How to Get Credit Card Annual Fee Waivers and Still Enjoy Rewards and Perks

When it comes to credit cards, it’s all about getting the upper hand—getting more money out of the bank than they’ll ever get from you.

The secret? Pay all your bills on the dot, use the cards strategically to maximise your cashback, rewards, and air miles, and remember that annual ritual of calling your bank or issuer to charm your way out of credit card annual fee.

Ah, those annual fee negotiations practically made me feel like a pen pal with customer service at almost every bank in Singapore. It’s as if I’m the next-door neighbour asking me private questions like my mother’s maiden name.

Some finally relented and waived my credit card’s annual fee, while other conversations ended with me unceremoniously cancelling my credit card.

Wondering how you can get the most out of your credit card and emerge victorious with a waived annual fee? I’ll unpack everything you need about annual fees, how to request an annual fee waiver, and tips to ensure you still enjoy the rewards and perks without spending more.

Your guide to get credit card annual fee waivers

How do credit card annual fees work?

Credit card annual fees are essentially membership fees that cardholders pay for the privilege of using a credit card. Banks charge these fees to cover administrative costs and offset the rewards and benefits. The annual fee depends on the type of card you have—from basic cards with minimal charges to premium ones offering exclusive benefits.

Simply put, you are paying for the fees of maintaining your credit card account. Lost, stolen, or damaged credit cards are typically replaced for free, a cost covered by your annual fee.

Now zoom in to understand how they work, whether you’re a new or existing cardholder:

For new credit cardholders

Banks often sweeten the deal by nixing the annual fee for the first year. It’s their way of saying, “Welcome aboard!” You get to test-drive all the perks without the initial fee hit.

But remember, when the honeymoon period ends, that fee will be charged to your card on its anniversary. Yes, it’s automatically charged to your account in general.

For existing credit cardholders

Many banks want you to play the “pretty please” card. In short, you need to contact the bank’s customer service to request a waived annual fee.

But here’s the catch—not everyone gets a free pass. Banks check out your spending habits, loyalty, and punctuality with payments. Yes, you need to prove you’re a responsible cardholder.

So, before you take the shiny plastic card out of its envelope and activate it, read the terms and conditions to understand the fee structure and any waiver conditions.

And, of course, how much you’ll pay exactly after the first or second-year honeymoon period.

How much do credit card annual fees cost in Singapore?

Credit card annual fees in Singapore vary depending on the banks you want to apply for a credit card. They range from S$177 to S$196 to give you a ballpark figure, and other banks that want to win your hearts and pockets simply waive it for life.

Here’s a look at some of the annual fees being charged listed alphabetically:

Credit card | Annual fee (incl. 9% GST) | Fee waiver |

S$174.40 | 1 year | |

S$196.20 | 1 year | |

S$196.20 | 1 year | |

S$196.20 | First 2 years. Waived from the third year onwards if you spend more than $12,500 with it per year. | |

S$180 | 3 years annual fee waived if you spend a minimum of S$12,000 per year to get subsequent waiver. | |

S$196.20 | 2 years (Fee automatically waived if you spend at least $10,000 in 1 year, starting from the month in which your card was issued) | |

S$196.20 | 1 year | |

S$196.20 | 1 year | |

S$196.20 | 1 year | |

S$196.20 | 1 year |

Almost all the credit cards mentioned above have a one-year waived annual fee, and some of them have 2 to 3 years waived annual fees if you hit the spending requirements for the year.

So, sign up for the card when you’re sure you’ll be able to max out the benefits and then ask for a fee waiver at the end of the year.

How can I get my credit card annual fee waived?

Now, let’s talk about getting those fees waived beyond the initial period. The process is quite straightforward. Most banks have an automated system for fee waiver requests.

Want to skip those fees after the freebie period?

It’s simpler than you think. I did the heavy lifting for you and provided a list of banks and tips on how to get your credit card annual fee waived.

How to get an AMEX annual fee waiver

You’ll probably have the hardest time trying to get your AMEX card fee waived among all the banks. That said, you’ve got nothing to lose, so you might as well give it a shot.

To request an American Express credit card fee waiver, you can either make a request via chat on the AMEX app or call customer service. If you want to phone in, dial a different contact number for each card.

You can find the number on the back of your card.

