Cooler start to summer is crushing natural gas prices

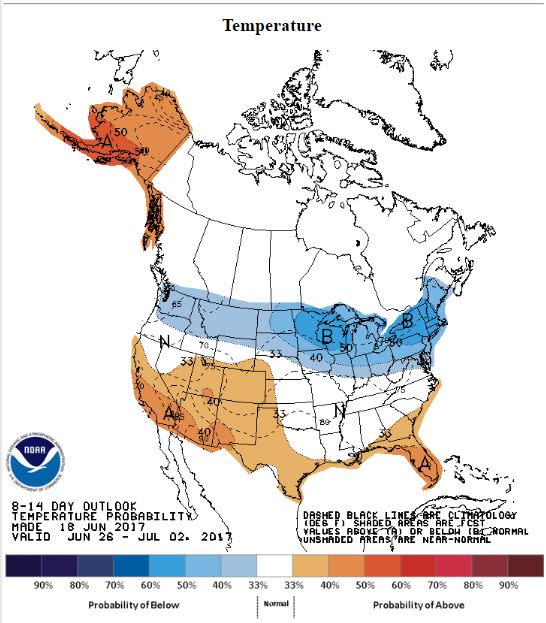

Natural gas prices dropped Monday on updated forecasts for a cooler early summer across the Midwest and Northeast, meaning utility customers will use a lot less air conditioning.

The natural gas industry typically sees a surge in demand in summer months as utilities meet increased power demand from air conditioning by consumers and businesses. Natural gas futures for July were trading at $2.89 per Mmbtu, a decline of 4.5 percent.

"When you look at basically Chicago to Boston in the next two weeks, you don't seen any hot weather," said Gene McGillian, manager, market research at Tradition Energy.

"We have the next two weeks in June, not hot, and you're actually seeing a little bit of July that's not hot," said McGillian. He noted that there is still very hot weather in Texas and other parts of the south, but a big portion of the U.S. is cooler.

"The last week of June temperatures in the New York area, you're going to have a hard time getting above 80 degrees. Good for folks, but bad for the bulls. You really need early season cooling demand. There's a lot of bulls in this market on the premise we would have a hot start to the summer," said John Kilduff of Again Capital.

The cooler weather forecast follows a brief period of hot weather, and there's potentially another spell of warmer weather in the 11-to-15 day period, according to Jacob Meisel, chief meteorologist at Bespoke Weather Services.

"We're in a rather volatile weather period. We're seeing this back and forth movement between hot and cold. We're not getting much of a signal out of the Pacific," said Meisel.

Meisel said there appeared to be an El Nino weather pattern in the Pacific, but signs of that were weakening. An El Nino condition would trigger storms and warmer water temperatures in the Pacific and cooler summer weather in North America.

Natural gas prices had run up to about $3.42 per Mmbtu in May ahead of summer cooling season, but traders have been paring back on positions.

"Until you get that really sustained heat, it's hard to see how this market can rally just yet," Meisel said. "It's a matter of why we're declining. If it's because people were too bullish with their weather expectations, I would say but there's still a lot of summer left to go."

Meisel said the market could easily return to $3.20 if the weather turns hot, but there are also other factors at work. "We saw wind generation really picked up during the past heat wave," he said. "There's enough to impact prices when there are big swings."

Kilduff said it's also sizzling hot in California, but there's been significant snow melt to drive hydroelectric power, limiting any increases in natural gas demand.

McGillian said, on the other hand, a steep enough drop in natural gas prices could mean natural gas demand would pick up, as utilities would switch over to replace higher priced coal.

"$3 seems to be the pivot area, but within 15 cents, the market does have a lot of fluidity," said McGillian.