Don't look away: how to face your finances in lockdown – whether you are furloughed, unemployed or saving

The coronavirus crisis has had a massive impact on people’s finances. For some households, the lockdown has led to a huge drop in income and little prospect of more money coming in any time soon.

Others have been more fortunate and are still earning their salary, but are unable to spend it on the things they would normally buy. One report by investment firm Peel Hunt suggested there could be £80bn of “enforced savings” in people’s accounts by the end of the year.

But even if you are in the fortunate position of having earned as normal through the crisis, you probably have one eye on the future. With the chancellor, Rishi Sunak, suggesting the UK is going to see a “severe recession, the likes of which we haven’t seen”, it would be unwise not to plan for a possible drop in income in future.

Don’t avoid looking at your bank balance

If you have had a wage cut it is unlikely you have thought of much other than your financial position, but you may have avoided looking at the numbers. Don’t.

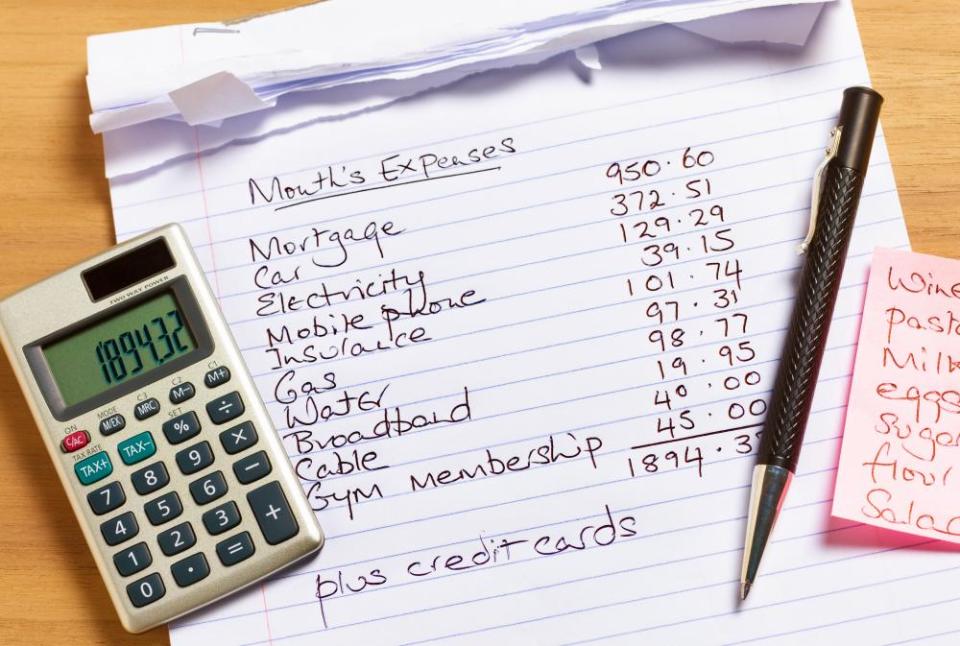

Sarah Coles, personal finance expert at investment firm Hargreaves Lansdown, says you may be tempted “to hope for the best and borrow your way through the crisis until things sort themselves out,” but this is unwise. “If you try to plough on with your usual spending, you are going to end up with far too much month [left] at the end of the money,” she says. “So you need to make a note of everything you have coming in at the moment, and everything you are spending.”

You may use an online bank, which provides this kind of breakdown for you, or you may need to do this with a pen and paper. Pull together details of all your income and outgoings, and work out how much you can cover from what is coming in, and if there are any gaps. Some of the spending you can no longer cover may be discretionary – a £9.99 a month subscription to Spotify, for example, which you would miss, but can live without while you need the money. This type of outgoing is the first thing to cancel.

You may also be able to reduce your spending on essentials. Some of the things you would do in normal times to save money are not an option now, such as visiting several shops to get the best price for food. But you can still make changes. “When it takes an hour to queue for the supermarket, you’re not in a position to visit several of them,” says Coles. “The easiest way to cut costs is to trade down to a budget supermarket, or from brands to own brands and essential ranges.”

