Deckers (DECK) Surpass Earnings and Sales Estimates in Q2

Deckers Outdoor Corporation DECK posted a sturdy second-quarter fiscal 2021. Both top and bottom lines outpaced the Zacks Consensus Estimate and compared favorably with the year-ago quarter’s respective figures.

Quarterly results were backed by compelling and innovative product launches, and gains from e-commerce and digital marketing engines that boosted awareness and customer acquisition. Also, optimizing marketing spending and robust supply chain that pivot resources and navigate challenges were tailwinds. Strength in the company’s brands, direct-to-consumer platform and positive impacts of the solid execution of its strategy further aided results. It also remains focused on investing in digital transformation to drive growth. However, management did not issue fiscal 2021 outlook given the fluid economic landscape with respect to COVID-19.

This Goleta, CA-based company’s shares have gained 79.8% in the past six months, outperforming the industry’s 43.3% rally.

Let’s Delve Deeper

Deckers posted quarterly earnings of $3.58 per share, which surpassed the Zacks Consensus Estimate of $2.61 and increased 32.2% from the year-ago quarter's tally.

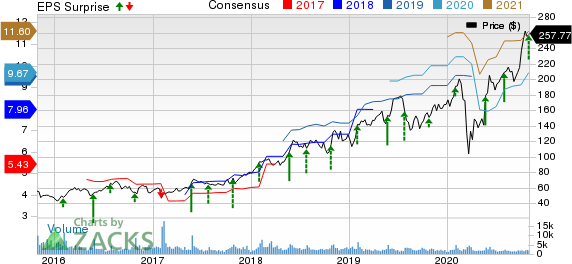

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

Net sales rose 15% to $623.5 million during the reported quarter and also surpassed the Zacks Consensus Estimate of $552.4 million. Notably, sales outpaced the Zacks Consensus Estimate for the 15th straight quarter. On a constant-currency basis, net sales grew 14.1%.

We note that gross margin expanded 80 basis points (bps) to 51.2% during the quarter, driven by a favorable channel mix, positive brand mix with a considerable increase in HOKA brand and gains from favorable exchange rates.

SG&A expenses grew 8.2% year over year to $190.4 million due to increased marketing and warehouse expenses, somewhat offset by savings from travel and retail costs. Furthermore, the company reported operating income of $128.6 million, up 32.4% from the year-ago quarter. Also, operating margin expanded 270 bps to 20.6% in the reported quarter.

Sales by Geography & Channel

The company’s domestic net sales increased 19.4% to $427.4 million in the reported quarter. Meanwhile, international net sales edged up 6.4% to $196.1 million. Direct-to-Consumer net sales jumped 74.2% to $171.9 million. Wholesale net sales in the reported quarter inched up 1.8% to $451.6 million.

Brand-wise Discussion

UGG brand net sales jumped 2.5% to $415.1 million in the reported quarter. HOKA ONE ONE brand net sales surged 83.2% to $143.1 million, while Teva brand net sales climbed 20.5% to $27.7 million. Net sales for the Sanuk brand, known for its exclusive sandals and shoes, came in at $9.5 million, down 11.4% year over year.

Other Financial Aspects

At the end of the reported quarter, this Zacks Rank #1 (Strong Buy) company had cash and cash equivalents of $626.4 million, outstanding borrowings of $39.9 million and shareholders’ equity of $1,243 million. Further, inventories as of Sep 30, 2020, were $484.1 million, down 13.4% year over year.

During fiscal second quarter, management did not buy back shares and had $160 million available under its stock-repurchase program as of Sep 30.

COVID-19 Update

With respect to the pandemic, the company has been evolving its operations. It will continue to review expert agency guidelines and information from local authorities, while assessing the scope of operations and allocation of resources to maneuver through the unprecedented environment. As of Sep 30, 2020, Deckers had a liquidity of about $1.1 billion, including $626.4 million of cash and $462.6 million under its existing revolving-credit facilities.

Management informed that nearly 95% of the company's global stores were open throughout fiscal second quarter. These stores were operating with limited capacity on enhanced health and safety measures. Deckers anticipates a few retail store closures across EMEA for at least some point in fiscal third quarter owing to the volatile pandemic-induced conditions. Further, its distribution center in Moreno Valley, California, and other third-party distribution facilities that the company leverages to service operations are currently operating and supporting logistics. However, these facilities may continue operating at limited capacity owing to safety protocols.

Moreover, management expects operational headwinds like capacity constraints, including higher levels of e-commerce shipments in peak wholesale-volume periods, and elevated costs with respect to warehouse employee safety and payroll cost. Also, the company’s third-party logistics providers are witnessing capacity constraints, which are affecting the company’s operations. During the reported quarter, the company witnessed some capacity constraints in its sourcing network apart from disruptions related to travel restrictions. Although impacts of such disruptions have been mitigated, the company expects possible disruptions ahead.

A Few More Solid Picks

Caleres CAL has delivered an earnings surprise of 21% in the last four quarters, on average. The company currently has a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Rent-A-Center RCII has an average earnings surprise of 12.9% in the trailing four quarters and carries a Zacks Rank #2 (Buy).

Crocs CROX, also a Zacks Rank #2 stock, which has delivered an earnings surprise of 191.7% in the last four quarters, on average.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

">Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RentACenter, Inc. (RCII) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Caleres, Inc. (CAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research