Elon Musk's wealth plunges by $16.3bn in largest single day-wipe out

Elon Musk’s net worth has dropped $16.3bn (£12.6bn) in 24 hours, the largest ever single-day fall for a billionaire.

The drop in the Tesla chief executive’s net worth came as the electric car manufacturer’s shares dropped 21pc on Tuesday.

The rapid fall in Mr Musk’s net worth is the largest drop ever seen for a member of the Bloomberg Billionaires Index.

Mr Musk, who is now worth $82.3bn, is the fifth wealthiest person in the world behind Bernard Arnault, the chairman and chief executive of luxury goods business LVMH Moët Hennessy – Louis Vuitton.

A 500pc rally in Tesla shares, which lasted from January to the end of August, had caused Mr Musk’s net work to exceed $100bn.

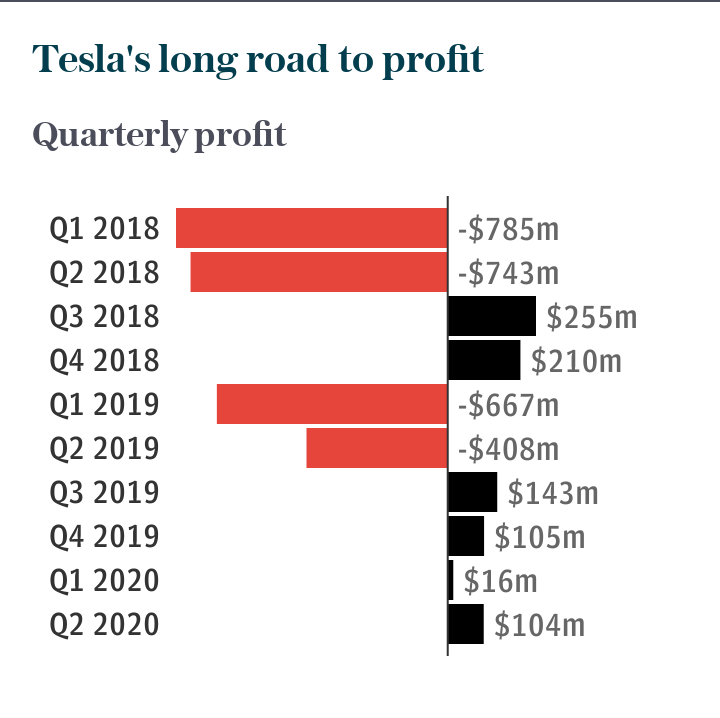

The company’s chief executive was handed a $769m pay package in May after he kept Tesla’s valuation above $100bn and raised its revenues to more than $20bn.

However, Tesla’s large share price fall earlier this week came after Scottish investor Baillie Gifford reduced its stake in the company and Tesla announced a $5bn stock offering.

Tesla was also denied entry to the S&P 500 in a reshuffle of the US blue-chip index on Friday.

Many investors had expected Tesla’s recent stock split to clear the way for entry, causing a rush of index-linked purchases of its shares.

Tuesday also saw Nikola, a key Tesla rival, announce a partnership with General Motors. GM agreed to take a $2bn stake in Nikola, which is building hydrogen-powered cars.

GM will also work with Nikola on its Badger pick-up truck which is expected to enter production by the end of 2022.

The wider Wall Street technology sell-off has spread to the Asian markets, with shares in Japanese telecoms conglomerate SoftBank falling as much as 7pc on Wednesday.

Investors have expressed concern over SoftBank’s new focus on making risky bets on equity derivatives. Filings show the business has invested in 26 listed companies including Netflix, Amazon, Microsoft, Alphabet, Zoom, T-Mobile and Tesla.