China's manufacturing weakens in May

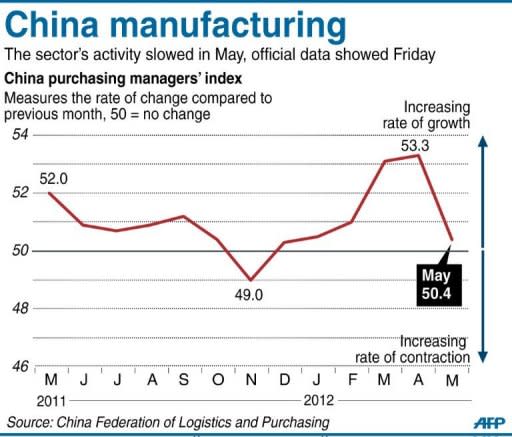

China's manufacturing sector weakened in May, two closely watched indices showed Friday, providing further confirmation that the world's second largest economy is slowing more than previously thought. The official purchasing managers' index (PMI) for manufacturing indicated a sharper than expected slowdown in April, while separate data released by British banking giant HSBC showed a contraction for the same month. The HSBC data marked the seventh consecutive contraction in manufacturing activity and the bank's chief China economist Qu Hongbin said the figure pointed to a slowing of the economy. "May's final reading confirmed that manufacturing growth slowed further on weakening demand from both global and domestic markets," he said. "This points to a continuous slowdown of the real economy in the second quarter and should promote Beijing to step up easing efforts in the coming months." HSBC's final PMI index for May stood at 48.4 compared with 49.3 in April, as demand slowed in both China's own markets and abroad. The official data showed a smaller than expected expansion in the sector, with PMI falling to 50.4 from 53.3 in April according to the China Federation of Logistics and Purchasing. For both the federation's and HSBC's indices, a reading above 50 indicates expansion, while a reading below 50 suggests contraction. "The rather sharp decline in the May PMI accords with the trend of economic slowdown," Zhang Liqun, an analyst with the federation, said in a statement. The federation's figure marked the sixth consecutive month of expansion and missed market expectations. Economists had predicted it would come in at 51.5, according to Dow Jones Newswires. HSBC's manufacturing figures typically paint a bleaker picture than China's official numbers. The HSBC survey puts more emphasis on smaller companies, which are suffering more in the economic downturn than state-owned giants. China's export-driven economy has begun to slow this year, posting growth of 8.1 percent in the first quarter compared to 9.2 percent in 2011 as a whole, as woes in key European and US markets hit overseas sales. Concerns over growth intensified after the release of weaker than expected data for April leading Beijing to lowered the amount of money that banks are required to hold in their coffers. Economists predict more measures to come as fears of a sustained slowdown intensify. An index for new orders also issued by the Chinese federation on Friday was down sharply, dipping to 49.8 in May from 54.5 in the previous month. "Based on this, we can expect that enterprises will operate at an even slower rate in the future, and economic growth may continue to decline," Zhang said. The British bank said the slowdown at China's plants and workshops also led jobs to be cut, with the latest reduction in staff numbers the sharpest in more than three years.