Australia's services exports have been smashed – and that's not good for jobs

The latest trade figures show that Australia continues to export more goods than it imports. But while a trade surplus is generally regarded as a good thing, the reality is that our exports of iron ore make things look better than they really are, and the collapse of our services exports is a better indicator of the current state of the economy.

Ten years ago, Australians were anticipating something that was deemed a virtual impossibility – the Australian dollar was about to achieve parity with the US dollar. A certain selection of nerds on Twitter (including me) were tweeting about a #parityparty and watching the live exchange rate get ever closer.

Related: Australia will need economic stimulus for far longer than the treasurer thinks | Greg Jericho

Soaring coal and iron ore prices after the GFC had pushed the dollar ever higher. And on 14 October 2010 the Aussie dollar reached US$0.99936, yet didn’t quite achieve parity.

Soon after there were occasional moments when it snuck above US$1 but it wasn’t until 4 November that the average daily value was above parity:

Graph not appearing? View here

It was a great time if you wanted to buy stuff from the US, or travel overseas; not so great if you wanted to encourage tourists to come here.

I was thinking about this while looking at the latest merchandise trade figures that were released on Monday by the Bureau of Statistics.

The surface picture looks pretty good. With the exchange rate at around US$0.70, exporting is favourable, and in the 12 months to September we exported $71.2bn more merchandise than we imported.

Yes, this was down on the previous month but still at a level that was unimaginable even three years ago.

Graph not appearing? View here

It’s the type of thing the government boasts, about even though it isn’t responsible for any of it.

The reality is our merchandise exports are mostly three things – iron ore, coal and gas. Gold also has a role to play, but the first three account for over 60% of all merchandise exports – at the start of this century they made up just a quarter:

Graph not appearing? View here

And yet, even among these big three there are differences. In the past year Australia exported $41bn more in iron ore than both coal and gas combined. And even more crucially, while iron ore exports have remained steady during the pandemic, coal and gas have fallen.

In the case of coal it was just the continuation of a long slide; in the case of gas the fall has been abrupt and steep:

Graph not appearing? View here

It reflects the movements in the prices of each commodity since the pandemic spread around the globe.

In September coal prices were 18% below what they were in March, LNG was down 38%, while iron ore was up 39%.

Graph not appearing? View here

So great news for iron ore companies, and for the 0.8% of Australian workers who work in that sector.

This is always the big problem with our exports sector – the big exports come from industries that are not labour-intensive.

Iron ore accounts for 36% of our merchandise exports, but less than 1% of total employment.

This is where the memory of a decade ago and parity comes back to haunt us.

Back then, when the dollar rose off the back of soaring iron ore and coal prices, our exports of goods rose strongly, but services exports – which is mostly tourism-related services and education – took a hit.

Usually our services exports grow between 6% and 7% each year. When the GFC hit, the services exports fell by 4% in one year period. But even after the GFC they remained flat as Australia became an expensive place to visit – either for tourism or education.

For the two and half years that our currency was at or above parity with the US dollar, our services exports barely grew at all:

Graph not appearing? View here

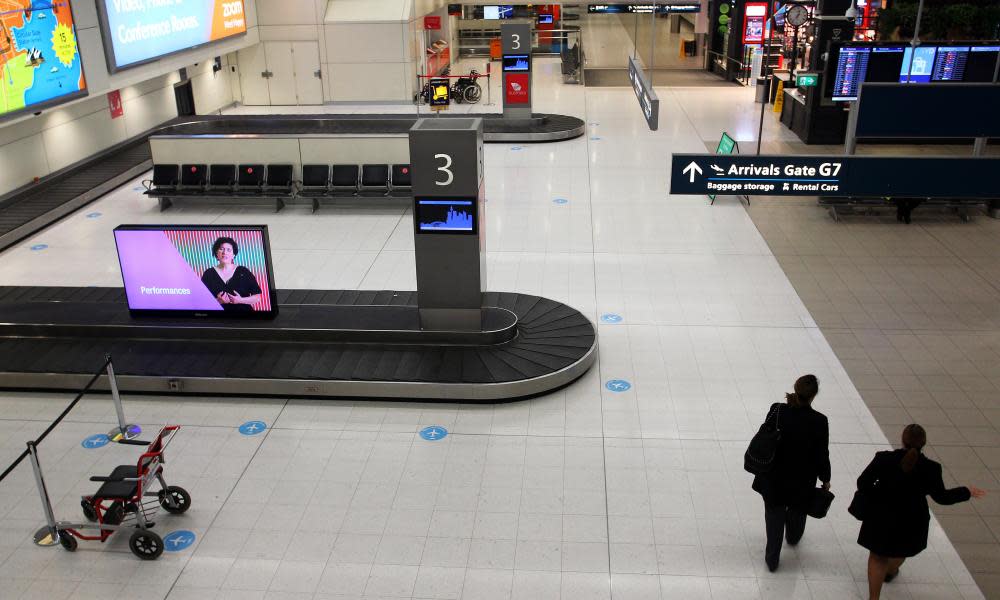

Now currency is not the issue preventing people visiting our shores and partaking of our hospitality and education services – it is the pandemic.

And while we may be exporting more goods than we import, thanks to the masses of iron ore still being shipped overseas, our services export sector has been utterly smashed – down 14% on last year.

This of course flows into jobs.

Since February the number of workers in metal ore mining has risen by 1,400; by contrast the number working in accommodation has fallen 20,800:

Graph not appearing? View here

It all highlights the weird and fractious nature of our economy. Our export sector remains overwhelmingly one of goods – even in bad times iron ore exports will continue to grow; but our employment sector is very much one in which services continue to grow.

And so trade surpluses will look nice and maybe even help with company tax revenue but for the health of the economy, the better guide is how our services are going. And for now, they are not going well at all.