E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Volatility Expected After Fed Minutes

March E-mini Dow Jones Industrial Average futures are edging higher at the mid-session on Wednesday in a lackluster trade as investors await the release of the minutes of the U.S. Federal Reserve late January monetary policy meeting.

A bullish technology sector is dominating the trade, sending both the cash NASDAQ Composite and S&P 500 Index to record highs. The Dow didn’t move in sync with the other majors because it is underweighted in technology stocks, but it did get a boost from component Apple, which rose a little more than 2%.

At 17:07 GMT, March E-mini Dow Jones Industrial Average futures are trading 29358, up 147 or +0.50%.

The minutes are likely to reiterate last week’s comments from Fed Chair Jerome Powell in which he said that the U.S. economy remains in a “very good place”. The minutes are also expected to show that policymakers agreed that monetary policy at present was “roughly appropriate.”

The minutes could also provide details on how FOMC participants viewed the outbreak of COVID-19 in late January.

Daily Technical Analysis

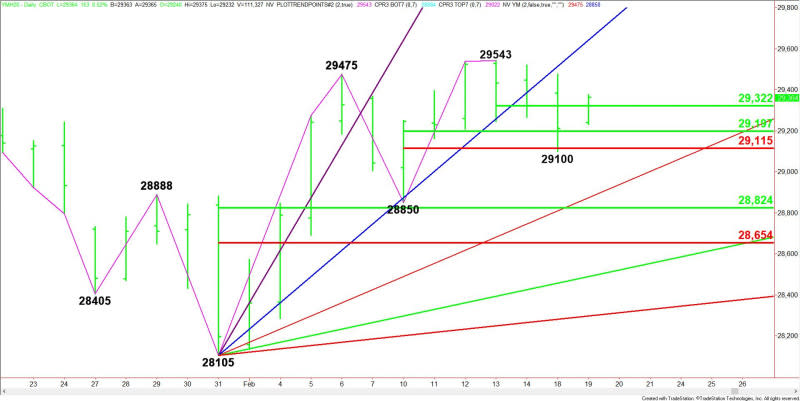

The main trend is up according to the daily swing chart. A trade through 29543 will signal a resumption of the uptrend. The main trend will change to down on a trade through 28850.

The minor range is 29543 to 29100. It’s 50% level or pivot is 29322. This price is controlling the direction of the Dow on Wednesday.

The short-term range is 28850 to 29543. Its retracement zone at 29197 to 29115 is support. This zone stopped the selling on Tuesday.

The main range is 28105 to 29543. Its retracement zone at 28824 to 28654 is major support and a value zone.

Daily Technical Forecast

Based on the early price action and the current price at 29358, the direction on the March E-mini Dow Jones Industrial Average the rest of the session on Wednesday is likely to be determined by trader reaction to the minor pivot at 29322.

Bullish Scenario

A sustained move over 29322 will indicate the presence of buyers. If this creates enough upside momentum then look for the rally to possibly extend into the record high at 29543. Overtaking 29364 will put the Dow in an extremely bullish position.

Bearish Scenario

A sustained move under 29322 will signal the presence of sellers. This could trigger a break into the short-term retracement zone at 29197 to 29115, followed closely by yesterday’s low at 29100.

The low at 29100 is a potential trigger point for an acceleration to the downside with the first target angle coming in at 28875.

Side Notes

Given the tight intraday trading range, look for volatility with the release of the Fed minutes at 19:00 GMT.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Prediction – Gold in Euros Hit All-time Highs as Prices Continue to Rally

S&P 500 Price Forecast – Stock Markets Continue To Show Resiliency

Silver Price Forecast – Silver Markets Continue To Show Resiliency

Natural Gas Price Prediction – Prices Consolidate After Breakout

Fed’s Kashkari: Virus Could Deliver Negative ‘Shock’ That Could Force Fed to Lower Rates