Celanese Increases Prices of Acetyl Intermediate Products

Celanese Corporation CE is raising list and off-list selling prices of acetyl intermediate products. The price hike is applicable for orders shipped and is immediately effective or as contracts permit.

The company stated that the latest price hikes are incremental to any earlier-announced increases.

Prices of acetic acid will increase by $50/MT in Asia outside China (AOC) and in China, it will rise by RMB 300/MT. Vinyl acetate monomer prices will rise $50/MT in AOC and RMB 300/MT in China. The prices of acetic anhydride are set to go up by $50/MT in AOC and RMB 300/MT in China.

The prices of ethyl acetate and butyl acetate will increase by $50/MT each in AOC. Vinyl-based Emulsions prices will increase by RMB 200/MT in China and by $50/MT in AOC.

Celanese’s shares have lost 18.2% in the past year against its industry’s 31.6% rise.

On its first-earnings call, the company said that it expects to generate $300-$400 million of incremental cash on account of the actions that it is presently taking on productivity, working capital management and capital-expenditure prioritization, which enable it to offset challenges related to demand and earnings in 2020.

Celanese also suspended its earlier-announced annual adjusted earnings per share guidance for 2020 due to uncertainties regarding the duration and impacts of the coronavirus pandemic.

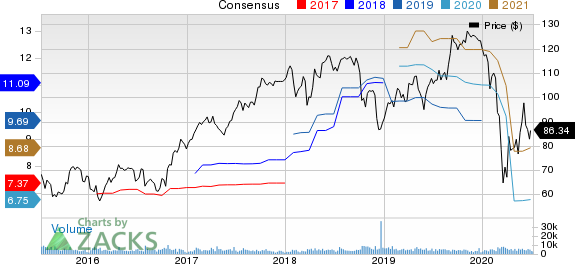

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Zacks Rank & Other Stocks to Consider

The company currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are AngloGold Ashanti Limited AU, Sandstorm Gold Ltd SAND and Harmony Gold Mining Company Limited HMY.

AngloGold has a projected earnings growth rate of 109.9% for the current year. The company’s shares have surged around 76% in a year. It currently has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sandstorm Gold has a projected earnings growth rate of 55.6% for the current year. The stock has gained around 79% in a year. It currently has a Zacks Rank of 2.

Harmony Gold has an expected earnings growth rate of 264.3% for 2020. The company’s shares have gained 146.4% in the past year. It is presently a Zacks #2 Ranked player.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research