GBPCAD Testing Slope Resistance- Long Scalps at Risk Sub 1.84

DailyFX.com -

Talking Points

GBPCAD testing multi-month slope resistance

Breach needed to keep long bias in play

Key support at monthly low / 2015 open (1.8087)

GBP/CAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

GBPCAD testing slope resistance- possible near-term inflection point

Key resistance 1.8476/80- backed by the February ML,1.8685 & 1.8850

Key support 1.8146, 1.8087– bullish invalidation

Daily RSI resistance trigger pending- breach would constructive (post 40-hold)

Event Risk Ahead: BoE Minutes tomorrow, UK Retail Sales on Thursday & US Durable Goods Orders on Friday

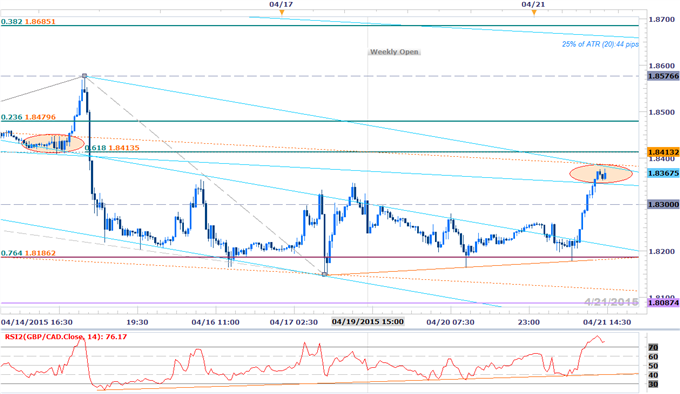

GBP/CAD 30min

Notes:The GBPCAD has come into resistance at a slope inflection zone we’ve been tracking since March after rebounding off the 78.5% retracement of the 2015 range. Note that although the weekly OR looks to have broken to the topside, the focus remains on the highlighted region just below the 1.84-handle with a breach above keeping the long bias in play targeting more significant resistance at 1.8476/80. This region is defined by the March swing low and a basic 23.6% retracement of the decline off the February high.

Bottom line: our immediate play looks for short-triggers below this region with our base case scenario targeting one more low in the pair before reversing higher (near 1.8087?). A breach above 1.8480 targets the median-line extending of (~8650) & the April highs. A quarter of the daily ATR yields profit targets of 42-44pips per scalp. Unless the BoE minutes reveal a growing decent within the committee, another unanimous vote may do little to shake up the British Pound as the central bank retains a wait-and-see approach ahead of the May 7 election.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

Scalp Webinar: USD Correction In Focus- Kiwi at Risk Sub 7700

NZDUSD Breakout Stalls at 7700 Resistance- Short Scalps Pending

AUDJPY Snaps 9 day Losing Streak- Long Scalps Favored Above 91.20

Scalp Webinar: USD at Risk Post Dismal NFPs- AUDUSD to Face RBA

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.