eBay's (EBAY) Q4 Earnings Beat Estimates, Revenues Down Y/Y

eBay Inc. EBAY reported fourth-quarter 2019 non-GAAP earnings of 81 cents, beating the Zacks Consensus Estimate by 8%. The reported figure also improved 14.1% year over year and 20.9% sequentially.

Net revenues of $2.82 billion also surpassed the Zacks Consensus Estimate by 0.4%. The top line was up 6.5% from the prior quarter.

However, it was down 2% on a year-over-year basis (flat on an FX-neutral basis). This can be attributed to slowdown in gross merchandise volume (GMV) due to sluggish contribution from Marketplace platform and StubHub.

Nevertheless, the company witnessed solid momentum across its managed payments offerings. Further, eBay’s Promoted Listings delivered robust performance by generating revenues of $136 million, up 73% from the year-ago quarter.

Additionally, the company witnessed growth of 2.2% in the active buyer number. The active buyers base came in at 183 million at the end of the fourth quarter.

Coming to share price movement, eBay’s shares have plunged almost 4.7% in pre-market trading thanks to the weak revenue guidance for the current quarter and the full year.

Further, eBay has returned 6.3% in the past year, underperforming the industry’s growth of 12.5%.

Nevertheless, the company’s growing initiatives toward strengthening its managed payments offerings and advertising revenues remain major positives. Further, eBay remains optimistic regarding growth initiatives, which are based on enhancing seller experience by offering innovative seller tools and delivering better buyer experience by utilizing structured data.

Moreover, integration between listing flows and Seller Hub remains a tailwind.

Notably, the company entered into a definitive agreement to sell StubHub to viagogo as a result of slowdown in StubHub’s volume.

All these strong endeavors are likely to help the stock to rebound in the near-term.

GMV Details

Total GMV of $23.3 billion in the fourth quarter was down 5% year over year on a reported basis and 4% on an FX-neutral basis. Further, the figure missed the Zacks Consensus Estimate of $23.8 billion.

Marketplace GMV came in $21.9 billion (94.3% of total GMV), down 5.4% year over year. We note that U.S. GMV fell 9% from the year-ago quarter primarily due to imposition of Internet Sales tax. Further, international GMV was down 1% year over year thanks to uncertainties related to Brexit.

StubHub GMV came in $1.3 billion (5.7%), down 5.4% on a year-over-year basis due to sluggish landscapes in concerts and theatres.

Revenues in Detail

eBay’s revenues are classified into two types:

Net Transaction: The company generated $2.28 billion of net transaction revenues in total in the fourth quarter. The figure accounted for 80.9% of the total net revenues and declined 1% year over year. This can be attributed to sluggish performance of Marketplace and StubHub, which generated $1.97 billion and $305 million transaction revenues, down 0.4% and 1.9% from the prior-year quarter, respectively.

Marketing Services and Other: eBay generated $539 million of total marketing services and other revenues (19.1% of total revenues), which fell 7.4% from the year-ago quarter. This was due to sluggish performance of Marketplace that generated $259 million revenues, down 18% year over year.

Nevertheless, StubHub delivered marketing revenues $16 million during the reported quarter, significantly increasing from $3 million in the year-ago quarter. Further, Classifieds generated $269 million revenues, up 3% year over year.

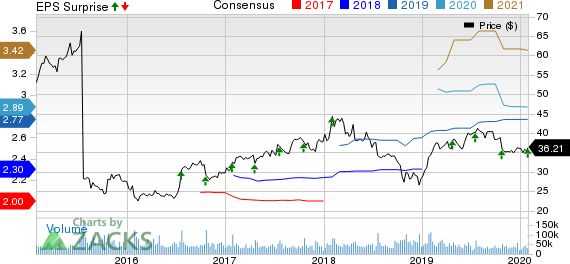

eBay Inc. Price, Consensus and EPS Surprise

eBay Inc. price-consensus-eps-surprise-chart | eBay Inc. Quote

Operating Details

In the fourth quarter, eBay’s gross margin was 76.9%, contracting 160 bps year over year.

Operating expenses of $1.55 billion expanded 20 bps as a percentage of net revenues from the year-ago quarter. This was due to the 80 bps and 290 bps respective expansion in product development and general & administrative expenses.

However, sales and marketing expenses contracted 340 bps year over year.

Consequently, non-GAAP operating margin was 29.3% in the fourth quarter, up 10 bps year over year.

Balance Sheet and Cash Flow

As of Dec 31, 2019, cash equivalents and short-term investments came in at $2.8 billion, down from $3.1 billion as on Sep 30, 2019.

Further, eBay’s balance sheet is highly leveraged, with a long-term debt of $6.7 billion at the end of the fourth quarter.

The company generated $811 million of cash from operating activities and had free cash flow of $672 million during the reported quarter.

Further, the company returned $1.1 billion to shareholders, which includes dividend payments worth $113 million, in the fourth quarter.

Guidance

For first-quarter 2020, eBay expects revenues within $2.55-$2.60 billion. The Zacks Consensus Estimate for the same is pegged at $2.66 billion.

Non-GAAP earnings are expected within 70-73 cents and the Zacks Consensus Estimate for the same is pegged at 70 cents per share.

For 2020, the company expects revenues between $10.72 billion and $10.92 billion, indicating FX-neutral growth of 1-3%. The corresponding Zacks Consensus Estimate is pegged at $11.02 billion.

The company expects Marketplace GMV to be down low-single-digit in 2020.

Adjusted earnings per share are expected within $2.95-$3.05. The Zacks Consensus Estimate for the metric is pegged at $2.89 per share.

The company has considered StubHub in the full year guidance.

Zacks Rank & Stocks to Consider

Currently, eBay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Retail-Wholesale sector are Zumiez Inc. ZUMZ, Boot Barn Holdings, Inc. BOOT and Booking Holdings Inc. BKNG. While Zumiez sports a Zacks Rank #1 (Strong Buy), Boot Barn and Booking Holdings carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Zumiez, Boot Barn and Booking Holdings is currently pegged at 12%, 17% and 13.2%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research