Boston Beer (SAM) Reports Q1 Loss, Misses Revenue Estimates

The Boston Beer Company, Inc. SAM reported a loss per share of 16 cents in first-quarter 2022, significantly narrower than a loss per share of $5.26 in first-quarter 2021. However, the loss per share significantly lagged the Zacks Consensus Estimate of earnings of $2.05. The dismal results were mainly due to the decrease in revenues due to lower shipment volumes and depletions, as well as gross margin contraction.

Net revenues declined 21.1% year over year to $430.1 million and missed the Zacks Consensus Estimate of $472.71 million. Excluding excise taxes, the top line fell 21.4% year over year to $457.3 million. The decline was a result of lower shipment and depletions in the quarter.

Shipment volume fell 25.1% to 1.7 million barrels in the first quarter, driven by declines in the Truly Hard Seltzer, Twisted Tea, Angry Orchard, and Dogfish Head brands, partly negated by gains in its Samuel Adams brand.

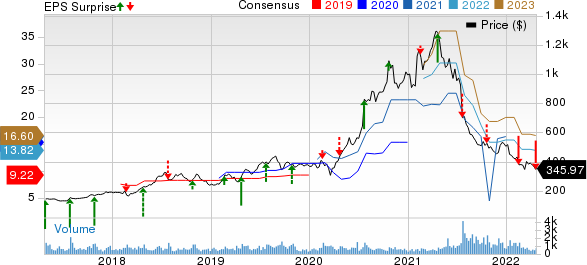

The Boston Beer Company, Inc. Price, Consensus and EPS Surprise

The Boston Beer Company, Inc. price-consensus-eps-surprise-chart | The Boston Beer Company, Inc. Quote

Depletions declined 7% in the first quarter on decreases in the Truly Hard Seltzer, Angry Orchard and Dogfish Head brands, offset by gains in the Twisted Tea brand. This is the first time in the last 16 quarters that the company did not grow depletions in double-digits. The decline resulted from a slow start in 2022 for the company and the overall beer market mainly due to internal supply-chain issues and inflation, affecting consumer purchases.

Depletions for the year-to-date period (the 16-weeks) ended Apr 16, 2022, have declined 6% from that witnessed in the year-ago period. For the same period, shipments have decreased 23%.

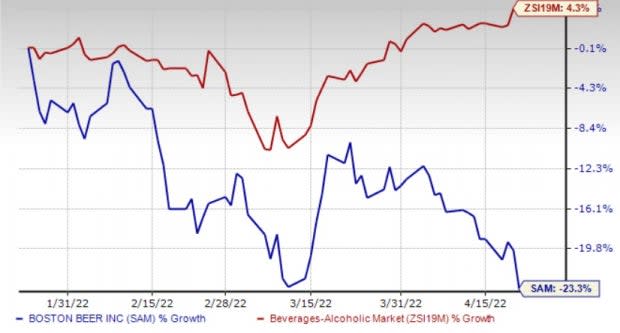

Shares of Boston Beer declined about 4% in the after-hours trading session on Apr 21 on dismal earnings results, owing to soft revenues and margin contraction. The Zacks Rank #4 (Sell) stock has lost 23.3% in the past three months against the industry’s 4.3% growth.

Image Source: Zacks Investment Research

Costs & Margins

The gross profit declined 30.7% year over year to $173 million. The gross margin contracted 560 basis points to 40.2% from 45.8% in the year-ago quarter, owing to higher supply-chain and material costs, partly negated by price increases.

Advertising, promotional and selling expenses fell 7.3% in the reported quarter to $130.6 million. The decline was driven by lower brand investments, particularly media costs, offset by higher investments in local marketing and lower freight to distributors, owing to lower volumes that were offset by higher freight rates.

General and administrative expenses increased 24.3% year over year to $39.7 million mainly due to a rise in external service costs, and increased salaries and benefits costs.

Financials

As of Mar 26, 2022, Boston Beer had cash and cash equivalents of $15.8 million, and total stockholders’ equity of $984.9 million. The company currently has $135 million in its line of credit, which, along with its cash position, will be sufficient to meet cash requirements.

For 2022, capital spending is anticipated to be $140-$190 million, backed by the current spending and investment plans.

Outlook

For 2022, Boston Beer envisions adjusted earnings per share of $11.00-$16.00, excluding the impacts of ASU 2016-09. However, it expects the earnings guidance to be highly sensitive to changes in volume projections mainly due to the slowdown in the hard seltzer category and the supply-chain performance.

Depletions and shipments are predicted to increase 4-10%. Based on the 7% depletion decline reported in the first quarter, in order to achieve the mid-point of the aforementioned view, the company estimates depletion growth of 10% for the remainder of the year from that reported in the last nine months of 2021. The company expects national price increases of 3-5%.

It anticipates a gross margin of 45-48%. Investments in advertising, promotional and selling are expected to be $0-$20 million. The advertising, promotional and selling guidance does not assume any changes in freight costs for the shipment of products to its distributors. The non-GAAP effective tax rate is anticipated to be 26%, excluding the impacts of ASU 2016-09.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely The Duckhorn Portfolio NAPA, Coca-Cola FEMSA KOF and Dutch Bros BROS.

Duckhorn currently has a Zacks Rank #2 (Buy) and an expected long-term earnings growth rate of 11.3%. NAPA has a trailing four-quarter earnings surprise of 122.4%, on average. The company has declined 7.9% in the past three months. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings per share suggests growth of 9.6% and 3.5%, respectively, from the corresponding year-ago reported numbers. The consensus mark for NAPA’s earnings per share has been unchanged in the past 30 days.

Coca-Cola FEMSA currently has a Zacks Rank of 2. KOF has a trailing four-quarter earnings surprise of 15.3%, on average. It has a long-term earnings growth rate of 6.2%. The company has gained 7.6% in the past three months.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests declines of 1.7% and 12.7%, respectively, from the prior-year reported number. The consensus mark for KOF’s earnings per share has been unchanged in the past 30 days.

Dutch Bros currently has a Zacks Rank #2. BROS has a trailing two-quarter earnings surprise of 93.75%, on average. It has an expected long-term earnings growth rate of 35.9%. The company has gained 14.4% in the past three months.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and earnings per share suggests growth of 42.7% and 3.3%, respectively, from the corresponding year-ago reported numbers. The consensus mark for BROS’ earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report

To read this article on Zacks.com click here.