Canadian pension fund switched sides in G4S battle

A US security services firm switched its attention to making a rival bid for G4S after its biggest investor was snubbed from financing GardaWorld’s £3bn swoop for the FTSE 250 firm.

Caisse de dépôt et placement du Québec, a Canadian pension fund and the largest investor in Allied Universal, originally offered GardaWorld a loan of several hundred million dollars to fund its hostile approach.

G4S revealed earlier this month that it had opened talks with US peer Allied Universal.

GardaWorld has made a 190p-a-share offer for G4S, and this weekend gave shareholders until Nov 7 whether to accept.

Major investors such as Schroders, which owns a tenth of G4S, have rejected GardaWorld’s offer but say they are open to a higher price.

Le Journal de Montreal reported that Caisse de dépôt originally approached GardaWorld to finance its deal.

GardaWorld instead selected a group of other lenders that include Barclays, UBS, Bank of America and three Canadian banks.

Offer documents published this weekend revealed a potential bonanza for those financing and advising on GardaWorld’s approach.

Bankers, lawyers, and public relations consultants would net more than £300m if the Canadian firm manages to convince G4S shareholders of the merits of its approach.

Details of the fees were published alongside a fresh attack by Stephan Crétier, the executive chairman of GardaWorld, on G4S’s management.

Highlighting a series of shortcomings, Mr Crétier said that operations need to be “reprogrammed”.

“Simply said, a cookie-cutter approach will not succeed in fixing G4S’s operations,” he said.

G4S is advising shareholders not to support the GardaWorld offer.

It told investors: “We believe that GardaWorld needs G4S in order to realise its aspirations,” the board of G4S told investors in response to the offer document.

It added: “GardaWorld is a very highly leveraged business that has grown through a string of acquisitions.”

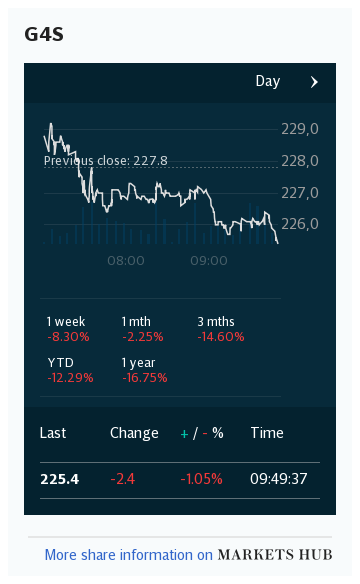

G4S shares fell 0.3pc to 208p on Monday.