Britain's once-popular digital banks face a bruising reality

They were once the shining stars of Britain's technology industry, promising to battle high street banks and create billions for the economy.

At their peak, Britain's digital banks were so popular that people were forced to sign up to waiting lists to get their hands on their iconic metal cards.

But one year later, and many of these promising fintech startups are struggling as the impact of the coronavirus pandemic makes itself clear.

Over the past few weeks, digital banking companies in the UK have held virtual board meetings with their investors in which they agreed to dial back aggressive growth plans.

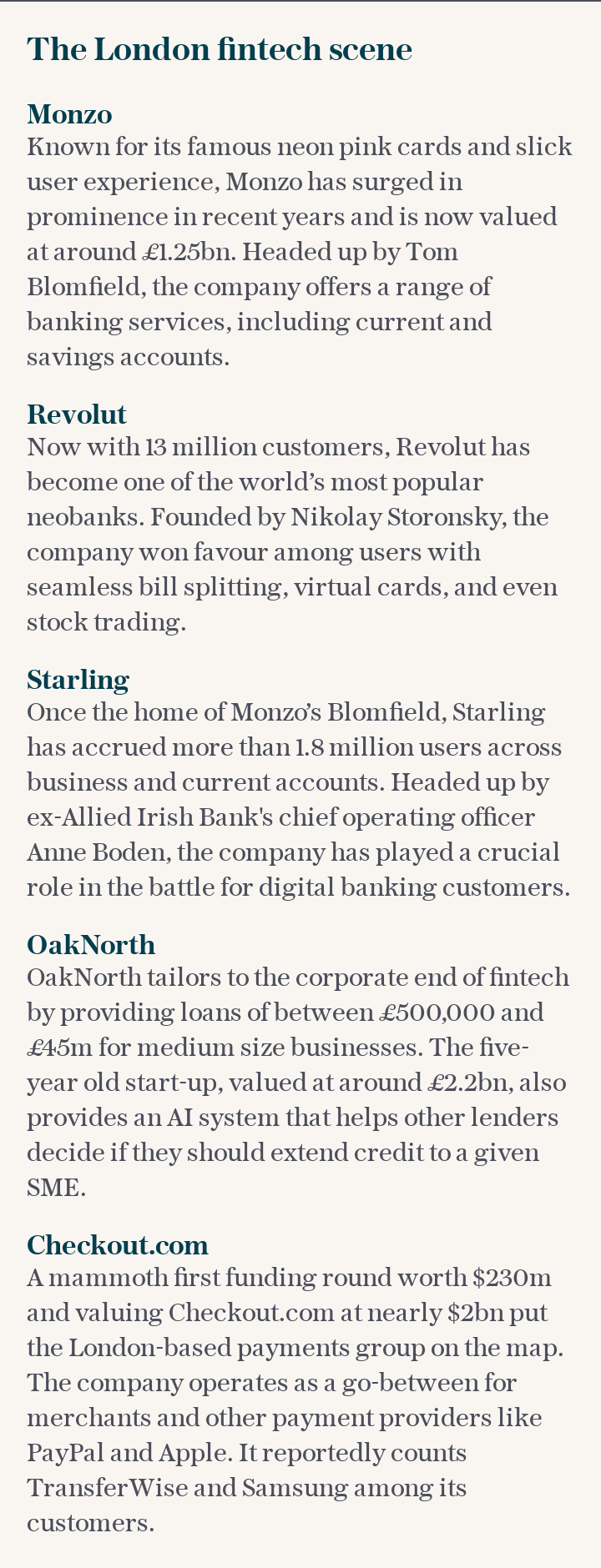

The latest annual reports from the UK’s three largest financial technology start-ups - Revolut, Monzo and Starling Bank - have made for uncomfortable reading for industry experts who had hoped to continue cheering a wave of banking innovation.

Monzo’s annual report, which covers a 12-month period to February, saw the start-up’s losses rise from £47.1m to £113.8m.

The business warned of slowing customer growth in 2020 and said it faced “material uncertainties” following the pandemic.

"We've seen organic customer growth slow as word-of-mouth drops, and we’ll see reductions in revenues and higher credit losses," co-founder Tom Blomfield wrote in the report.

“Day to day banking just hasn't happened for three months,” says David Brear, the chief executive of financial technology consultancy firm 11:FS.

