Berkshire (BRK.B) Q4 Earnings Miss on Poor Segmental Results

Berkshire Hathaway Inc. BRK.B delivered fourth-quarter 2019 earnings of $4.4 billion, down 22.7% year over year.

Operating earnings of $24 billion decreased 3.2% year over year.

The company witnessed soft performance at the Railroad, Utilities and Energy segment and higher expenses.

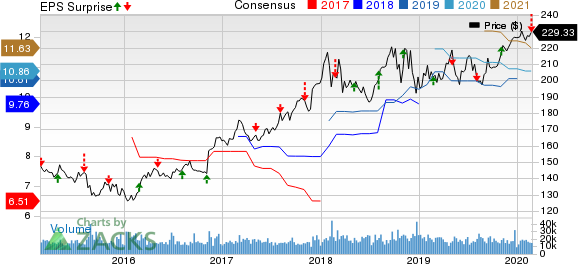

Berkshire Hathaway Inc. Price, Consensus and EPS Surprise

Berkshire Hathaway Inc. price-consensus-eps-surprise-chart | Berkshire Hathaway Inc. Quote

Behind the Headlines

Revenues increased 2.7% year over year to $254.6 billion.

Costs and expenses inched up 2.9% year over year to $225.7 billion.

Segment Results

Berkshire Hathaway’s Insurance and Other segment revenues increased 3.4% year over year to $211.1 billion on the back of higher insurance premiums earned, increase in sales and service revenues, leasing revenues and Interest, dividend and other investment income. This segment’s net earnings were $5.8 billion, down 4.3% year over year.

Railroad, Utilities and Energy operating revenues declined 0.5% year over year to $43.4 billion due to lower revenues from freight rail transportation, energy operations and lower service revenues and other income. Net earnings of $8.3 billion were up 6.1% year over year.

Total revenues at Manufacturing, Service and Retailing rose 1.3% year over year to $142.7 billion. Net earnings grew 0.1% year over year to $9.4 billion.

Financial Position

As of Dec 31, 2019, consolidated shareholders’ equity was $424.8 billion, up 21.8% from the level as of Dec 31, 2018. At 2019 end, cash and cash equivalents were $64.2 billion, up 111% from the level at 2018 end.

The company exited 2019 with a float of about $129 billion, up $6 billion from the figure at year-end 2018.

Cash flow from operating activities totaled $38.7 billion in 2019, declining nearly 3.4% from 2018.

Zacks Rank

Berkshire Hathaway currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Insurance Releases

Among other players from the insurance industry that have reported fourth-quarter earnings so far, the bottom line of Brown & Brown, Inc. BRO and RLI Corp. RLI beat the respective Zacks Consensus Estimate while that of Principal Financial PFG matched the same.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research