BP stocks rise as it beats expectations and swings back into profit

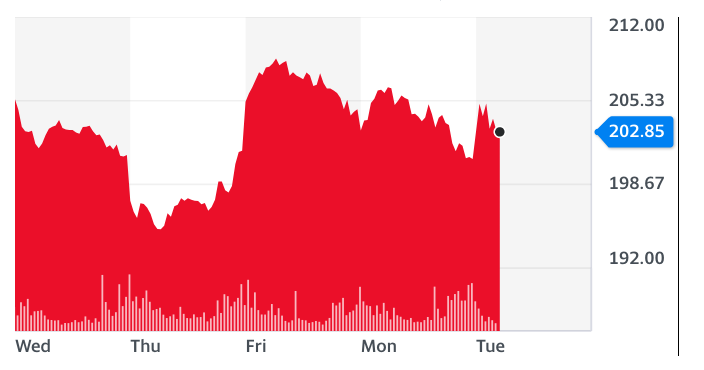

BP stocks rose on Tuesday as it swung back into profit and cut debt levels, beating expectations as global oil and gas prices recovered in its third quarter.

The energy giant (BP.L) reported earnings of $100m (£76.5m), when it had suffered a record $6.7bn (£5.1bn) loss in the second quarter and analysts expected further losses. Its shares were trading 1.6% higher in early trading on Tuesday morning in the UK.

It still came significantly short of the $2.3bn profit it made in its third quarter of 2019, however, and the earnings were reported on BP’s preferred measure of underlying replacement cost profit. On a reported basis, it lost $500m.

“Compared to the previous quarter, the result benefitted from the absence of significant exploration write-offs and recovering oil and gas prices and demand. This was partly offset by a significantly lower oil trading result,” BP said in its third-quarter results published on Tuesday.

The company is embarking on heavy cost-cutting in a bid to get through the crisis, which has hammered energy prices.

READ MORE: BP halves dividend as it swings to record $6.7bn loss

The company said it agreed or completed “approaching half” of its planned $25bn in proceeds from divestments and other disposals by 2025, with $600,000 in the third quarter.

It continues to plan a total of 10,000 job cuts, mostly by the end of this year. It confirmed around 2,800 staff had left the company already this year, and another 2,100 had “elected to leave.”

Net debt was cut by $500m, and it is expected to fall further in the fourth-quarter as it receives more proceeds from divestments.

BP now plans a dividend of 5.25 cents (4p), down from 10.25 cents last year, marking the first time shareholder payouts have been slashed in a decade.

The company sounded upbeat about recovering demand for oil. “The gradual recovery in oil demand seen since the spring looks set to continue, led by strengthening demand in Asia,” it said.

READ MORE: Modest gains for European and Asian stocks as COVID cases mount

“The [International Energy Agency] estimates an increase of around six million barrels a day in 2021, as economies continue to open up. OPEC+ production cuts have played a major role in stabilising the market and there is already a reduction in crude and product inventories.”

But it added: “The ongoing impacts of the COVID-19 pandemic continue to create a volatile and challenging trading environment.”

CEO Bernard Looney has moved to accelerate BP’s shift towards more low-carbon energy since the crisis hit, announcing a new strategy in August to hike investment tenfold within a decade.

He said on Tuesday: “Having set out our new strategy in detail, our priority is execution and, despite a challenging environment, we are doing just that - performing while transforming.

“Major projects are coming online, our consumer-facing businesses are really delivering and we remain firmly focused on cost and capital discipline. Importantly , net debt continues to fall. We are firmly committed to our updated financial frame, including the dividend – the first call on our funds.”

AJ Bell investment director Russ Mould noted: “While better than the loss which had been pencilled in and a big improvement on the record loss posted for the second quarter, the uncomfortable truth is a huge amount of manpower, resources and effort was put into achieving a profit of less than $100m.

“The recovery in oil demand which underpinned a return to profit may now be threatened again by a second wave in the COVID-19 pandemic."

WATCH: IEA lowers forecast for global oil demand