CMHC saw 'moderate' risk of overvalued markets, stands by price forecast

The Canadian Mortgage Housing Corporation (CMHC) saw ‘moderate’ evidence of an overvalued housing market in the Spring of 2020.

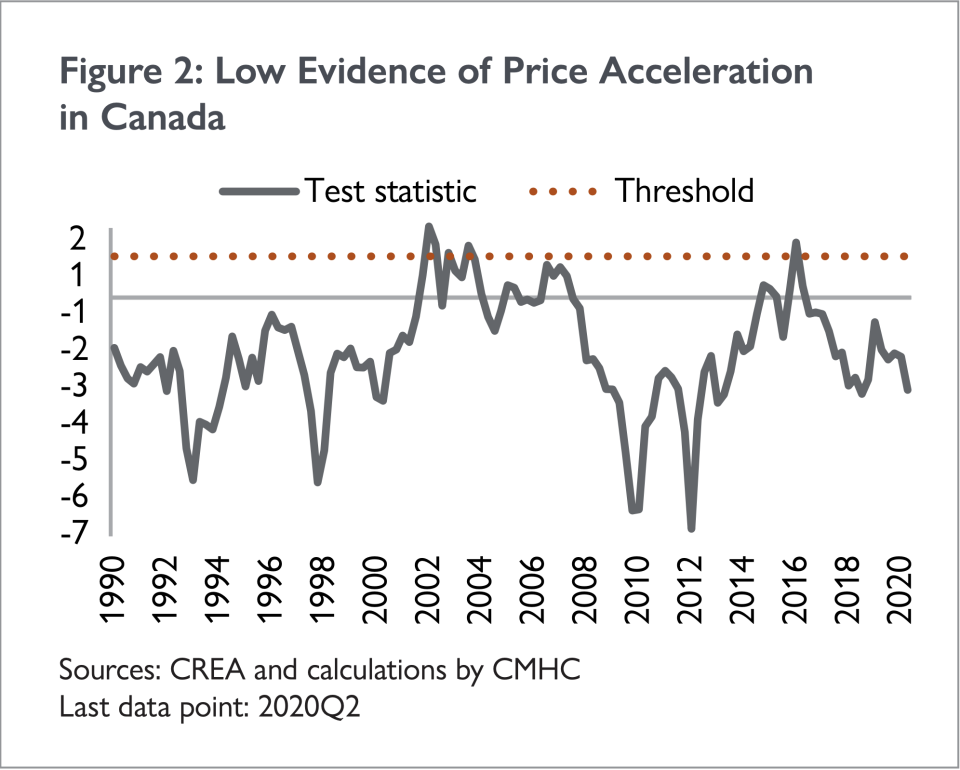

The organization’s Housing Market Assessment report released Monday says real estate imbalances (whether the market skewed towards a buyer or seller’s market) in Canada had eased by the end of 2019.

In the second quarter, the Vancouver market sales-to-new-listings ratio (SNLR) sunk from the mid-60 per cent range to mid-40 per cent, swinging it closer to a buyer’s market. For Toronto, the ratio fell to 55 per cent in the second quarter, but only because COVID-19 lockdowns temporarily hit the brakes on transactions. At the beginning of the third quarter, the market began to rebound with pent-up demand bringing the ratio back closer to 65 per cent.

However, the pandemic led to rising unemployment and reduced hours worked, which lowered income in most regions. Prices rose more than expected in areas like eastern Canada, Ottawa, Montréal, Moncton, and Halifax, considering factors like lower population growth, rising unemployment, lower income, and lower mortgage rates.

Sales fell slightly more than new listings, which tumbled at a record pace. This tipped housing closer to a balanced market, with a drop in the sales-to-new-listing ratio to 61.9 per cent from 65.8 per cent in 2019. The shock of the pandemic shutting down open houses and stalling transactions caused the average house price to fall. However, the data do not reflect the federal government supports or the record-breaking house prices the country has seen in recent months.

