Trump says he'll nominate Shelton, Waller to remaining Federal Reserve board seats

President Donald Trump on Thursday announced his intent to submit two nominations to fill the remaining vacancies at the Federal Reserve, but questions remain on whether both candidates will ultimately get confirmed by the Senate.

St. Louis Fed economist Christopher Waller and former Trump transition economic adviser Judy Shelton will be nominated by the White House for the two remaining Fed governor seats. Trump had announced his picks via Twitter in July of last year, but the White House delayed formally announcing his intent to nominate Waller and Shelton until Thursday.

Those inside the Washington beltway expect both candidates to be thoroughly vetted. But one possible obstacle: a technicality that requires each Fed governor to represent a different region of the country. The Fed divides the U.S. into 12 geographic “districts,” and no two Fed governors are allowed to represent the same district.

Waller is from Missouri, which is covered by the Kansas City and St. Louis districts (represented by Fed Governors Randy Quarles and Miki Bowman, respectively). And Shelton is from Virginia, which is covered by the Richmond district (represented by Fed Governor Lael Brainard).

The location-based puzzle has been weaponized by the Senate before. In 2011, Obama-appointee and Massachusetts-based Peter Diamond faced opposition from Alabama Republican Richard Shelby, who accused Diamond of having no experience in monetary policy. He also claimed that Diamond couldn’t serve because then-Fed Governor Daniel Tarullo had already represented the Boston district, which covers Massachusetts. Diamond was never confirmed.

Tweaks can be made to work around the technicality. Fed Governor Randal Quarles, who lives in Utah, memorably switched his state of association to Colorado in 2017 to avoid conflict with Janet Yellen’s association with the San Francisco district, which covers Utah.

Third times is the charm?

While Waller, a career economist who taught at Notre Dame before heading to the St. Louis Fed, appears to have little history of political ties, Shelton may face some questions on whether she has altered her economic thinking to fit the monetary policy needs of the administration.

“Our sense is that Shelton’s path to confirmation is slightly narrower,” Compass Point’s Isaac Boltansky wrote in a note when Shelton was first named as a nominee in July, adding that Waller appeared to be a more “conventional pick.”

This is Trump’s third try at filling the remaining two seats on the board.

Last year, Trump nominated Carnegie Mellon economist Marvin Goodfriend and former Fed official Nellie Liang, only to have those nominations expire and withdrawn, respectively. As Trump boiled over the Fed’s decision to raise interest rates under Fed Chairman Jerome Powell, he nominated campaign adviser Stephen Moore and former pizza executive Herman Cain.

Both were heavily criticized for their close ties to Trump; Cain ultimately bowed out citing low pay, and Moore withdrew his nomination shortly after his controversial writings about women resurfaced.

‘Appealing’ to the White House

Since entering the rumor mill as a possible Fed candidate, Shelton has publicly called for lower interest rates. Shelton, who is the U.S. executive director of the European Bank for Reconstruction and Development, told The Washington Post June 19 that she would like to lower the federal funds rate “as fast, as efficiently, as expeditiously as possible,” even to zero.

On June 28, Shelton told The Wall Street Journal that she was worried about other central banks easing policy while the Fed stays on hold, speculating that other countries are doing so to devalue their currency to “gain an export advantage.”

Both of those viewpoints appeared to align with Trump’s disappointment with current Fed policy. Trump has called on the Fed to not only lower rates to zero, but deepen interest rates into negative territory.

But Shelton’s history hints at an economist who may not favor a policy as easy as she has publicly messaged. Boltansky wrote July 3 that Shelton had made a “seismic shift” in thinking monetary policy as of late. In a 2015 paper for the libertarian think tank Cato Institute, Shelton posited that governments “suppressed interest rates through accommodative monetary policies” to finance sovereign debt. She has advocated for a more “rules-based” approach to monetary policy anchored by gold.

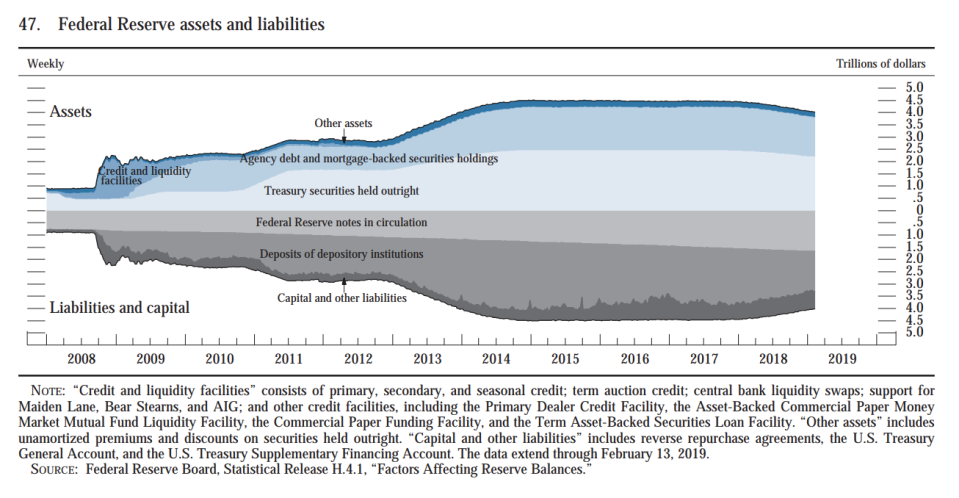

Shelton appears to have dialed back her public comments in favor of quantitative tightening, the process of the Fed unwinding its balance sheet to undo the asset purchases it made to counter the negative impacts of the financial crisis (quantitative easing). Trump has repeatedly argued that quantitative tightening constrains economic growth, at times calling on the Fed to actually restart quantitative easing.

Shelton has advocated for eliminating the Fed’s process of paying interest on reserves that U.S. banks park at the Fed, an in-the-weeds mechanism that the central bank uses to steer the benchmark interest rate to its target. Reducing bank deposits left at the Fed reduces the liabilities on the central bank’s balance sheet, meaning the Fed would similarly have to reduce its asset holdings to keep the books balanced.

In short, her proposal would suggest further asset roll-offs and more quantitative tightening, the opposite of what Trump would like to see at the central bank.

George Selgin, a senior fellow at the libertarian think tank Cato Institute, told Yahoo Finance in July that Shelton appears to be holding back on this view, instead choosing to publicly harp on lower rates to win Trump’s favor.

“That combination makes her more appealing to Trump but it sounds like she’s going all out for easy money but I think, in fact, she favors shrinking the balance sheet as well,” Selgin said.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Powell: Fed is 'insulated' from short-term political pressure

Largest U.S. banks clear first round of 'stress tests,' fewer banks tested

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn, YouTube, and reddit.