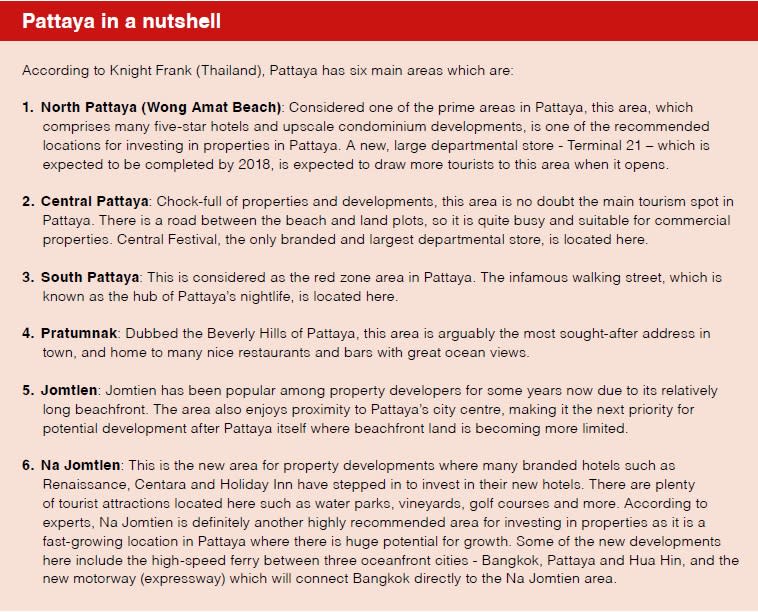

A bright spot for investors

Pattaya is popular with tourists due to its tropical climate and stunning coastline. (Photo: Sergey S. Dukachev, Wikimedia Commons)

With its warm, tropical climate, golden sandy beaches, crystal blue waters, lush vegetation, and many other attractive qualities, Pattaya – the gem of Thailand’s East Coast, has been attracting throngs of foreign investors who are seeking great property investment opportunities and holiday homes.

By Michelle Yee

Although political unrest in Thailand has been ongoing since late 2013, Thailand’s famous resort city of Pattaya is still attracting throngs of investors from around the globe who are drawn by its highly affordable property prices, high rental yields, increasing tourist numbers and pleasant climate.

According to Chinese international property portal Juwai.com, Thailand has seen a significant increase in investor interest from China over the past year, and the soaring demand can be attributed to tourism.

“The rapid growth in tourism is contributing to growing Chinese real estate investment,” said Charles Pittar, CEO of Juwai.com, noting that Thailand ranked sixth among the list of countries that Chinese travellers would like to visit this year, above the likes of France and Singapore.

While enquiries for all the top Thai destinations grew significantly over the past year, two destinations in particular stood out.

“The real battle over the past 12 months has been between Bangkok and Pattaya,” Pittar said. “Today, Pattaya property receives about twice as many buyer leads as Bangkok property.”

From the second quarter of 2015 through the second quarter of 2016, Pattaya climbed from 100 to 209 on the Juwai.com Chinese Purchasing Intent Index, which measures Chinese buyer interest in a given location by tracking their online property hunting activities. The city has attracted the most number of enquiries among all locations in Thailand.

Knight Frank (Thailand) also noted an increase in the take-up rate of new condominium projects in Pattaya during the first six months of 2016, compared to the same period last year, which the consultancy said can be attributed to the lack of new supply.

“The take-up rate increased to 66 percent during the first six months of 2016, from just 62 percent in 2015. The increase was due to the slow growth in the number of new supply during H1 2016,” said the team from Knight Frank (Thailand).

Factors contributing to Pattaya’s success

Increasing Tourist Arrivals

According to the Tourism Authority of Thailand (TAT), arrivals to Thailand continued to increase in the first and second quarters of 2016 – 9.04 million visitors were recorded in the three first months, which is an increase of 15.45 percent as compared to 2015. For the second quarter of 2016, there were 7.55 million visitors, which is an increase of 8.23 percent as compared with the second quarter of 2015.

Tourism is cited as one of the main reasons for an upswing in interest in Pattaya’s real estate. Research from Plus Property showed that Chinese buyers looking for a vacation home are helping improve demand with the city’s Wongamat area being the most popular among buyers.

Affordability

Although property prices in Pattaya have been rising steadily since 2008, real estate is still relatively affordable here – units in prime locations such as Wongamat, which has the highest prices in the Pattaya market, start from approximately THB60,000 per sq m, while the beachfront condominium projects in the Wongamat area are priced at more than THB120,000 per sq m. That said, the price tag is still very attractive to Chinese investors seeking good rental investments, as it is still many times cheaper than properties in first-tier cities in mainland China.

Great connectivity

As with buying properties in any country, location is always central to selecting a property. Unlike other resort towns which are usually located far away from the city, Pattaya is situated only a 90-minute drive from Bangkok, and travellers can get there easily along Highway No.7. In addition, a high-speed train route is currently under construction to make the journey even more seamless.

