Crude Oil Price Update – Trend is Down, but Next Major Move Up to the Saudis

U.S. West Texas intermediate crude oil futures were under pressure most of the session on Friday as demand destruction caused by the coronavirus outweighed stimulus efforts by policymakers around the world. Warnings about a steep drop in demand and the lack of financial support from the U.S. government weighed on prices throughout the session.

On Friday, May WTI crude oil settled at $21.51, down $1.09 or -4.82%.

Daily Technical Analysis

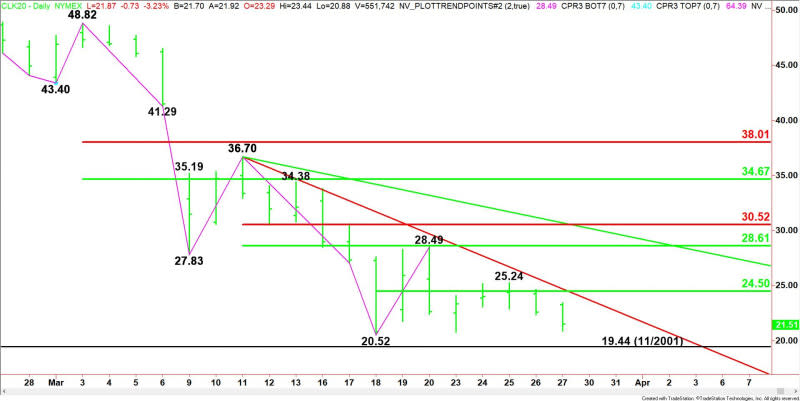

The main trend is down according to the daily swing chart. A trade through $20.52 will signal a resumption of the downtrend. The main trend will change to up on a move through $36.70.

The minor trend is also down. A trade through $25.24 will change the minor trend to up. This will also shift momentum to the upside.

The minor range is $20.52 to $28.49. Its 50% level or pivot at $24.50 is controlling the direction of the market. Closing below this level is helping to generate the downside bias.

The short-term range is $36.70 to $20.52. Its retracement zone at $28.61 to $30.52 is resistance. The recent rally stopped at $28.49 on March 20, just under the short-term 50% level at $28.61.

Short-Term Outlook

May WTI crude oil has been walking down a Gann angle, moving at a rate of $1.00 per day from the $36.70 main top. We’re looking for the downside momentum to continue as long as this angle remains resistance.

Crossing to the strong side of the angle and the minor 50% level at $24.50 will signal the return of buyers. This is likely to be short-covering but if it creates enough upside momentum, the rally could even extend into $28.61 to $30.52.

There isn’t any incentive to buy crude oil as forecasts continue to point toward $15 to $10 crude oil. The White House is urging Saudi Arabia to dial back its plan to flood the crude market. Still, any agreement to curtail supply among producers will be too little and too late in the face of an unprecedented shock for the world’s oil refining system, Goldman said.

Unless the Saudi’s rescind their threat to flood the market with crude oil, prices are doomed to drop another $5 to $10 per barrel. If they withdraw their threat then prices will surge similar amounts, but gains will be limited by extremely low demand.

This article was originally posted on FX Empire

More From FXEMPIRE:

EOS, Ethereum and Ripple’s XRP – Daily Tech Analysis – 28/03/20

The Weekly Wrap – A Dollar Slump, The Stimulus Bill, and The Coronavirus Grabbed the Headlines

E-mini S&P 500 Index (ES) Futures Technical Analysis – 2404.25 – 2350.00 Near-Term Target

Crude Oil Price Update – Trend is Down, but Next Major Move Up to the Saudis