Think about how you can improve the income side of the equation. If there are things you have paid for and are not able to use – if, for example, you had a holiday booked or have a season ticket for travelling to work – ask for a refund.

Jasmine Birtles, founder of MoneyMagpie, says that if you are at home it could be a good time to “go through things that you don’t need and sell them on – eBay and Gumtree are your friend”.

It may be possible to fill some of the gaps between your income and outgoings with help. You could be entitled to benefits that you have not previously claimed – the website Entitledto.co.uk is a good place to go for advice and has a calculator to help you work out what you are, as it says on the tin, entitled to.

However daunting it might seem, doing a proper audit of what you have and what you are spending will help. As well as highlighting possible savings, it could also reveal mistakes or fraud, which you can sort out. And it could make you feel better – knowing exactly where you stand and what you need to tackle can be less stressful than just being aware that things are bad.

Get help if you need it

If you are struggling financially, admit it – first, to any lenders you may owe money to. Banks, building societies and other lenders have been told they have to help, so this should be easier than in normal times. Whether it is a mortgage, loan, credit card and buy-now-pay-later debt you are struggling with, the lender should offer you a three-month payment holiday to give you some breathing space.

Mortgage repayment holidays can be requested up until the end of October; other payment breaks can be requested before early July. This holiday is not free – your debt will still be earning interest during the break. On a mortgage, for example, interest is typically calculated every day, and so if you are not repaying the loan it will not be getting smaller and will be accruing more interest. This will typically mean that when you restart your monthly repayments they will be higher. But for most people it will be less than £50 a month.

“It’s not an alternative to drawing up a budget and cutting your other costs. It should be an option open to you if you have done everything else and can’t make ends meet,” says Coles.

The same may be true of a rental holiday. Your landlord may take a pragmatic view and agree to a lower rent that you can afford and that they can still cover their mortgage repayments with. Or they may take a mortgage holiday and pass on the monthly increase at a later date. Although landlords have been told to pause evictions, there are no rules around how they should respond to payment holidays.

Taking a temporary break is a good option if you are furloughed or taking unpaid leave and expect to return to full pay soon, but may not be enough if you have lost your income. Again, though, speak to your lenders. Some, such as Nationwide building society, have put in special measures to help. It has pledged that no mortgage borrowers who fall into arrears as a result of the pandemic will lose their home in the next 12 months, as long as they work with it to get their finances back on track.

Also, speak to companies you pay for services. Councils have been given money to help those in hardship, so you may be able to get help with your council tax bills, and energy companies and phone companies will consider pausing or rearranging payments.

Advice on how to manage debts, and to ensure you are claiming the benefits you are entitled to, is available from a number of organisations. Citizens Advice, Turn 2 Us, Stepchange and the Money Advice Trust all have lots of information online, and National Debtline is offering calls and webchats with its advisers.

Plan for the worst

Even if you have so far come through this unscathed, you might have concerns about the next few months. A second wave of infections could mean further disruption to the economy and livelihoods, and the effects of the current wave of closures could continue to ripple out over time. The most sensible thing to do is to try to build up your savings while you can.

“One of the things this crisis has shown is the importance of having a savings safety net,” says Birtles. If you have cash put aside, you won’t need to turn to credit cards which, as she points out, still have interest rates around 20%, even though the Bank of England base rate is close to zero.

She says that ideally you should have six months’ expenses in an easy access account ready to use if you suddenly lose your income, but admits that most people will struggle to achieve that, so suggests aiming for three. Once you have totted up your outgoings, you will have an idea of how much that is.

Do not take a risk with this money. “If you are putting it aside, you need to know that £100 you put away now will still be £100 this time next year, and that means a savings account and not the stock market,” Birtles says.

Choose an easy access account so you can get hold of the money when you need it. The simplest option is to choose one offered by your main bank as i is straightforward to access. But if you feel that you want to make it a little harder to dip into, shop around for an account with a better rate. Moneyfacts.co.uk and Savingschampion.co.uk have best buy tables showing interest rates and details of accounts. Look for one that has no penalty or restrictions on withdrawals.