Crimewatch: 4 Scams On The Rise (As Reported By Singapore Police Force)

Being safe physically does not necessarily translate to being safe on our devices. In 2020, 4 out of 10 reported cases were scam related. As a city known for its law and order, we have achieved an international standard of physical security with 97% of Singaporeans feeling safe to walk home in the dark. However, crime rate per population density still rose by 6.8% in 2020, due to the increase in scams especially within on digital space. Based on Singapore Police Force 2020’s Annual Crime Brief, the top 10 scams cheated a total of $201 million.

Amongst the top 10, 4 types of scams are increasing at a faster rate as compared to the rest. Here are the scams to look out for:

Read Also: 4 Awful Money Scams Singaporeans Keep Falling For

#1 E-Commerce Scams

E-commerce scams rank first for the highest number of reported cases. A total of $6.9 million were lost to scammers with the single largest cheat at $1.9 million. Digital platforms have enabled a greater reach for scammers. 85% of e-commerce scams are now conducted on digital platforms. Notably, Carousell contributes the largest proportion, approximately 40% of all reported cases.

A common example of an e-commerce scam is a fraudulent representation of a product deal that is usually too good to be true.

Source: CNA

Based on a case reported last year, people were duped into purchasing inferior computer parts and more than $5,000 were scammed. A recurring tactic used by scammers includes:

Displaying limited information on the terms and condition

Time limited deal or quantity to pressure consumers to make the decision hastily

Lack of authentic certifications

Sellers are equally susceptible to deceptive scammers posing to be customers and caution should always be practised by both parties. Based on SPF’s ScamAlert website, here are some measures to reduce the likelihood of being scammed via e-commerce.

Check for comments on the buyer/seller and ensure the comments are not too similar and repetitive like they could be generated from a bot

Do not agree to bank transfers before delivery

Insist on cash-on-delivery or use the platform’s secure payment options

Check for all terms and conditions

Offenders of e-commerce scams can be charged under Section 415 of the Penal Code, for cheating, with an imprisonment of up to 3 years, a fine, or both.

Read Also: How To Protect Yourself From Scams While Shopping Online

#2 Social Media Impersonation

Amounting to 8% of total crime cases reported, social media impersonation crime has almost tripled in the past year, with Facebook and Instagram accounting for 94% of reported cases.

Source: Ministry of Home Affairs

According to a case cited by Ministry of Home Affairs, the victim was contacted by his “friend” via Facebook and was eventually cheated $3,000 from sharing sensitive information. In most cases, the impersonator would try to get people to divulge personal information such as bank account details, identification number, mobile number, and other sensitive details.

Here are some areas to be cautious about for such scams:

Never share sensitive information

Never agree to an unexpected friend request

If your account is compromised, inform all your friends and family immediately

Ensure good password security practises

Offenders of social media impersonation can be charged under Section 416 of the Penal Code an imprisonment of up to 5 years, a fine, or both. In the case of the offender hacking into an account for impersonation, they can be charged under Section 4 of the Computer Misuse Act with an imprisonment of up to 10 years, a fine of up to $50,000, or both.

#3 Loan Scams

In difficult times such as a pandemic, the demand for loans has inevitably increased, and with it the rise in loan scams. In total, the reported loan scams amount doubled in 2020, from $6.8 million to $14.5 million. In any case, if anyone were to receive loan service solicitation via SMS or WhatsApp, the message is a scam as official money lending institutions are not allowed to directly solicit customers.

Source: ScamAlert.sg

A familiar sight would be the Whatsapp spams as shown, which most of us have probably received before. These loans are marketed as unsecured with instant disbursement. Upon further enquiry, the loans are usually conditional to a minimum down payment. Here some measures to take note of these scams:

Only seek financial help from legitimate money lenders

Never share any personal or sensitive information

Ignore, block and report the number

Offenders of loan scams can be charged under the Section 415 of the Penal Code, for cheating, with an imprisonment of up to 3 years, a fine, or both.

#4 Banking Related Phishing Scams

Lastly, banking related phishing cases marks the highest rate of increase among the top 10 scams at almost 17 times. The largest sum scammed was $506,000. Messaging platforms such as IMO (an app), Viber and WhatsApp used by the scammers to reach out to the victims.

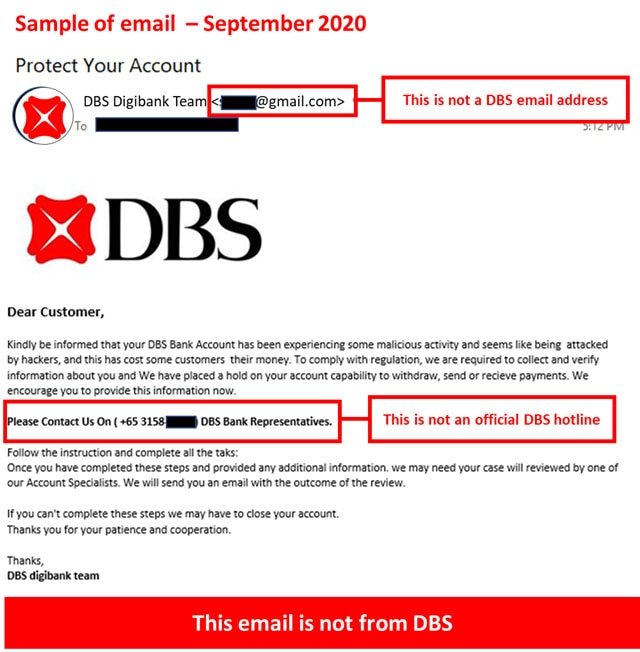

Source: DBS

Another common example would be scammers posing as bank emails requesting for individuals to share sensitive personal information. These emails are done up professionally and it can fool even the most meticulous person.

Source: DBS

Nevertheless, there are some measures to practise to prevent oneself from falling victim to this scam.

Verify with the bank of mention

Check the email address of the sender to look out for spelling errors

Never share any personal or sensitive information

Ignore, report and block the sender

Offenders of phishing related scams can be charged under Section 416 of the Penal Code with an imprisonment of up to 5 years, a fine, or both.

Read Also: Banking-Related Phishing Scams: How To Spot And Avoid Them

In the unfortunate event that you or a loved one have fallen prey to such scams, always make sure to report the case to the Singapore Police Force. Prevention is always better than cure, while the police have been making concerted efforts to enforce on scammers, individuals should be discerning and practise caution. After all, only 35% of the money being scammed gets recovered.

For more information on scams, visit scamalert.sg or call the anti-scam hotline at 1800-722 6688.

The post Crimewatch: 4 Scams On The Rise (As Reported By Singapore Police Force) appeared first on DollarsAndSense.sg.