August may have set another record for house prices, though the Crown corporation stands by its nine to 18 per cent house price decline forecast in May. “We stand by our forecast in the sense that I think there remain a lot of conditions in the housing market and the economy, for that matter,” said CMHC chief economist Bob Dugan over the report’s briefing call, adding that there are risks with provinces lifting their lockdowns. “There are risks related to the different mortgages that are in place right now and for the risks to come upon them going forward. So I don’t think we’re out of the woods, yet.”

Overheating in Canada’s Major Markets

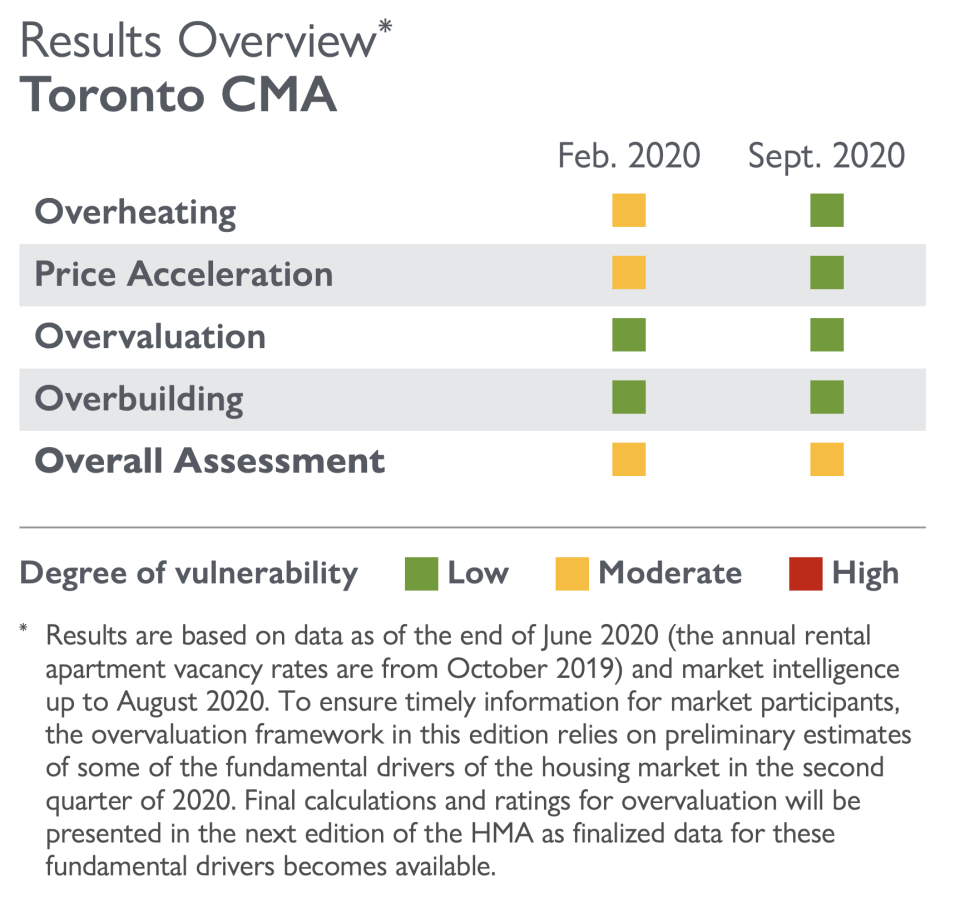

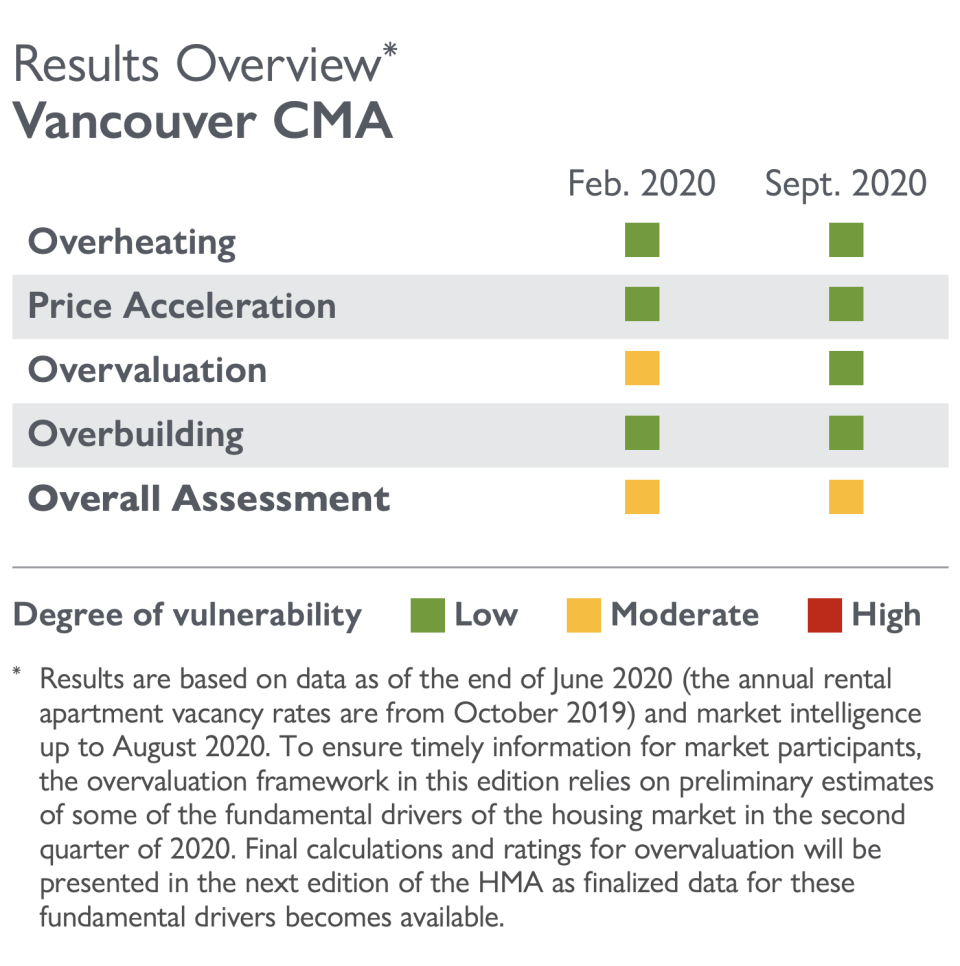

The company’s estimates for overvaluation in Toronto and Vancouver picked up as both cities saw a boost in house prices in the second quarter despite the economic fallout from the pandemic.

The Greater Toronto Area (GTA) market was more vulnerable to overheating in February than September. These concerns eased as the shutdown prompted new listings to decline from 48 to 41 per cent since last quarter.

The acceleration in prices slowed down since the last quarter, with the report citing that the seasonally adjusted average price declined by 3.4 per cent in Q2 2020. The GTA saw the largest drop in condominiums (7.3 per cent), followed by single-detached units (4.0 per cent) and row units (1.8 per cent).

In Vancouver, the report found low evidence of overheating as sellers and buyers paused their transactions during the lockdown.

The Looming Housing Risks

Bob Dugan explained that while there was a strong growth in disposable income in the second quarter, it was largely supported by government transfers to households and the employment income portion of those figures was low. “That's likely to change going forward,” Dugan explained adding that high indebtedness remains a risk to the housing outlook. “So I think a lot of what we’ve seen in the housing market in Q2 and Q3 are temporary factors such as pent-up demand from the period of closure, which increased demand in the third quarter.”

![The simultaneous occurrence of [social distancing measures and employment losses] caused the number of transactions and the number of new listings entering the market to fall at a record pace. With sales falling by slightly more than new listings, the sales-to-new-listings ratio dropped to 61.9 per cent from a recent high of 65.8 per cent in the fourth quarter of 2019 (Figure 1). SOURCE: CMHC](https://s.yimg.com/ny/api/res/1.2/ec5hJQTSMkKQRn9EGE2NUQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTc2Ng--/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2020-09/5390ef80-fc1d-11ea-ad76-a45f102806e2)