Peugeot eyes 'European champion' rank with Opel takeover

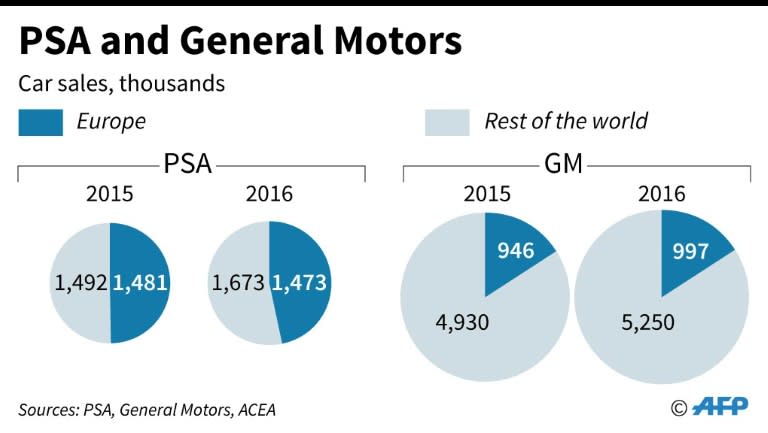

PSA said Thursday its takeover of Opel would create a "European champion" in the auto industry, as the French carmaker pursued its acquisition plans armed with soaring fresh profit numbers. PSA, which owns the Peugeot and Citroen brands, said net profit for 2016 nearly doubled as the group pushes plans to buy General Motors' European brands Opel and Vauxhall. Chief executive Carlos Tavares said the bid to acquire GM's European brands presented an "opportunity to create a European automobile champion". Net profit for the full year rose 79 percent to 2.15 billion euros ($2.27 billion) with the auto giant pledging to pay shareholder dividends for the first time since 2011 to the tune of 0.48 euros per share. If the planned takeover is successful, it would see PSA regaining its position as the second-biggest car manufacturer in Europe after Germany's Volkswagen group. That position is currently held by rival French automaker Renault. PSA would help Opel get back into the black and put the struggling German carmaker "back on its feet," Tavares told a news conference. The proposed move has sparked fears in Germany and Britain, which is home to its sister brand Vauxhall, that non-French jobs could be axed if the deal goes ahead, although Tavares repeated assurances that Opel would remain "a German company". - Reassuring May - And PSA would respect existing social agreements at the firm, including keeping jobs in the short term, which was a "moral" question and one of trust, he said, insisting the company would seek to build a partnership with "the employees, the unions and the government" in Germany. PSA has been active in trying to win backing for the acquisition, with Tavares on Wednesday securing the backing of Germany's Chancellor Angela Merkel. He also held a phone conversation with British Prime Minister Theresa May, pledging to "develop" the Vauxhall brand if the takeover plans succeed. Founded in 1862, Opel, with its lightning-bolt emblem, has long been a familiar sight on German and European roads. But in recent years the firm has booked repeated losses, costing Detroit-based GM around $15 billion (14 billion euros) since 2000. - Lifting margin forecast - It operates some 10 factories in Europe spread across six countries and had 35,600 employees at the end of 2015 -- 18,250 of them in Germany. In Britain, it sells vehicles under the Vauxhall brand. PSA's improved profitability comes despite a decline in sales due to the scope of consolidation and foreign exchange effects. "In an environment characterised by adverse exchange rates, this growth was driven by higher volumes, positive price and mix effects, and lower fixed and production costs," a statement said. Mix effects refer to the contribution that each company's product makes to sales or profits. The automaker also upped its medium-term objectives for 2016-2018, aiming for an operating margin of more than 4.5 percent, compared with a previous target of 4 percent. Its target for 2021 is 6 percent. Turnover for the full year fell to 54 billion euros, down from 56.3 billion a year earlier, a fall of 4.1 percent which was largely accounted for by last year's sale of the bumper arm of Faurecia, a car parts manufacturer partly owned by PSA. Excluding the sale, revenues fell just 1.2 percent, largely hit by exchange rate fluctuation, PSA said. Last month, the carmaker said car sales rose 5.8 percent to 3.15 million units in 2016 in an increase largely due to its resumption of business in Iran following the easing of most international sanctions under a nuclear deal with world powers. Following the results, shares in the French automaker fell on the Paris stock exchange by 1.7 percent to 18.43 euros.