E-commerce & Cost Cut to Aid Advance Auto (AAP) Q2 Earnings

Advance Auto Parts, Inc. AAP is slated to release second-quarter 2020 results on Aug 18, before the bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $1.88 per share and $2.34 billion, respectively.

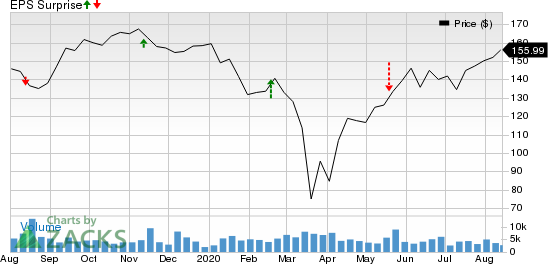

Over the trailing four quarters, Advance Auto Parts missed estimates on two occasions and beat on the other two, with the average negative surprise being 7.8%. This is depicted in the graph below:

Advance Auto Parts, Inc. Price and EPS Surprise

Advance Auto Parts, Inc. price-eps-surprise | Advance Auto Parts, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter earnings per share has been revised upward by 6 cents in the past 30 days to $1.88. The figure indicates a year-over-year decrease of 6%. Further, the Zacks Consensus Estimate for revenues indicates an increase from the year-ago level of $2.33 billion.

What the Zacks Model Says

Our proven model predicts an earnings beat for Advance Auto this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: It has an Earnings ESP of +6.38%. This is because the Most Accurate Estimate of $2 per share is 12 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Advance Auto carries a Zacks Rank of 3 currently.

Key Factors

Advance Auto Parts — whose peers include O’Reilly Automotive Inc ORLY, U.S. Auto Parts Network Inc. PRTS and AutoZone Inc. AZO — is anticipated to have gained from the expansion of footprint through new stores, widening online presence and collaborations in the second quarter. The acquisition of Sears’ DieHard brand is likely to have helped the company enhance the brand portfolio and drive more traffic to its stores. Also, its Speed Perks 2.0 program provided employees with data insights during the quarter under review.

Further, Advance Auto Parts undertook several initiatives to strengthen and streamline the supply chain to meet the evolving need of customers in the second quarter. This is likely to have helped the company unlock margin expansion during the June-end quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q2 2020, while the S&P 500 gained an impressive +44.0%, five of our strategies returned +50.9%, +93.8%, +122.2%, +153.0%, and even +156.8%.

This outperformance has not just been a recent phenomenon. From 2000 – Q2 2020, while the S&P averaged +5.5% per year, our top strategies averaged up to +51.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

OReilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

U.S. Auto Parts Network, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research