Buying a House in Singapore

Buying a House in Singapore – What to Consider

Understanding the housing types in Singapore will help you make a decision on which property is most suited for you.

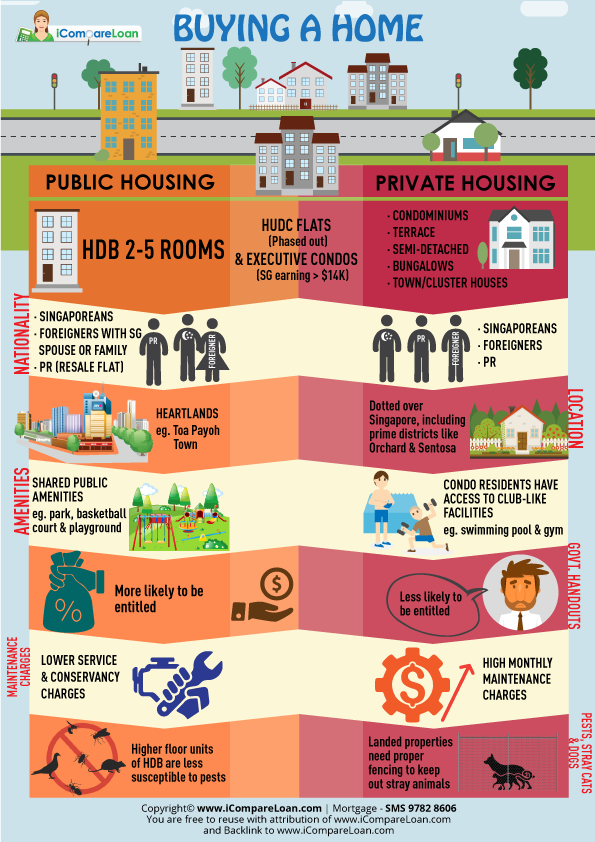

Homes in Singapore can be categorised into public housing and private housing.

Angeline C (iCompareLoan.com)

Under public housing, we have HDB flats (2,3,4,5-rooom). Two-room flats are generally for singles, lower income groups as well as for Singaporeans above 55 years.

HDUC flats and executive condos are hybrids between public and private housing. An executive condo is applicable for Singaporeans earning below S$14,000 and become private after 5 years of ownership. HDUCs were built in the 70s and 80s for middle income Singaporeans before being phased out in 1987 and a large proportion has since been privatised.

Under private housing, we have condominiums, apartments as well as landed housing comprising terrace, semi-detached homes, bungalows, town houses and cluster homes.

While public housing is generally cheaper, choice units in well located areas have been transacted at above S$1m.

Apart from cost, there are various factors which differentiate these housing types.

Free to reuse with Attribution and backlink to www.iCompareLoan.com

1 - Nationality

First, your Nationality will determine if you can purchase a house in a particular category.

Foreigners can only buy private properties. Unless you have a Singaporean spouse or family member, foreigner cannot buy HDB.

Singapore Permanent Residents can buy private properties and resale HDB flats.

Singapore Permanent Residents can buy Landed Property (Subject to Land Dealings Authority Unit Approval) LDAU approval and can only use for “own stay” if approved.

Singaporeans are entitled to buy the above as well as apply for new HDB flats, which can only be sold or rented after 5 years of ownership.

Foreigners cannot buy a Landed Property in Singapore.

2 - Location

Second, Location. There are some places where HDBs are not located. Top of the mind would be Orchard and Sentosa. Whereas in Toa Payoh, the first HDB town, the estate is largely made up of non-landed property.

Apart from the general address, if you are particular about feng shui, you can choose a landed property with the best facing and have more discretion in the landscape of your garden but for condos and HDBs, you are somewhat limited by the condo and block.

3 - Amenities

Third, Amenities. A key draw of condos is their club like amenities such as swimming pool and tennis courts. Developers have upped the game in this challenging climate, dangling freebies such as fitness classes for sales of new units.

Developers have also been experimenting with new concepts such as the 1,399 unit High Park Residences, a mega development comprising a unique blend of condos, bungalows, semi-detached homes and shops, where residents can have access to facilities such as gym and swimming pool.

This draws some home buyers who value club-like facilities at their door step.

Condos are also unique as they typically have a security guard, and non-residents can’t enter without a valid reason.

4 - Government Grants

Fourth: Government Grants. From past examples, we note that government grants do vary according to housing type as they do reflect your income group to a certain extent.

5- Maintenance Charges

Fifth: Maintenance charges. A condo’s monthly maintenance charges can be expensive especially if you don’t fully utilise those amenities. This compares with lower service and conservancy charges of less than $100 for HDB flats. For landed property, it depends on whether you hire someone to clean your house or DIY.

Generally, a smaller area would mean less cleaning and lower utility bills.

6 - Unwanted Guests

Sixth: Pests, stray cats and dogs. Non-landed property with units on the higher floors are typically less susceptible to insects and mosquitos compared with landed housing, which could also have a possibility of welcoming stray cats and dogs into their homes, if not properly fenced.

In Summary

In conclusion, do consider what matters most to you and find a home that suits you most!

There are certain housing tips for expatriates that may be useful for you.

Home Loan guides can be useful for someone who is a first time home-buyer.

You will need to know about the Downpayment amount, stamp duties as well as other additional buyer stamp duties (Where applicable) and how much CPF Ordinary account you can use and how much cash you need to prepare for downpayment and how much loan you can obtain.

Free Assessment with Property Buyer Home Loan Report

You can download the sample property buyer home loan report here.

OR

Get your property agent to generate a report for you at www.iCompareLoan.com/consultant