EU talks on tougher bank capital rules go into overtime

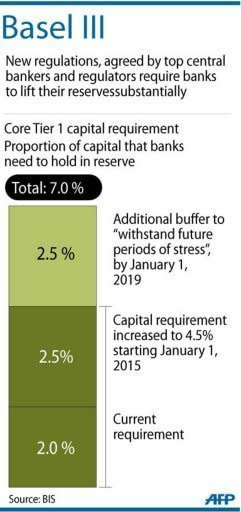

European Union finance ministers struggled Wednesday to reach a deal on rules to shelter banks from future crises, as Britain and Sweden fought for the power to impose tougher defences. The talks in Brussels went into overtime as the ministers sought to find a compromise after more than 12 hours of a debate pitting Britain, Sweden and some eastern European nations against France, Germany, Luxembourg and others. The special meeting was called to find a common EU position on the Basel III regulation, which will require banks to increase their capital buffers to avoid a repeat of the massive bailouts they received in the 2008 financial crisis. But Europeans were sharply divided, with Britain and Sweden seeking freedom to impose tougher capital requirements than under Basel while the Franco-German bloc wants all 27 EU nations to follow the same standards for more than 8,000 banks. British finance minister George Osborne, whose country is home to Europe's biggest financial sector, used stark terms to say no to the latest compromise presented by Denmark, which chairs the EU rotating presidency. "I'm not prepared to say something that is going to make me look like an idiot five minutes later," Osborne said. He added that he was willing to miss a dinner for eight at his London home in order to reach a deal, raising the prospect that talks would go on past midnight. German Finance Minister Wolfgang Schaeuble voiced concern that the EU may never reach an agreement if a deal was not found on Wednesday, warning that such an outcome would be "disastrous." Paris and Berlin want a "maximum harmonisation" of the rules, fearing that allowing nations to set higher threshholds would spark a race for the biggest reserves that would divert funds away from investments and lending. The heated discussion comes in the midst of concerns about the health of the Spanish banking sector, still reeling from a real estate bubble that burst in 2008. The Basel III rules, which governments must start to implement in 2013, require all banks to raise total core reserves to 7.0 percent from 2.0 percent at the moment. Denmark proposed a compromise that would allow governments to impose an extra 3.0 percent buffer. It later raised it to 5.0 percent with certain conditions attached to it. France and Italy backed the compromise but Britain and Sweden stuck to their guns. London and Stockholm say governments have the right to set the standards they want and refuse to let the European Commission have a say in such decisions. "We feel that it is very important that we have strong banks, and that means strong capital in the banks, so we are looking for a solution today," Swedish Finance Minister Anders Borg said before the talks started. "Either we have strong banks or the taxpayers take the risk, and I prefer to have strong capital in the banks than to take risks with the taxpayers," he said. Polish Finance Minister Jacek Rostowski pointed to the "sad example" of Ireland, which was bailed out after its public deficit blew up following a banking crisis. "A group of countries including Poland, the Czech republic, Sweden and the UK are very determined to see that banking systems in the future should be kept as healthy as we expect the fiscal side, budgetary side, to be kept," he said. "This crisis is a crisis in which fiscal and banking system crisis feed on each other. It's not enough to deal with one, you need to deal with both at the same time."