C.H. Robinson (CHRW) Shares Slip Despite Q3 Earnings Beat

C.H. Robinson Worldwide’s CHRW third-quarter 2020 earnings of $1 per share surpassed the Zacks Consensus Estimate of 99 cents. However, the bottom line declined 6.5% year over year, which might have disappointed investors, causing shares of the company to decline 4.5% in after-market trading on Oct 27.

Total revenues of $4,224.8 million not only outperformed the Zacks Consensus Estimate of $3,909 million, but also increased 9.6% year over year owing to higher pricing and increased volumes across most of the company’s service lines, thanks to gradual recovery in the freight environment.

Total operating expenses dipped 2.6% year over year to $421.03 million, primarily due to cost savings of approximately $40 million. However, operating ratio (operating expenses as a percentage of net revenues) deteriorated to 71.4% from 68.3% in the year-ago quarter. With respect to this metric, lower the value, the better.

The company returned $71.9 million to its shareholders in the third quarter through a combination of cash dividends ($70.3 million) and share repurchases ($1.6 million). Capital expenditures totaled $15.2 million in the quarter under review. Full-year capital expenses are expected between $50 million and $55 million, with the maximum reserved for technology spends. Previously, the company anticipated capital expenses to be in the range of $60-$70 million.

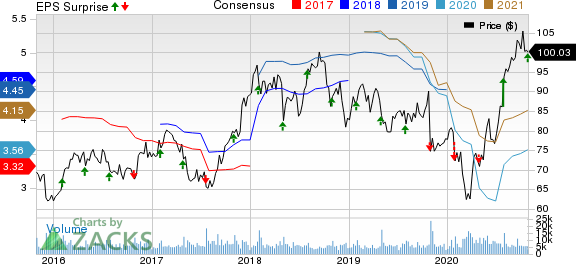

C.H. Robinson Worldwide, Inc. Price, Consensus and EPS Surprise

C.H. Robinson Worldwide, Inc. price-consensus-eps-surprise-chart | C.H. Robinson Worldwide, Inc. Quote

Segmental Results

At North American Surface Transportation (“NAST”), total revenues were $2,923.84 million (up 3.5%) in the third quarter. Segmental revenues increased due to higher truckload pricing and increase in less than truckload ("LTL") shipments. However, net revenues in the segment dropped 15.2% despite the Prime Distribution Services acquisition contributing 3.5 percentage points to segmental results. NAST results include Robinson Fresh transportation, which was previously reported under a separate segment.

Total revenues at Global Forwarding summed $831.96 million, up 39.2% year over year. Higher pricing in ocean and air, increased charter flights, and larger shipment sizes boosted results. Net revenues at the segment climbed 16.1% year over year.

A historical presentation of the results on an enterprise basis is given below:

Transportation: The unit (comprising Truckload, Intermodal, LTL, Ocean, Air, Customs and Other logistics services) delivered net revenues of $566.33 million in the quarter under consideration, down 6.9% from the prior-year figure.

Truckload net revenues declined 21% year over year to $251.07 million. Volumes inched up 0.5% year over year. LTL net revenues dropped 4.8% year over year to $118.56 million despite volumes increasing 13.5% in the quarter.

At the Intermodal segment, net revenues increased 4.9% year over year to $7.45 million. Intermodal volumes rose 2.5% year over year. Net revenues at the Ocean transportation segment ascended 14.2% year over year to $88.93 million. The same at the air transportation segment surged 29% to $34.98 million. Meanwhile, customs net revenues slid 5.3% to $22.46 million.

However, Other logistics services’ net revenues rose 42.8% to $42.87 million.

Sourcing: Net revenues at the segment slipped 8.5% to $22.94 million.

Liquidity

This Zacks Rank #3 (Hold) company exited the third quarter with cash and cash equivalents of $252.57 million compared with $447.86 million at the end of 2019. Long-term debt was $1,093.09 million compared to $1,092.45 million at 2019-end. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshot

Let’s take a look into some other Zacks Transportation sector companies’ third-quarter earnings.

Southwest Airlines Co. LUV, carrying a Zacks Rank #3, incurred a loss of $1.99 per share (excluding 3 cents from non-recurring items) in the third quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $2.44. Moreover, operating revenues of $1,793 million surpassed the Zacks Consensus Estimate of $1,678.2 million.

Trinity Industries Inc TRN, carrying a Zacks Rank #2 (Buy), reported third-quarter 2020 earnings (excluding 4 cents from non-recurring items) of 17 cents per share, massively surpassing the Zacks Consensus Estimate of 5 cents. Total revenues of $459.4 million also outperformed the Zacks Consensus Estimate of $443.8 million.

CSX Corporation CSX, carrying a Zacks Rank of 3, reported third-quarter 2020 earnings of 96 cents per share, surpassing the Zacks Consensus Estimate of 93 cents. However, total revenues of $2,648 million lagged the Zacks Consensus Estimate of $2,704.6 million.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research