Great infrastructure and facilities

Comprising three major hospitals, 10 international schools, a world-class MICE centre (the Pattaya Exhibition and Convention Hall), and an array of shopping malls, five-star hotels, spas and fitness centres, Pattaya’s infrastructure and facilities are no doubt fully developed, and hugely popular with tourists from all around the world.

Pattaya is also home to some of the largest water parks in South East Asia: Cartoon Network Water Park, Ramayana Water Park, and the upcoming Nusa Water Park which is set to open in 2018.

Good investment

Whether buying a property for investment or as a holiday home, experts says Pattaya makes an ideal choice as buyers can enjoy the benefits of a second home in lovely surrounds while seeing their capital value increase, and even earn some rent along the way.

“In terms of selling price, the selling price of sea view condominiums in Pattaya increased two percent in H1 2016, from just 117,466 baht per sq m in 2015 to 119,795 baht per sq m in H1 2016. Whereas the partly sea view and non-sea view condominium prices are quite stable at THB 67,900 and 66,925 baht per sq m, respectively,” shared Knight Frank (Thailand).

Knight Frank (Thailand) also added that developers have been trying to attract more investors by offering guaranteed rental returns of five to seven percent for the first three years after the project is completed, in order to clear their remaining inventory.

Additionally, for those looking for a fuss-free investment, they would be pleased to know that many of the developers in Pattaya offer rental and resale services as part of the package, in fact, many of them package the projects as serviced apartments so buyers do not have to worry about maintenance and cleaning.

Looking ahead

Although Pattaya’s infrastructure and facilities are already fully developed – the city boasts a slew of conveniences including international hospitals, international schools, various shopping malls, restaurants and more, the government is still constantly improving on its infrastructure to ensure that it becomes a world-class resort city.

Moving forward, while it is hard to predict how the Pattaya condominium market will perform for the rest of 2016, experts say there are several factors that will help boost tourism and real estate in Pattaya.

Pattaya is expected to benefit greatly from the new high-speed rail link from Bangkok in 2018, which will cut the journey time from the capital from 90 minutes to just 30 minutes.

The new high-speed rail link will not only make life easier for tourists who plan to travel between both cities, but it is also set to attract more locals to live in Pattaya, especially those working in Bangkok and would like to move to the resort city where the cost of living is lower and the quality of life is substantially better.

In addition, Pattaya is set to benefit from its proximity to Rayong, Chonburi and Lamchabang seaports. With many executives working in the industrial estates close to these seaports, Pattaya no doubt has huge potential as many of the executives working in the industrial estates in Rayong, Chonburi and Sri Racha are likely to choose to stay in Pattaya rather than within the industrial areas,” said Knight Frank’s (Thailand) research team.

Condominium projects to look at

For investors looking to purchase a property on a beachfront location, they should look no further than Best Western Premier BayPhere Pattaya, a low-rise residential development by Habitat Group. Comprising 174 units, which range from 30 sq m to 33 sq m in size (similar to the size of a standard hotel room), this eight-storey building is strategically located on a beachfront site in Na Jomtien Soi 18.

Unike owning a traditional condominium, owners of this property can be better described as fractional hotel owners, as the people renting these properties will be tourists, and the property will be managed by Best Western Hotels & Resorts.

Prices start from 3.69 million baht, and owners will be entitled to stay at their own property for 14 nights per year.

What should investors look out for?

According to the pricing trends released by Knight Frank (Thailand), one of the main factors that will determine the selling price of condominiums in Pattaya is the view from the condominium unit.

Another thing that investors should do is thorough research on who developed the properties, as established developers will guarantee high quality properties as well as good hotel services.

CITY FAST FACTS

(PATTAYA)

Population: Approx. 109,000

Total area: 22 sq km

Currency: Thai Baht

GDP per capita (Thailand): US$5,000

GDP growth (Thailand): 3.2 percent in 2016

Future transport: Proposed ferry to link Hua Hin and Pattaya

Average home prices in city centre: US$200 psf

Distance from Singapore: 1,329 km

INTERNATIONAL HIGHLIGHT

New beachfront condo in Pattaya for investment.

NEW PROJECT

Best Western Premier Bayphere Pattaya

Na Jomtien 18, Pattaya

Type: Beachfront condominium

Developer: Habitat Group

Tenure: Freehold

Project Area: 1,724 sq m

Facilities: Concierge, outdoor lobby, restaurants, bars, infinity-edge pool, gymnasium, rooftop garden with barbecue area, playground, business centre, management office

Starting Price: S$150,869

Expected Completion: Q4 2018

Bayphere Pattaya is a new luxury beachfront condominium for lifestyle investment. It offers long-term passive income under a 60-year lease agreement. Investors will enjoy high returns – seven percent guaranteed returns for five years (from March 2019 to February 2024).

There are more than 20 facilities at Bayphere Pattaya, including three restaurants and bars. The development also features five-star hotel services by Best Western Premier, a world-class brand from the US. With a global network of 4,100 hotels in more than 100 countries, Best Western is one of the world’s leading hotel operators, with more than 70 years of hospitality management experience.

Investment starts from S$150,869.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||