Crypto Market Daily Highlights – June 23 – ETH, and SOL Lead Top 10

Key Insights:

It was a bullish session for the crypto market on Thursday, with Solana (SOL) and Ethereum (ETH) leading the top 10 rebound.

From elsewhere, Polygon (MATIC) was among the broader market front runners, with investors moving on from Fed Chair Powell, inflation, and fears of a recession.

Reversing a $33 billion slide on Wednesday, the total market cap rose by $48 billion to $900 billion.

It was a bullish session for the crypto market on Thursday. Bitcoin (BTC) and the broader market reversed Wednesday’s losses with interest.

A pickup in risk appetite delivered support as the markets moved on from Fed Chair Powell’s testimony on Wednesday.

While crude oil took another hit, the US equity markets found support, with the NASDAQ 100 rising by 1.62%.

The upside came despite disappointing private sector PMI numbers from the US that showed slower growth across the private sector.

Following a busy few days for the global financial markets, it’s a quieter day ahead on the economic calendar.

Finalized Michigan consumer sentiment figures are due out later today. We don’t expect the numbers to impact the crypto market. However, FOMC member chatter will draw interest.

FOMC member Bullard is due to speak ahead of the US open.

Crypto Market Cap Bounces Back on Pickup in Risk Appetite

On Thursday, the total market cap rose by $48 billion. Reversing Wednesday’s $33 billion loss, the market cap returned to $900 billion levels.

The upside came despite investor fears of a US recession, driven by inflation and the prospects of a 3.8% Federal Funds Rate by 2023.

On the second day of testimony, Fed Chair Powell provided no surprises to shift sentiment from Wednesday, where the Fed Chair talked of cutting inflation at any cost.

The Thursday rally reversed losses for the current week. Holding onto gains could see the total market cap see a weekly rise for just the second time since early April.

However, it is still grim reading for June, with the total market cap down by $384 billion.

The bullish sentiment was evident across the crypto market top ten.

SOL and ETH led the way, rallying by 11.79% and 9.06%, respectively, with BNB (+6.87%) and BTC (+5.73%) finding strong support.

ADA (+4.36%), DOGE (+3.65%), and XRP (+4.10%) trailed the front runners.

From the CoinMarketCap top 100, Polygon (MATIC) extended its winning streak to five sessions, rallying by 23.69% on news of the launch of Polygon ID.

However, the biggest mover on the day was Storj (STORJ), which surged by 54.10%.

Stablecoins Hold Steady Despite USDD Peg Issues

On the stablecoin front, USDD inched higher to ease fears of another stablecoin collapse.

According to TRON DAO Reserve, the collateral ratio stood at 326.3%.

Looking at the leading stablecoins, Binance USD (BUSD) and USD Coin (USDC) remained the only coins with the dollar peg firmly in place.

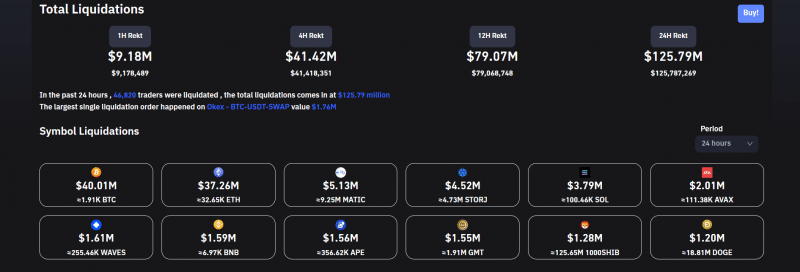

Total Crypto Liquidations Eased Further Back Powell’s Testimony

The downward trend in total crypto liquidations extended into this morning.

24-hour liquidations fell from a Thursday $165.11 million to $125.79 million, reflecting improving market conditions. Last week, total liquidations had hit $1 billion levels.

However, one-hour liquidations suggested a possible bearish start to Friday.

According to Coinglass, one-hour liquidations stood at $9.18 million.

Daily News Highlights

Cristiano Ronaldo and Binance formed a partnership to launch an exclusive NFT collection.

Qatar central bank progressed on a Central Bank Digital Currency (CBDC).

On Wednesday, Voyager Digital (VOYG) shares tumbled 52.5% on news of a possible Three Arrows Capital loan default.

Binance targeted US customers by offering fee-free bitcoin trading.

This article was originally posted on FX Empire