European stocks edge higher on strong earnings and economic data

European stocks edged higher on Friday, with strong corporate earnings and economic data nudging markets higher.

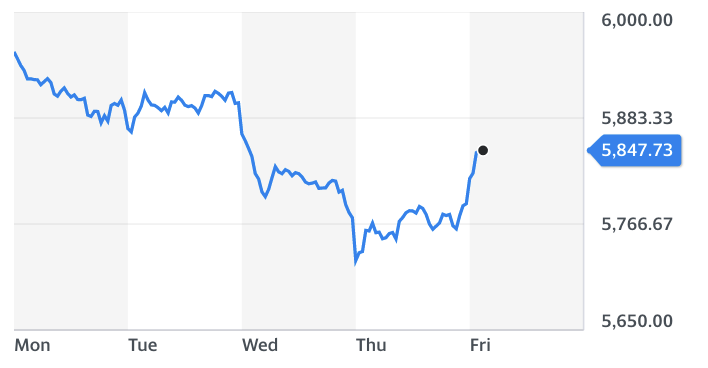

The pan-European STOXX 600 (^STOXX) rose 0.9% in the first hour of trading, largely helped by Britain’s FTSE 100 (^FTSE), which rose 1.1%, and France’s CAC 40 (^FCHI) at +1.15%. Germany’s DAX (^GDAXI) was up 0.8%.

Barclays (BARC.L) shares leapt 3.7% as it beat forecasts for income, profits, and loss provisions in the third quarter, with the bank making the largest gains on the FTSE on Friday morning.

“Profits before tax of £1.15bn ($1.48bn) was about twice what was expected by the market. Much like its bigger Wall Street cousins the investment banking division is offsetting a weaker performance in the consumer bank,” said Neil Wilson, chief market analyst for Markets.com.

“Sticking with the investment bank was the best thing Barclays could have done. Corporate and Investment Bank (CIB) income +24% to £9.8bn, up 24% driven by strong performance in trading. Consumer, Cards and Payments (CC&P) income –11% to £2.6bn, driven by lower balances, margin compression and reduced payments activity. The numbers really highlight what’s happening in the real economy.”

Stronger-than-expected retail sales also boosted UK stocks, with official data showing sales growth accelerated to 4.7% in September.

Watch: What is a V-shaped recovery?

''The retail recovery revved up again in September... but it's become clear just how dramatically the crisis has changed the shape of the industry. The pandemic has revolutionised the way we shop, as more consumers have switched to online stores and opt for click and collect services from the high street,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“With restaurant dining curtailed, due to social distancing and the 10pm curfew, the food and grocery sector is profiting with sales volumes in food stores 3.7% higher in September than before the pandemic.

“Rather than switch back to old habits, consumers seem to have embraced the transition to online. It's still extremely tough for the fashion sector, as clothing sales in September were still 12.7% below pre-pandemic levels.

READ MORE: Barclays beats forecasts as it sets aside another £600m for COVID losses

“City centres remain quiet, with many people working from home, which has had a severe impact on shops in streets that used to be crowded with workers. Overall footfall is 70% below the pre-pandemic level.”

In France, L’Oreal shares jumped 1.3% as its sales rebounded into positive territory. Closely watched purchasing managers index (PMI) data for France’s manufacturing sector showed firms expanding output in October, though in services activity levels declined and were slightly worse than expected.

In Germany, Daimler shares were up 1.1% as it hiked its profit outlook for this year, highlighting resilient demand in China. PMI data also showed a slight decline in output in its services sector, though manufacturing output surged higher and exceeded analysts’ expectations.

Leading indices mostly edged higher in Asia overnight. China’s Shanghai Composite (^SSEC) fell 0.9%, but Japan’s Nikkei (^N225), the Kospi (^KS11) in South Korea and the Hang Seng (^HSI) in Hong Kong all rose 0.2%.

Wall Street looked set to drop on the open. S&P 500 (ES=F) futures were trading 0.3% lower, while Dow Jones futures (YM=F) and Nasdaq (NQ=F) were down 0.2%.

Watch: What is a budget deficit and why does it matter?