Deere's (DE) Earnings and Revenues Trump Estimates in Q1

Deere & Company DE posted first-quarter fiscal 2020 (ended Feb 2, 2020) earnings of $1.63 per share, beating the Zacks Consensus Estimate of $1.28. The reported figure increased 5.8% from the prior-year quarter’s earnings per share of $1.54.

The quarterly results reflect signs of stabilization in the U.S. farm sector. Farmer sentiment improved on expectations of easing of trade tensions and higher agricultural exports.

Net sales of equipment operations (which comprise Agriculture and Turf, Construction and Forestry) came in at $6.53 billion, down 6% year over year. Revenues, however, surpassed the Zacks Consensus Estimate of $6.20 billion. Total net sales (including financial services and others) came in at around $7.63 billion, down 4% year over year.

Operational Update

Cost of sales in the reported quarter was down 6.5% year over year to $5.1 billion. Gross profit, excluding financial services, for the January-end quarter fell 3.7% year over year, to $1.45 billion. Selling, administrative and general expenses flared up 5.9% year over year to $809 million. Equipment operations reported operating profit of $466 million in the quarter compared with the $577 million witnessed in the prior-year period. Total operating profit (including financial services) dipped to $645 million from $769 million reported in the year-ago quarter.

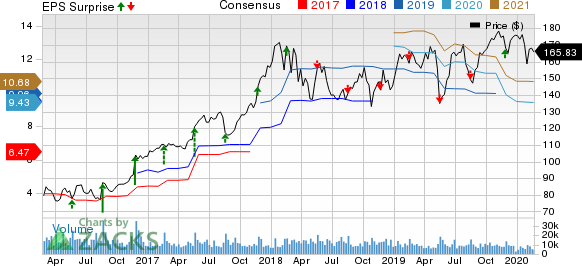

Deere & Company Price, Consensus and EPS Surprise

Deere & Company price-consensus-eps-surprise-chart | Deere & Company Quote

Segment Performance

The Agriculture & Turf segment’s sales slid 4% year over year to $4.5 billion, primarily due to lower shipment volumes and unfavorable currency-translation impact, partly offset by price realization. Operating profit in the segment increased 7% year over year to $373 million, resulting from higher price realization, improved production costs, and lower warranty-related expenses, partly offset by lower shipment volumes and voluntary employee-separation expenses.

Construction & Forestry sales slipped 10% year over year to $2 billion from the year-earlier quarter, due to lower shipment volumes and unfavorable foreign currency, partly offset by price realization. This segment’s operating profit plummeted 59% year over year to $93 million.

Net revenues in Deere’s Financial Services division came in at $931 million in the reported quarter, up 9% year on year. The segment’s operating profit came in at $179 million, down 7% year over year.

Financial Update

Deere reported cash and cash equivalents of $3.60 billion at the end of the fiscal first quarter compared with the $3.63 billion recorded at the end of the prior-year quarter. Cash utilized in operating activities were $508 million in the fiscal first quarter compared with the year-ago quarter’s $1,651 million. At the end of the reported quarter, long-term borrowing was $30.5 billion, up from $27.9 billion at the year-ago quarter’s end.

Outlook

Net income for the fiscal year is projected at $2.7-$3.1 billion.

For fiscal 2020, Deere expects Agriculture and Turf equipment sales to be down 5-10%. Industry sales of agricultural equipment in the United States and Canada are anticipated to be down 5%, due to softer large equipment demand in Canada. Moreover, Construction and Forestry equipment sales are expected to slip 10-15%, due to sluggish construction activity and the company’s efforts to manage inventory levels. Nevertheless, the Financial Services segment is anticipated to benefit from lower losses on lease residual values and income earned on a higher average portfolio.

Share Price Performance

Shares of Deere have lost 0.1% over the past year compared with the industry’s decline of 1%.

Zacks Rank and Stocks to Consider

Deere currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Industrial Products sector are Northwest Pipe Company NWPX, Sharps Compliance Corp SMED and Graco Inc. GGG. All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Northwest Pipe has an expected earnings growth rate of 19.5% for the current year. The stock has appreciated 50% over the past year.

Sharps Compliance has an estimated earnings growth rate of a whopping 767% for the ongoing year. In a year’s time, the company’s shares have gained 43%.

Graco has a projected earnings growth rate of 4.3% for 2020. The company’s shares have rallied 20% over the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Click to get this free report

Deere & Company (DE) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Sharps Compliance Corp (SMED) : Free Stock Analysis Report

Northwest Pipe Company (NWPX) : Free Stock Analysis Report

To read this article on Zacks.com click here.