Here’s the list of AMEX credit card contact numbers for Singapore and overseas:

Credit Card Name | Contact Number in Singapore | Contact Number from Overseas |

AMEX Platinum Card | 1800 392 1177 | +65 6392 1177 |

American Express Platinum Credit Card | 1800 396 6000 | +65 6396 6000 |

American Express Platinum Reserve Credit Card | 1800 392 1181 | +65 6392 1181 |

American Express True Cashback Card | 1800 295 0500 | +65 6295 0500 |

American Express Singapore Airlines KrisFlyer Credit Card | 1800 392 2000 | +65 6392 2000 |

American Express Singapore Airlines KrisFlyer Ascend Credit Card | 1800 392 2000 | +65 6392 2000 |

American Express Singapore Airlines PPS Club Credit Card | 1800 396 6888 | +65 6396 6888 |

American Express Singapore Airlines Solitaire PPS Credit Card | 1800 396 6888 | +65 6396 6888 |

American Express CapitaCard | 1800 723 1339 | +65 6880 1343 |

American Express Rewards Card | 1800 296 0220 | +65 6296 0220 |

American Express Gold Card | 1800 733 0833 | +65 6733 0833 |

American Express Personal Card | 1800 732 2244 | +65 6732 2244 |

Remember, requesting an annual fee waiver does not guarantee success, but it’s worth trying.

How to get a Citi annual fee waiver

You only have 1 option for asking for a fee waiver on a Citibank credit card—and it’s the old-fashioned one: Call their 24-hour hotline at (65) 6225 5225 and follow the voice prompts to navigate the Interactive Voice Response (IVR) system.

Enter your NRIC or credit card number when prompted.

Next, press 0 to ask a Citibank customer service officer to request an annual fee waiver.

How to get a DBS annual fee waiver

Some DBS credit cards offer an automatic annual fee waiver if you meet a certain minimum spending requirement within the preceding membership year. For example, the DBS Altitude Visa Signature Card requires an annual spend of S$25,000 for the fee to be waived for the following year.

If you don’t want to rack up spending this way, then you might as well request an annual fee waiver. Banks like DBS and POSB have switched to automated systems to keep the process simple and customer-centred.

To ask for a credit card fee waiver from DBS or POSB, you have 2 options:

The first is to use the DBS digibot, which is easier than talking to a real person on the phone. Go to the DBS website, click the red chat logo at the bottom right of the screen, and launch the digibot. Then, type “fee waiver” into the chatbox and follow the onscreen prompts.

The second option is, If you want to do things the old-fashioned way—the more troublesome way—call DBS at 1800 111 1111 (from Singapore) or (+65) 6327 2265 (from overseas).

According to the POSB website, fee waivers go through the automated system only. DBS Digibot & Phone Banking take a break from 11:45 PM to 12:30 AM and from 2:30 AM to 2:45 AM daily, except Sundays and public holidays.

After requesting an annual fee waiver, keep an eye on your email or SMS, they will update you on your waiver status within three working days, based on your bank’s records.

How to get an HSBC annual fee waiver

Whether you are a new cardholder or have been using your HSBC credit card for some time, the steps to request a waiver are similar.

Here’s what you need to do:

Dial the HSBC phone banking hotline. For local calls, use the number 1800 4722 669 (that’s 1800-HSBC-NOW), and if you are overseas, dial +65 64722 669. The hotline is open 24/7.

Navigate the phone menu. Follow the voice prompts to select the menu option for credit card fee waivers. The system is automated, so listen carefully.

Wait for confirmation. After you make your request through the phone banking system, HSBC will process it and send you a confirmation of the waiver status. This confirmation may come through various channels, such as SMS or email.

How to get a Maybank annual fee waiver

The most direct way to request an annual fee waiver is through Maybank’s phone banking service.

Call the 24-hour hotline at 1800-MAYBANK (1800-629 2265) or +65 6533 5229 if you’re calling from overseas.

Follow the automated instructions to navigate the fee waiver option and submit your request. The process is user-friendly and designed to be completed within a few minutes.

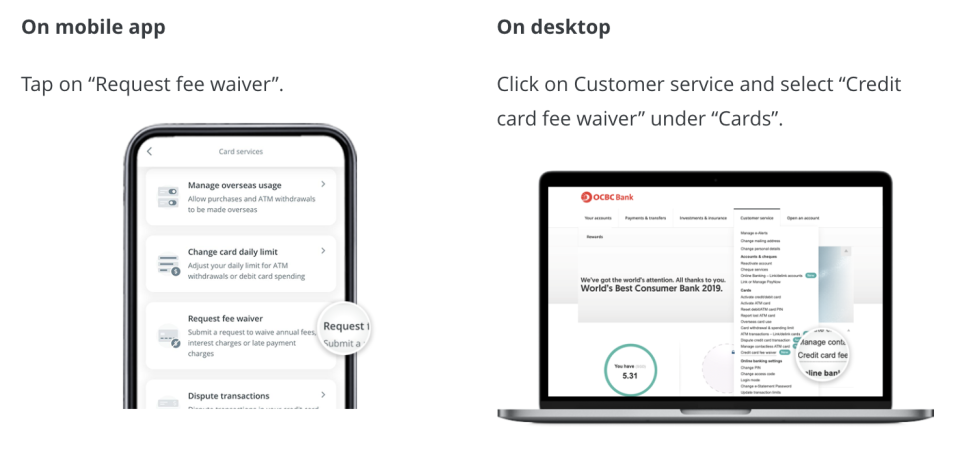

How to get OCBC annual fee waiver

You can quite easily get your OCBC credit card annual fee waived online via the OCBC mobile app or desktop.

