Box (BOX) Q1 Earnings and Revenues Top Estimates, Rise Y/Y

Box, Inc. BOX reported fiscal first-quarter 2021 earnings per share of 10 cents, which surpassed the Zacks Consensus Estimate by 5 cents. The company had recorded a loss of $0.03 per share a year ago.

Total revenues came in at $183.56 million, surpassing the consensus mark by 0.3%. The top line increased 12.6% year over year and was within the guided range of $183-$184 million.

Following strong fiscal first-quarter results, the share price rose 5.02%.

The global shift to work from home due to the coronavirus crisis increased the demand for Box’s online collaboration tools.

Also, strong demand for its add-on products and high volume of large enterprise deals aided revenue growth during the quarter.

Box is currently working on enriching cloud content management and AI platforms. During the quarter, it made some notable partnerships and deeper integrations with leading organizations such as BETC, City of Berkeley FLIR, NASA, National Bank of Canada, Toyota Finance Corporation, and many more.

The company’s rich technology partner ecosystem will continue to be a strong driving force behind growth.

Let’s delve deeper into the numbers.

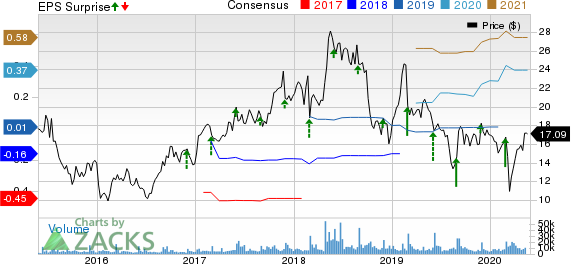

Box, Inc. Price, Consensus and EPS Surprise

Box, Inc. price-consensus-eps-surprise-chart | Box, Inc. Quote

Billings and Deferred Revenues

Billings were $128.1 million, up 8% year over year. Deferred revenues were $368.3 million, up 11% from the year-ago quarter.

Operating Results

Box’s operating expenses (general & administrative, sales & marketing, as well as research & development) of $153.8 million increased 2.8% year over year.

On a non-GAAP basis, the company recorded operating income of $17.2 million versus operating loss of $3 million a year ago. Operating margin was 9% versus 2% in the year-ago quarter.

Balance Sheet and Cash Flow

At the end of the quarter, cash and cash equivalents, and accounts receivables balance were $268 million and $99.1 million compared with $195.6 million and $209.4 million, respectively, at fiscal fourth quarter-end.

Net cash provided by operations was $61.9 million and free cash flow was $39.8 million in the fiscal first quarter.

Guidance

For the second quarter of fiscal 2021, Box expects revenues between $189 million and $190 million. The Zacks Consensus Estimate for the same is pegged at $187.5 million. On a non-GAAP basis, the company projects earnings per share within 12-14 cents. The corresponding Zacks Consensus Estimate is pegged at 8 cents per share. GAAP loss per share is expected within 13-11 cents.

For fiscal 2021, Box’s revenue guidance is expected within $760-$768 million. The Zacks Consensus Estimate for the metric is pegged at $758.36 million. On a non-GAAP basis, it projects earnings per share in the range of 47-52 cents. The consensus mark for the same is pegged at 37 cents per share. GAAP loss per share is expected in the range of 55-50 cents.

Zacks Rank and Other Stocks to Consider

Currently, Box has a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Wayfair Inc. W, eBay EBAY and Inphi Corporation IPHI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Wayfair, eBay, and Inphi is currently projected at 23%, 12.4% and 37.7%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research