Garmin (GRMN) Grows Wearable Portfolio With Index BPM Monitor

Garmin GRMN is consistently expanding its fitness offerings on the back of product introductions.

This is evident from GRMN’s recent launch of a smart blood pressure monitor named Index BPM, featuring an integrated display to show readings immediately.

With the all-in-one upper arm blood pressure monitor, users can measure and track systolic and diastolic blood pressure at home.

Using Wi-Fi technology, users can connect the wearable with Garmin Connect to sync their Index BPM blood pressure readings.

On the back of Index BPM, Garmin aims to provide users with an enhanced health tracking experience. This is expected to boost the adoption rate of the wearable.

With the rollout of Index BPM, GRMN is positioning itself well to capitalize on the prospects in the smart blood pressure monitoring devices market.

According to Vision Research Reports, the aforesaid market is likely to touch $2.7 billion by 2030, seeing a CAGR of 11.2% from 2022 to 2030.

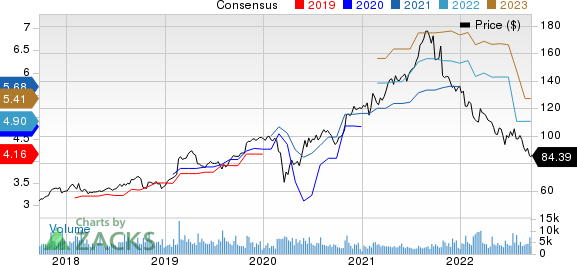

Garmin Ltd. Price and Consensus

Garmin Ltd. price-consensus-chart | Garmin Ltd. Quote

Growing Wearable Offerings

In addition to the latest wearable, Garmin unveiled a watch named the Black Panther, a special edition vívofit jr. 3, to provide children with an enhanced fitness tracking experiencer.

GRMN also introduced the Venu Sq 2 and Venu Sq 2 – Music Edition GPS smartwatches. The smartwatches come with all-day health monitoring, fitness and wellbeing features, on-device music storage for phone-free listening and an extended battery life of 11 days.

Last month, GRMN launched the Enduro 2 multisport GPS smartwatch featuring LED flashlight, music, enhanced positioning precision and a battery life of up to 150 hours in GPS mode.

In June, Garmin introduced the Forerunner 955 Solar smartwatch, featuring solar charging, longer battery life, multi-satellite system tracking, and health and wellness tracking.

Garmin’s expanding fitness wearable offerings are expected to help it expand its presence in the booming fitness tracker market.

Per a Straits Research report, the underlined market is likely to reach $192 billion by 2030, witnessing a CAGR of 17.5% between 2022 and 2030.

Strengthening Fitness Segment

Apart from the smart blood pressure monitor, Garmin introduced a premium heart rate strap named HRM-Pro Plus in August to help athletes keep track of pace and distance during indoor runs, thus improving their performance.

GRMN also released Edge Explore 2 and Edge Explore 2 Power Mount Bundle GPS cycling computers, featuring an improved battery life, and high-contrast maps of popular roads and high-traffic areas to avoid, eventually guiding cyclists to opt for a more convenient route.

The consistent introduction of fitness offerings is expected to help Garmin gain momentum among fitness enthusiasts. This, in turn, will improve its fitness segment’s performance in the days ahead.

However, the segment is currently suffering weak demand for advanced wearables and cycling products due to the normalization of demand from the pandemic-induced hike. This remains a downside.

Garmin generated sales of $272.1 million in second-quarter 2022, accounting for 21.9% of its total sales, which decreased 34% year over year.

Shares of GRMN have been down 38% in the year-to-date period, lagging the Computer and Technology sector’s decline of 31.9%.

Zacks Rank & Stocks to Consider

Currently, Garmin carries a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Arista Networks ANET, Teradata TDC and Monolithic Power Systems MPWR. While Arista Networks sports a Zacks Rank #1 (Strong Buy), Teradata and Monolithic Power Systems carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks has lost 20.8% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 18.6%.

Teradata has lost 27.1% in the year-to-date period. The long-term earnings growth rate for TDC is currently projected at 27.4%.

Monolithic Power Systems has lost 18.2% in the year-to-date period. The long-term earnings growth rate for MPWR is currently projected at 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Teradata Corporation (TDC) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research