DOWN 1.5 percent at 7,220.38 (close) Frankfurt - DAX 30: DOWN 0.1 percent at 11,540 (close) Paris - CAC 40: DOWN 0.5 percent at 4,859.69 (close) EURO STOXX 50: DOWN 0.3 percent at 3,285.04 Tokyo - Nikkei 225: DOWN 1.5 percent at 18,813.53 (close) Shanghai - Composite: UP 0.2 percent at 3,108.77 (close) Hong Kong - Hang Seng: UP 0.5 percent at 22,840.97 (close) Pound/dollar: UP at $1.2409 from $1.2055 Euro/dollar: UP at $1.0712 from $1.0602 Dollar/yen: DOWN at 112.65 yen from 114.04 yen Oil - West Texas Intermediate: UP 11 cents at $52.48 per barrel Oil - Brent North Sea: DOWN 39 cent at $55.47 per barrel