Log in with your access code and PIN or fingerprint ID. Navigate to “Request fee waiver” or “Credit card fee waiver” and select the card you’d like to request a waiver, then submit your request.

How to get a UOB annual fee waiver

You can request an annual fee waiver on UOB through the mobile app or phone banking.

The most convenient way to request an annual fee waiver for your UOB credit card is through the UOB TMRW app.

Here’s how you can do it:

Open the UOB TMRW app on your smartphone.

Navigate to the ‘Accounts’ section and select the credit card you want to request a fee waiver.

Tap on ‘Settings’, then select ‘Waive Fees’.

Choose ‘Annual Fee’ and confirm your request.

This method is straightforward and can be done anytime, anywhere, making it the first option you should try.

If you prefer speaking to a customer service representative or if the app method doesn’t work for you, the UOB customer service hotline is another effective way to request a fee waiver:

Dial 1800 222 2121 or +65 6222 2121 if you’re overseas.

Follow the voice prompts to navigate to the fee waiver option.

You may be asked to provide your credit card details for verification.

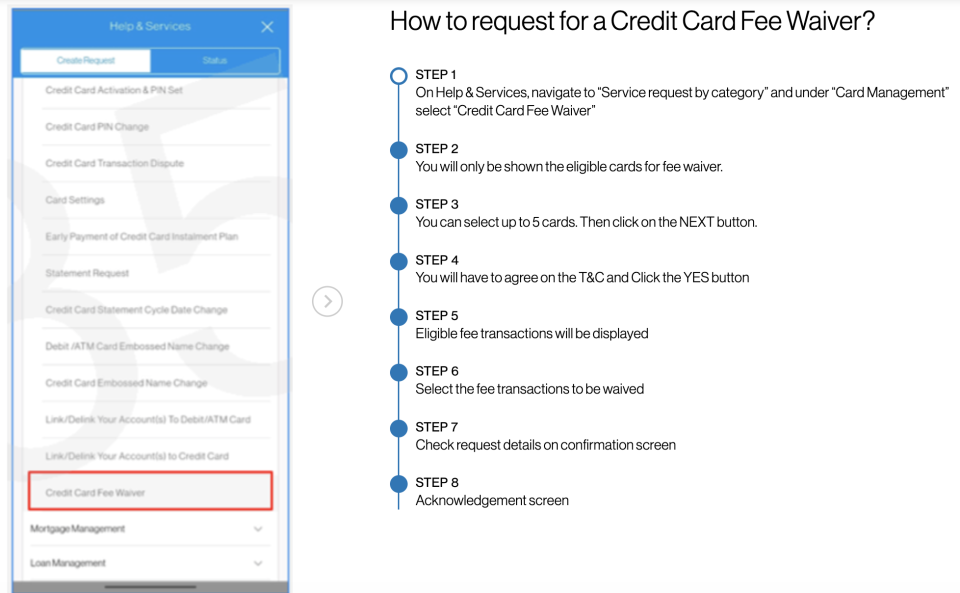

How to get a Standard Chartered annual fee waiver

Standard Chartered’s online waiver system makes dodging credit card fees a breeze. There’s no need to chat with humans—it’s that simple.

You can request an annual fee waiver for a Standard Chartered credit card through online banking or the SC Mobile app.

On the Standard Chartered mobile app, select:

Help & Services

Service request by category

Card Management

Credit Card Fee Waiver

Next, select the credit card you wish to request a fee waiver, agree to the terms and conditions, and submit your request.

What’s the chance of getting my annual fee waiver request approved?

The chance of getting your annual fee waiver request depends on you and your bank’s records. Banks have varied methods to decide on fee waivers, often based on your card usage, spending amount, and timely bill payments.

Some banks set a spending threshold, like waiving the annual fee if you’ve spent $500 in the last 3 months.

While the exact threshold might not be openly shared, you might get a hint from the customer service representative about how much more you need to spend for a waiver. If you’re close to the threshold, it could be worth spending more instead of paying the fee.

