Five Stocks to Buy for Coronavirus Zombie Apocalypse

I guess the zombie apocalypse is finally here. Good news for all you closet homicidal maniacs. You finally get to live out your fantasies of loading up grandpappy’s shotgun and letting loose on the general population after they’ve been taking over by the virus. Could not be a better time to sharpen your double-tap skills with Zombieland 2 turning into reality TV.

Newsflash folks, this is not the zombie apocalypse. Yes, coronavirus is a real threat. It’s a threat to the global economy, it’s a threat to anyone over the age of 70 and a threat to anyone with a compromised immune system. You know what else checks all three of those boxes? The regular old, run-of-the-mill influenza that makes its way across the US every year. In fact, according to the CDC, 16,000 people have died and 280,000 people have been hospitalized during the 2019-2020 flu season in the US alone.

Right now, there is panic in the stock market. Over the last 6 trading days, the S&P 500 has gone from all-time highs to a 10% correction. The only other time that’s ever happened was in 1928. Rather than staring at your screen in disbelief and telling your permabear friends they were right this time (after they started calling tops in 2011) I’ve got a better idea. I’m looking for stocks with strong earnings trends which are considerably off their highs and I’m looking for stocks that would benefit from people being locked in their houses.

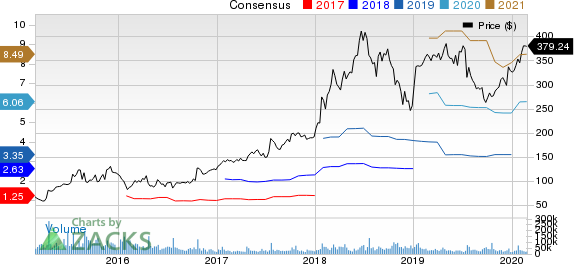

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Dare I say, “Netflix and chill.” If you’re going to be locked away in your house, waiting out a pandemic, what’s better than binge-watching The Walking Dead? Netflix (NFLX) has been sort of bucking the trend over the last few days. Wednesday February 26th the stock was up over 5% and the next day it continued its move higher. Roku (ROKU) shares are getting in on the action a bit too, although Roku has been in some trouble since its last earnings report, taking the stock down from highs over $150 to the $114s.

Leaning on the Zacks Rank, I’ve found thirteen stocks which are Zacks Rank #1 (Strong Buy) with EPS and Revenue growth this year greater than 10% which are down more than 10% over the last week alone. This list includes Sibanye Gold (SBSW), Teekay Tankers (TNK) and Costamare (CMRE).

Now See All Our Private Trades

While today's Zacks Rank #1 new additions are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for all Zacks trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Sibanye Gold Limited (SBSW) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Costamare Inc. (CMRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research