Does the Volatility of the Underlyings Affect the Pricing of Structured Products?

The short answer is Yes. Essentially, choosing underlyings with a low volatility (usually being indices) means that there is less risk involved and in turn, resulting in a lower reward (Returns P.A in this case). Likewise, when you choose underlyings with higher volatility (usually stocks), the risk is much greater and vice versa.

What is implied volatility?

Implied Volatility is the estimated volatility of a security’s price. In general, implied volatility increases when the market is bearish, when investors believe that the asset’s price will decline over time, and decreases when the market is bullish, when investors believe that the price will rise over time.

At NEBA we personally tailor your investments to you. You can have the most adventurous basket you can think of but this is usually accompanied by a very high volatility product. And the other end of the spectrum is by choosing low volatile underlyings to give a much safer investment.

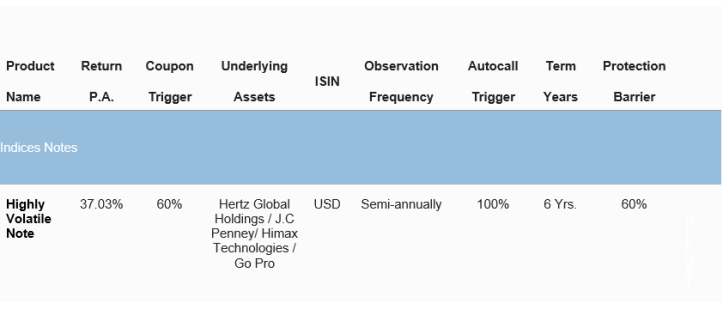

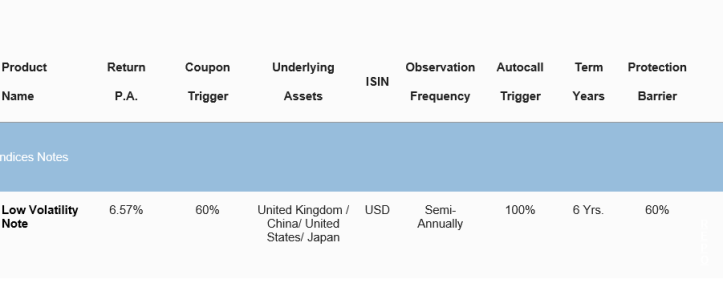

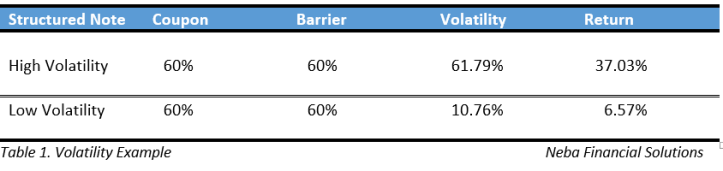

For e.g, taking 4 of the most volatile underlyings and taking 4 of the least volatile underlyings, we get to see how much different it makes to pricing.

Based on our findings as placed into the table below, we see a distinct correlation between the volatility and the return.

In this case, investors of various risk appetites get to select which investment is more suitable for their portfolio.

Some may prefer the lower risk option at 6.57% PA while others may perceive the 37.03% PA to be aligned with their interests and worth the risk-taking! What type of an investor are you? Would you take the risk?

Although providing exceptional returns, NEBA does not generally recommend such high-risk investments unless otherwise sought by a professional.

Related Articles

- The 3 Basic Features of Structured Products

- Unit Trusts vs Structured Notes

- What is a Structured Product?