If you are unsure about the threshold, appealing to bank higher-ups with valid reasons can also work. Remember, a friendly approach to a customer service representative can improve your chances of getting a waiver.

Here are some tips for a successful waiver fee request:

Be prepared. Know the reasons why you believe the fee should be waived. Perhaps you’re a loyal customer, you spend a significant amount on the card, or you haven’t been able to maximise the card’s benefits fully.

Be polite but firm. Explain your situation clearly and assertively. Let them know if you’re considering cancelling the card because of the fee, but be prepared to follow through.

Highlight your spending. If you’ve been using the card frequently and paying off your bills on time, mention this. Banks often consider your spending habits when deciding on a waiver.

Ask about retention offers. If the representative is unable to waive the fee, inquire about any other retention offers that might be available, such as bonus points or statement credits. If your request is rejected, continue to the next section for elaborated tips.

What to do if my bank rejected my annual waiver request?

So, the customer service officer is using their most apologetic voice to tell you that they cannot waive the annual fee. Your next step is to ask them if there is a way to appeal the decision. If your appeal gets rejected as well, the decision is final, and there is no point in trying your luck again.

At this point, you can burst into tears and cancel the card or grit your teeth and pay the annual fee.

For most cards, the most worthwhile option is to cancel the card on the spot before the annual fee is due. However, you can always reapply for the card if you really like it.

You’ll lose all rewards points and air miles you haven’t transferred out when you cancel your card. So, ensure you redeem all rewards points and air miles before making that fateful call.

Cash rebates, if credited directly to your account every month, are considered your money and cannot be withheld by the bank. The cash is usually used to offset your final bill or repaid to you after you close your account.

Also, make sure that you don’t have any standing instructions to pay recurring bills like utilities, telco, insurance premiums and so on. You should set up new recurring payment arrangements before making the call.

Which credit cards offer no annual fee?

Not keen on wasting time with the annual ritual of asking for fee waivers?

Here are some credit cards that don’t ever charge annual fees:

Standard Chartered Smart Credit Card. This card gives you rewards points equivalent to 6% cashback on everyday spending like bus and train rides, Netflix, Spotify, McDonald’s, Toast Box and Yakun. It also offers fee-free 0% 3-month instalments.

MoneySmart Exclusive

Up to 6% Cashback

Standard Chartered Smart Credit Card

MoneySmart Exclusive:

Get a Sony LinkBuds S Earbuds (worth S$309) or a Lenovo Tab M10 Gen 3 (worth S$299.01) or up to S$230 Cash via PayNow when you apply and meet the relevant spend criteria! T&Cs apply.

Valid until 30 Apr 2024

More Details

Key Features

6%* cashback on your everyday spend at your favourite merchants across fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). No minimum spend requirement. *T&Cs apply.

No Annual Fees ever

3-month interest-free instalments with no service fees

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life Program

Complimentary travel medical insurance - Have a peace of mind when you travel with complimentary travel insurance coverage of up to S$500,000. Simply charge your full travel fare to your card before you go abroad. Terms and conditions apply.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

CIMB World MasterCard. Get 2% unlimited cashback on eating and drinking out, online food delivery, movies and digital entertainment, taxis and ride-hailing and luxury goods when you spend at least $1,000 in a month.

MoneySmart Exclusive

Unlimited 2% Cashback | FASTER GIFT REDEMPTION

CIMB World Mastercard

MoneySmart Exclusive:

[FASTER GIFT REDEMPTION]

Get S$280 Cash via PayNow, in as fast as 2-3 months when you apply and spend a min of S$988. T&Cs apply.

Valid until 30 Apr 2024

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

HSBC Revolution Credit Card. This card offers card members 10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments. Not only does it have no annual fee—it also has no minimum spend.

MoneySmart Exclusive

Earn up to 4 miles per S$1 | Instant Activation*

HSBC Revolution Credit Card

MoneySmart Exclusive:

Get a Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) or an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to the end of the following calendar month. T&Cs apply.

Valid until 30 Apr 2024

More Details

Key Features

10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments.

1X Reward point for all other types of spending.

No min. spend required.

No annual fee

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Cap of 10,000 rewards points per calendar month on eligible purchases. Other terms apply.

Found this article useful? Share it with those who need to declutter their wallets.

The post How to Get Credit Card Annual Fee Waivers and Still Enjoy Rewards and Perks appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post How to Get Credit Card Annual Fee Waivers and Still Enjoy Rewards and Perks appeared first on MoneySmart Blog.

Original article: How to Get Credit Card Annual Fee Waivers and Still Enjoy Rewards and Perks.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.