The easiest ways to transfer money using your smartphone

Transferring money and going Dutch has never been this easy

We’ve all faced the hassle of transferring money to friends and family, staring at our PCs and keying in long, obscure bank account numbers while holding onto our bank tokens.

Times have changed though. These days, we have a lot of ways to transfer money using the apps on our smartphones — so many that it can be confusing to get through them all, which is why we wrote this guide. If you’ve ever wanted an easier way to transfer money to your friends and family, this is it.

Note: This guide is focused on transferring money within Singapore, and not on remittance to overseas. It’s also focused on person to person transfers, instead of merchant payments (some merchants do use the same methods, like QR code payments, to receive money). Lastly, while you can log onto banking websites via the mobile browser, we’re focusing on using apps in this guide.

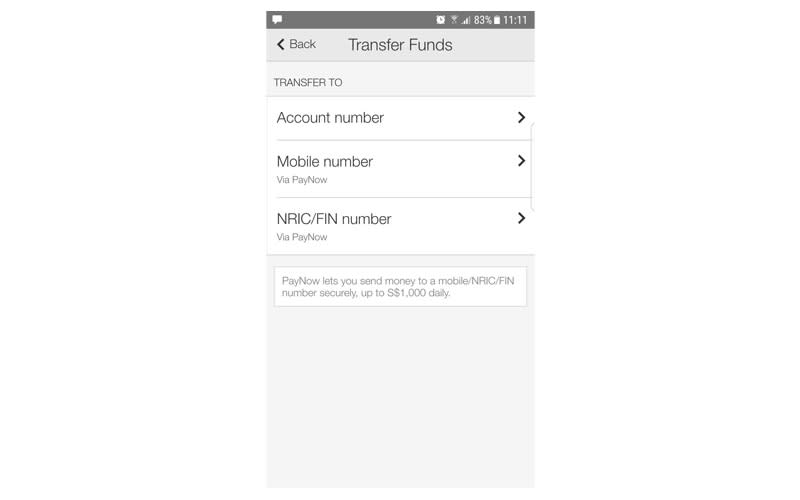

Option 1: Send money via mobile and/or IC number

This is probably the easiest of all. Thanks to PayNow, you can transfer money to someone using just their mobile or identity card number.

There are two catches. One, both the sender and the recipient need a bank account with a bank that offers PayNow. The good news is that seven major banks, DBS Bank/POSB, OCBC Bank, UOB, Citibank, HSBC, Maybank, and Standard Chartered Bank, do.

The second catch is that while you, the sender, don’t have to register with PayNow to send money, the recipient has to, in order to receive money.

What you need

Recipients must register their mobile phone or IC numbers with their bank’s PayNow service. This can be done on the bank’s internet banking website.

How to transfer

Using the recipient’s mobile or IC number, senders can use their bank’s respective app to transfer money using PayNow.

Where does the money come from?

It depends. If your bank’s app also functions as a mobile wallet, like DBS PayLah, you can choose to transfer funds from the wallet or your bank account. If the app is tied only to your bank account, then the money is deducted from your bank account.

How much can you transfer?

PayNow actually allows you to transfer up to $50,000 per day if you use internet banking or mobile banking (through your smartphone’s mobile browser), but if you use your bank’s app, you can transfer up to S$1,000 per day.

Next: How to send money via QR code

Option 2: Send money via QR code

This is relatively new here, but some apps can now generate QR codes, which the sender can scan to transfer money. Think of QR codes like invoices, which the recipient creates to ask for money, and the payer scans to pay for. The two of you don’t even need to be in the same room to transfer money.

What you need

DBS PayLah and OCBC Pay Anyone both offer the option to transfer funds via QR code, but unfortunately, the apps aren’t cross-compatible. You can only use QR codes from PayLah to PayLah and Pay Anyone to Pay Anyone.

You don’t need a DBS or POSB account to use PayLah, an account with a bank which offers FAST will do, but you do need an OCBC account to use Pay Anyone.

How to transfer

To request money using DBS PayLah, click on the QR code icon on the top right side of the Home page, then click on ‘Show My Code.’ Key in the amount that you want, and this will generate a QR code that your friend can scan to start a transfer. To send money using PayLah, click on the same QR code icon and scan your friend’s QR code.

Here’s how to do it with OCBC Pay Anyone:

The two of you don’t even need to be in the same room to do a transfer using QR codes. If you’re the one asking for money, you can also send the QR code over as an image, which your friend can then upload to the app on their smartphone and authorize a transfer.

Where does the money come from?

If you’re using DBS PayLah, the money is deducted from your mobile wallet. If the mobile wallet is set to auto top-up, then it’ll deduct the amount from your linked bank account when your mobile wallet funds run low.

If you’re receiving money, then the money will go to the mobile wallet, however, if the PayLah wallet’s limit is set to zero, then the money will be sent straight to your account.

If you’re using OCBC Pay Anyone, the money is deducted from your linked bank account.

How much can you transfer?

Up to S$999 using DBS PayLah, and up to S$1,000 using OCBC Pay Anyone

Next: Send money via SMS, email, or Facebook

Option 3: Send money via SMS, email, or Facebook

Here’s another way to send money using SMS, email, or Facebook, using the OCBC Pay Anyone app. You’ll need to have an OCBC account to send money, but if you’re receiving money you’ll just need an account from any of the FAST (Fast And Secure Transfer) participating banks.

What you need

You need an OCBC account, and the OCBC Pay Anyone app to send money. The receiver doesn’t need either, she just needs to have a bank account that supports FAST. You won’t need the person’s bank account number either, just her contact details.

How to transfer

Using the Pay Anyone app, you’ll send a URL via SMS, email or Facebook, which the recipient can click to receive money. To keep the transaction secure, a passcode is generated on the sender’s end, which she needs to share with the recipient to authenticate the transfer.

Where does the money come from?

It’s deducted from your OCBC account.

How much can you transfer?

Up to S$1,000 daily.

How about paying for things using my smartphone?

Want to know how you can use your smartphone to pay for things, as if it’s a credit/debit card? How about using it for public transportation? Then check out our Ultimate guide to paying with your smartphone in Singapore.