Rising losses at a banking start-up isn’t in itself a problem, instead it’s exactly what investors expect to see as these businesses grow.

But losses rising against a backdrop of growth slowing down and a pandemic affecting consumer behaviour have raised concerns.

“We know that they were under pressure before, so I think that pressure is exacerbated,” says Tom Merry, the managing director of Accenture Strategy.

Banking start-ups hope to reach profitability

The pandemic arrived just as many banking start-ups had hoped that rising revenues and manageable costs would set them on a path to profitability.

Starling Bank, a key rival to Monzo which previously employed many of Monzo’s top executives including Blomfield, says it remains on track to break even this year despite the pandemic.

The business reported losses of £52m in 2019, up from £25m for the previous year. Despite this, chief executive Anne Boden remains optimistic about the company’s prospects based on its performance during lockdown.

“Our costs are very much in control. If we continue on that trajectory, we will break even in December. In December, our revenue will exceed our costs. That's a really good story for us,” Boden says.

Starling has reached an average of £999 in deposits per customer, higher than Monzo’s average deposit of £357 per customer and Revolut’s £236 average.

“Yes we have less accounts than some of the other new banks, but our accounts are very, very well-used. They're real accounts,” Boden adds.

Despite this optimism from Boden, reaching breakeven and eventually profitability is going to be a difficult task for digital banks, especially during the recovery from the pandemic.

“I think it's a big challenge,” says Merry. “Getting to profitability even on a point in time basis, let alone a sustained basis, remains a pretty uphill task.”

Regulators are taking a close look at fintech start-ups

Digital banks, which already face squeezed revenues during the pandemic, are also now facing higher regulatory scrutiny than ever before.

The Prudential Regulation Authority (PRA), part of the Bank of England, warned in a consultation published last month that “many of these new banks have underestimated the development required to become a successful and established bank.”

This concern has led to higher capital requirements for banking start-ups, which is likely to force them to turn to venture capitalists for fresh funding to meet these requirements.

Monzo’s latest report shows that it was required to raise its capital to 13.65pc of its risk-weighted assets, up from 8.5pc. This caused the business to bring in £21m to meet the higher requirements.

The introduction of higher regulatory requirements while start-ups are struggling during the pandemic has frustrated some industry insiders who favour a light-touch approach by the Bank of England, but others welcome the renewed interest.

“It would be unrealistic to expect the PRA to not be closely monitoring these banks through a really high stress situation,” Merry says.

A drop in international travel has caused a headache for many companies

The challenging environment of the pandemic has presented a particular problem for banking start-ups which rely on international transactions for a large share of their revenue.

Overseas transfers allow start-ups to take a higher cut of transaction amounts, meaning many businesses had positioned themselves as travel cards before lockdown.

Revolut has signed up more than 10m customers around the world, and their international transactions have been an important source of revenue for the company.

But it warned in its latest accounts that the level of these transactions had fallen during the pandemic, although the company did see a rise in cryptocurrency transactions during lockdown.

Revolut’s losses rose to £106.5m last year, although revenues increased sharply from £58m to £163m in 2019.

Any start-ups which are particularly reliant on international transactions for revenue face a difficult few months ahead.

“Challenger banks have not matured enough to be able to spread their bets, really. If you have all your eggs in one basket then actually if that basket has a problem then your business has a problem,” Brear says.

Boden says Starling doesn’t risk losing out on significant revenue from a drop in international transactions as her customers largely use Starling for domestic and business transactions.

“We are not dependent on international business,” she says.

The problem could be more pronounced for start-ups like Soldo which offer prepaid cards popular among business travellers. A pause on business travel risks decimating revenues for similar businesses.

“Travel cards are going to struggle massively, that whole industry is going to really struggle in this period,” Brear says.

And cross-border exchanges such as TransferWise and Azimo also face significant changes to consumer behaviour, which could upset their finely tuned models that are reliant on regular flows of capital around the world.

But so far, executives from both companies insist that lockdown hasn’t caused serious problems for them.

Changing consumer behaviour, a potential drop in revenues and more regulatory scrutiny than ever before has created an unprecedented challenge for the UK’s financial technology start-ups.

Digital banks are facing a struggle during the pandemic, but the companies which manage to control their costs and emerge at the other side of lockdown could see themselves taking advantage of a resurgence in consumer spending.